Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Penway Services is a freight service carrier in Steinbach, Manitoba with fiscal year end of Dec 31. On December 30, 2018, they bought a

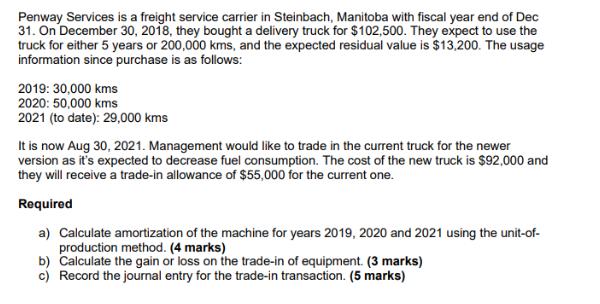

Penway Services is a freight service carrier in Steinbach, Manitoba with fiscal year end of Dec 31. On December 30, 2018, they bought a delivery truck for $102,500. They expect to use the truck for either 5 years or 200,000 kms, and the expected residual value is $13,200. The usage information since purchase is as follows: 2019: 30,000 kms 2020: 50,000 kms 2021 (to date): 29,000 kms It is now Aug 30, 2021. Management would like to trade in the current truck for the newer version as it's expected to decrease fuel consumption. The cost of the new truck is $92,000 and they will receive a trade-in allowance of $55,000 for the current one. Required a) Calculate amortization of the machine for years 2019, 2020 and 2021 using the unit-of- production method. (4 marks) b) Calculate the gain or loss on the trade-in of equipment. (3 marks) c) Record the journal entry for the trade-in transaction. (5 marks)

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started