Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pension data for Sam Adams Inc. include the following for the current calendar year: Discount rate, 8% Expected return on plan assets, 10% Actual return

Pension data for Sam Adams Inc. include the following for the current calendar year: Discount rate, 8% Expected return on plan assets, 10% Actual return on plan assets, 9% Service cost, $380,000

| January 1: | |||

| PBO | $ | 2,980,000 | |

| ABO | 1,980,000 | ||

| Plan assets | 3,180,000 | ||

| Amortization of prior service cost | 28,000 | ||

| Amortization of net gain | 6,800 | ||

| December 31: | |||

| Cash contributions to pension fund | $ | 273,000 | |

| Benefit payments to retirees | 308,000 | ||

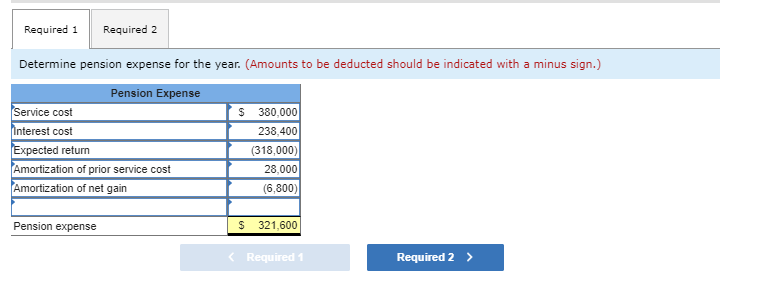

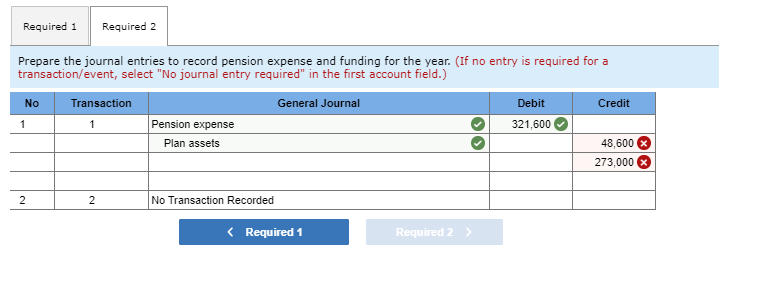

Required: 1. Determine pension expense for the year. 2. Prepare the journal entries to record pension expense and funding for the year. ***

*** I need help with the journal entries, please and thank you ****

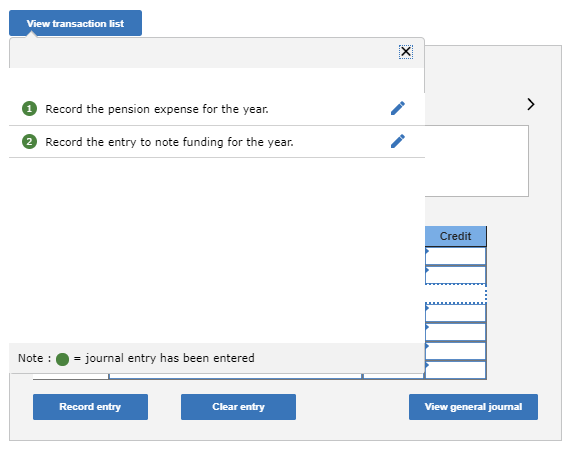

Required 1 Required 2 Determine pension expense for the year. (Amounts to be deducted should be indicated with a minus sign.) $ Pension Expense Service cost Interest cost Expected return Amortization of prior service cost Amortization of net gain 380,000 238,400 (318,000) 28.000 (6,800) Pension expense $ 321,600 Required 1 Required 2 Prepare the journal entries to record pension expense and funding for the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Credit Debit 321,600 1 Pension expense Plan assets 48,600 273,000 No Transaction Recorded Required 1 Required 2 > View transaction list Record the pension expense for the year. Record the entry to note funding for the year. Credit Note : = journal entry has been entered Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started