Answered step by step

Verified Expert Solution

Question

1 Approved Answer

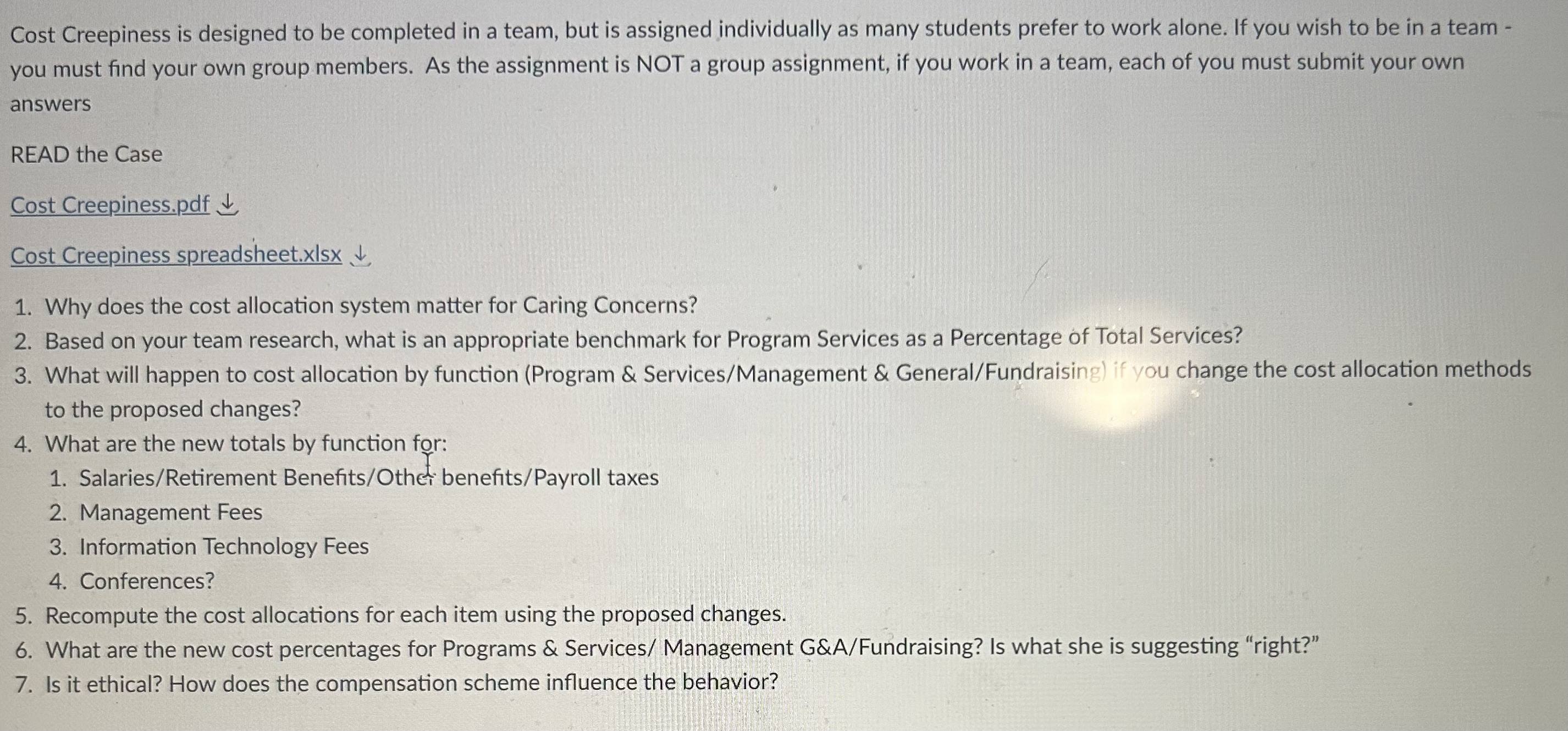

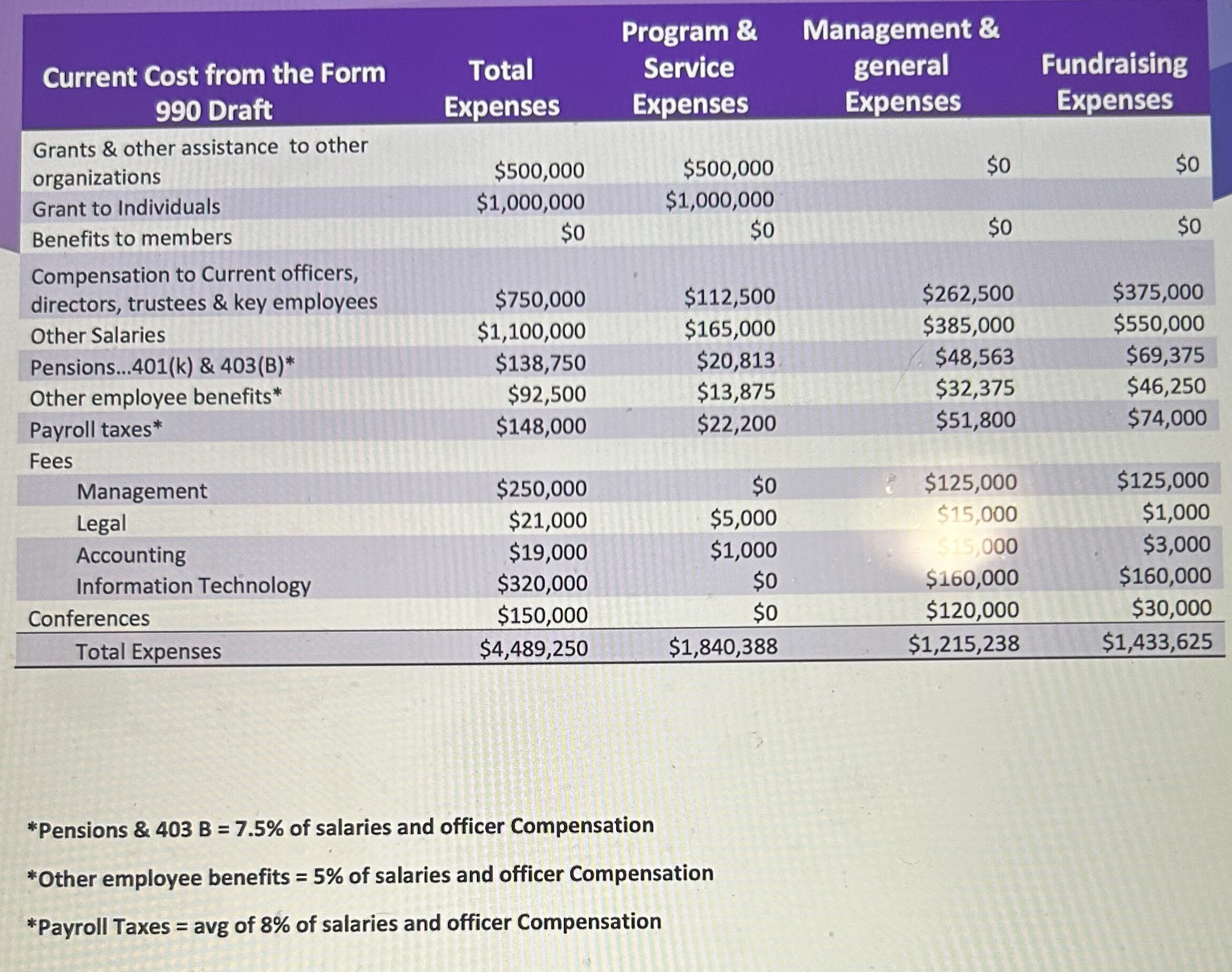

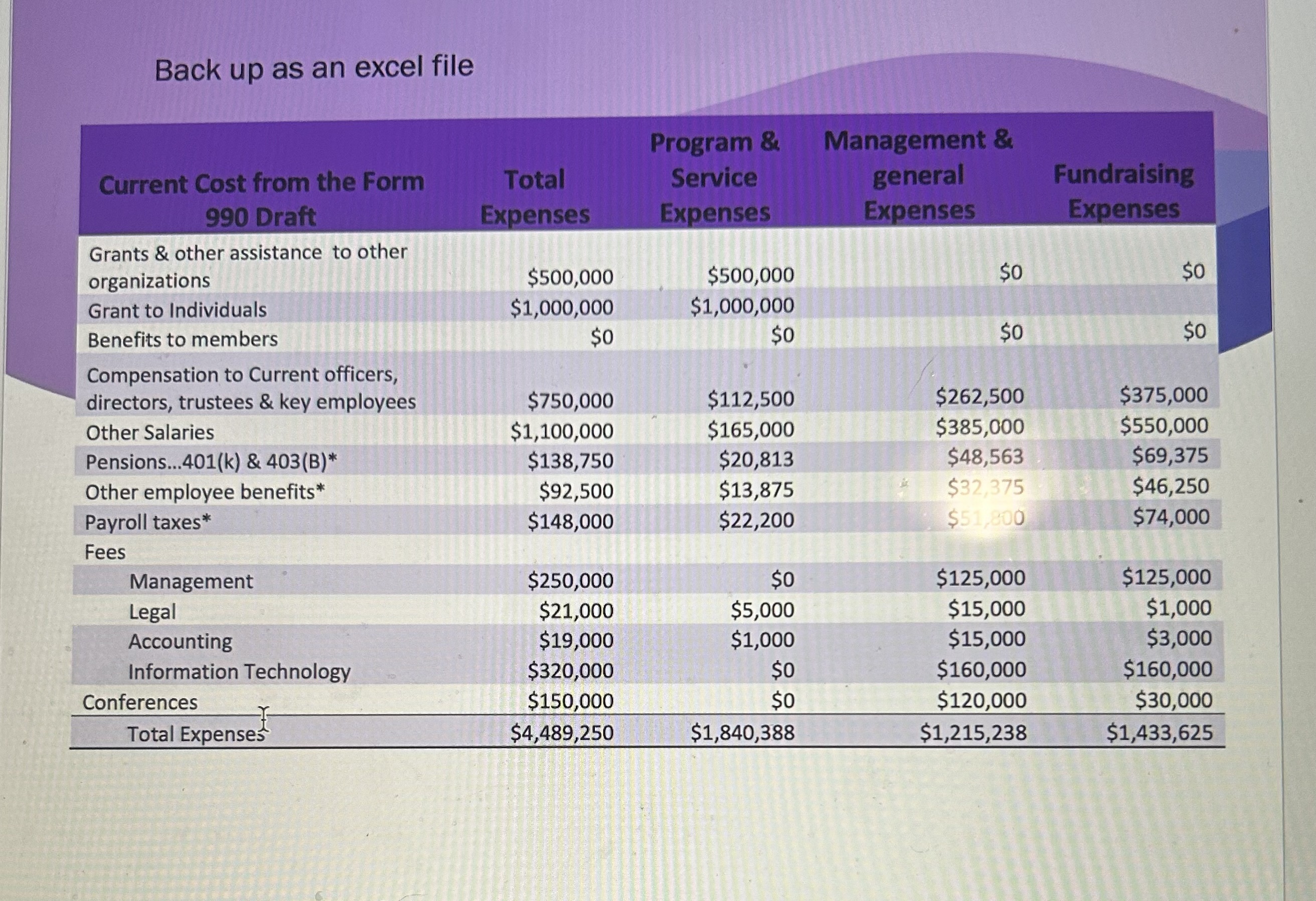

*Pensions & 403 B =7.5% of salaries and officer Compensation *Other employee benefits =5% of salaries and officer Compensation *Payroll Taxes = avg of 8%

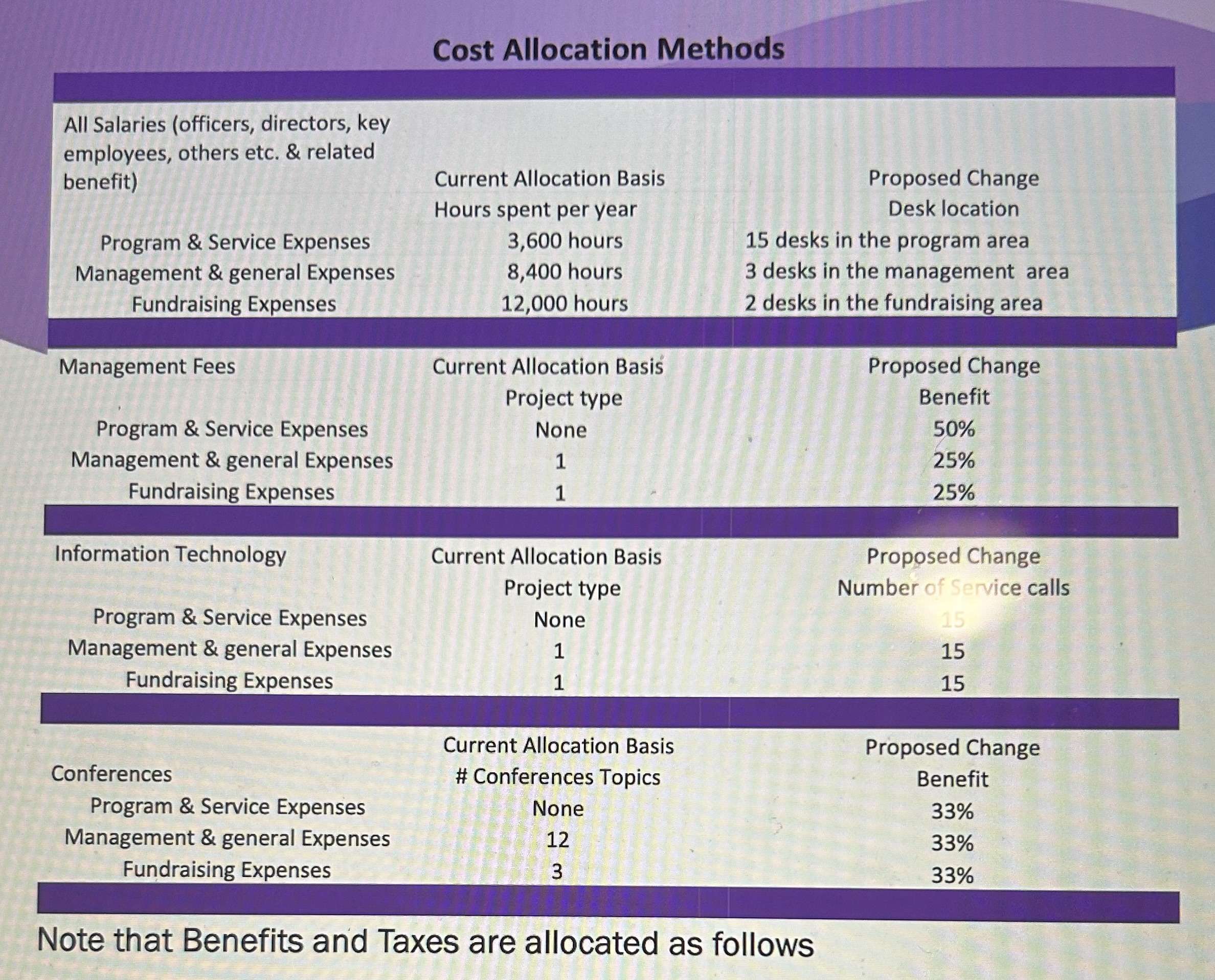

*Pensions \& 403 B =7.5% of salaries and officer Compensation *Other employee benefits =5% of salaries and officer Compensation *Payroll Taxes = avg of 8% of salaries and officer Compensation Cost Creepiness is designed to be completed in a team, but is assigned individually as many students prefer to work alone. If you wish to be in a team you must find your own group members. As the assignment is NOT a group assignment, if you work in a team, each of you must submit your own answers READ the Case Cost Creepiness.pdf Cost Creepiness spreadsheet.xlsx 1. Why does the cost allocation system matter for Caring Concerns? 2. Based on your team research, what is an appropriate benchmark for Program Services as a Percentage of Total Services? 3. What will happen to cost allocation by function (Program \& Services/Management \& General/Fundraising) if you change the cost allocation methods to the proposed changes? 4. What are the new totals by function for: 1. Salaries/Retirement Benefits/Othe benefits/Payroll taxes 2. Management Fees 3. Information Technology Fees 4. Conferences? 5. Recompute the cost allocations for each item using the proposed changes. 6. What are the new cost percentages for Programs \& Services/ Management G\&A/Fundraising? Is what she is suggesting "right?" 7. Is it ethical? How does the compensation scheme influence the behavior? Cost Allocation Methods Note tnat benerits ana Iaxes are allocated as tollows Use the form below for #5 Can you display these graphically? Back up as an excel file *Pensions \& 403 B =7.5% of salaries and officer Compensation *Other employee benefits =5% of salaries and officer Compensation *Payroll Taxes = avg of 8% of salaries and officer Compensation Cost Creepiness is designed to be completed in a team, but is assigned individually as many students prefer to work alone. If you wish to be in a team you must find your own group members. As the assignment is NOT a group assignment, if you work in a team, each of you must submit your own answers READ the Case Cost Creepiness.pdf Cost Creepiness spreadsheet.xlsx 1. Why does the cost allocation system matter for Caring Concerns? 2. Based on your team research, what is an appropriate benchmark for Program Services as a Percentage of Total Services? 3. What will happen to cost allocation by function (Program \& Services/Management \& General/Fundraising) if you change the cost allocation methods to the proposed changes? 4. What are the new totals by function for: 1. Salaries/Retirement Benefits/Othe benefits/Payroll taxes 2. Management Fees 3. Information Technology Fees 4. Conferences? 5. Recompute the cost allocations for each item using the proposed changes. 6. What are the new cost percentages for Programs \& Services/ Management G\&A/Fundraising? Is what she is suggesting "right?" 7. Is it ethical? How does the compensation scheme influence the behavior? Cost Allocation Methods Note tnat benerits ana Iaxes are allocated as tollows Use the form below for #5 Can you display these graphically? Back up as an excel file

*Pensions \& 403 B =7.5% of salaries and officer Compensation *Other employee benefits =5% of salaries and officer Compensation *Payroll Taxes = avg of 8% of salaries and officer Compensation Cost Creepiness is designed to be completed in a team, but is assigned individually as many students prefer to work alone. If you wish to be in a team you must find your own group members. As the assignment is NOT a group assignment, if you work in a team, each of you must submit your own answers READ the Case Cost Creepiness.pdf Cost Creepiness spreadsheet.xlsx 1. Why does the cost allocation system matter for Caring Concerns? 2. Based on your team research, what is an appropriate benchmark for Program Services as a Percentage of Total Services? 3. What will happen to cost allocation by function (Program \& Services/Management \& General/Fundraising) if you change the cost allocation methods to the proposed changes? 4. What are the new totals by function for: 1. Salaries/Retirement Benefits/Othe benefits/Payroll taxes 2. Management Fees 3. Information Technology Fees 4. Conferences? 5. Recompute the cost allocations for each item using the proposed changes. 6. What are the new cost percentages for Programs \& Services/ Management G\&A/Fundraising? Is what she is suggesting "right?" 7. Is it ethical? How does the compensation scheme influence the behavior? Cost Allocation Methods Note tnat benerits ana Iaxes are allocated as tollows Use the form below for #5 Can you display these graphically? Back up as an excel file *Pensions \& 403 B =7.5% of salaries and officer Compensation *Other employee benefits =5% of salaries and officer Compensation *Payroll Taxes = avg of 8% of salaries and officer Compensation Cost Creepiness is designed to be completed in a team, but is assigned individually as many students prefer to work alone. If you wish to be in a team you must find your own group members. As the assignment is NOT a group assignment, if you work in a team, each of you must submit your own answers READ the Case Cost Creepiness.pdf Cost Creepiness spreadsheet.xlsx 1. Why does the cost allocation system matter for Caring Concerns? 2. Based on your team research, what is an appropriate benchmark for Program Services as a Percentage of Total Services? 3. What will happen to cost allocation by function (Program \& Services/Management \& General/Fundraising) if you change the cost allocation methods to the proposed changes? 4. What are the new totals by function for: 1. Salaries/Retirement Benefits/Othe benefits/Payroll taxes 2. Management Fees 3. Information Technology Fees 4. Conferences? 5. Recompute the cost allocations for each item using the proposed changes. 6. What are the new cost percentages for Programs \& Services/ Management G\&A/Fundraising? Is what she is suggesting "right?" 7. Is it ethical? How does the compensation scheme influence the behavior? Cost Allocation Methods Note tnat benerits ana Iaxes are allocated as tollows Use the form below for #5 Can you display these graphically? Back up as an excel file Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started