Answered step by step

Verified Expert Solution

Question

1 Approved Answer

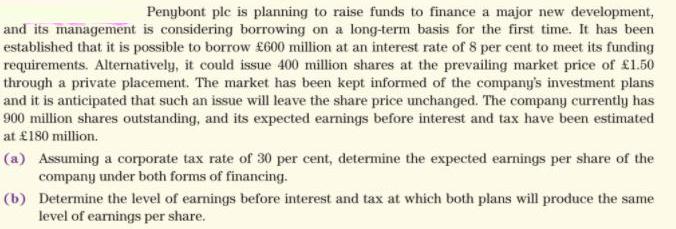

Penybont ple is planning to raise funds to finance a major new development, and its management is considering borrowing on a long-term basis for

Penybont ple is planning to raise funds to finance a major new development, and its management is considering borrowing on a long-term basis for the first time. It has been established that it is possible to borrow 600 million at an interest rate of 8 per cent to meet its funding requirements. Alternatively, it could issue 400 million shares at the prevailing market price of 1.50 through a private placement. The market has been kept informed of the company's investment plans and it is anticipated that such an issue will leave the share price unchanged. The company currently has 900 million shares outstanding, and its expected earnings before interest and tax have been estimated at 180 million. (a) Assuming a corporate tax rate of 30 per cent, determine the expected earnings per share of the company under both forms of financing. (b) Determine the level of earnings before interest and tax at which both plans will produce the same level of earnings per share.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANALYZING CAPITAL STRUCTURE AND APPROPRIATION OF PROFITS IN DEBT AND NONDEBT FINANCED PROJECTS Introduction A profit and loss appropriation account shows the distribution of earnings before interest a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started