Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peoples Limited has the following securities in issue: 1 million ordinary shares currently trading at N$1.30 each. The last dividend paid amounted to 15.5

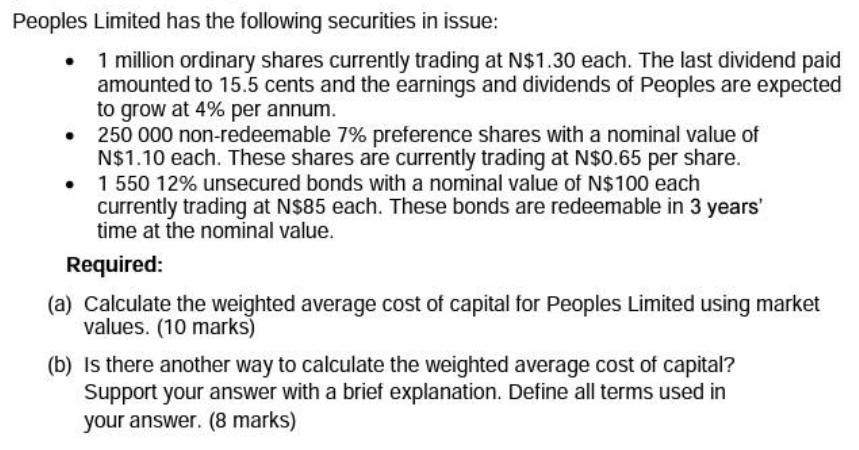

Peoples Limited has the following securities in issue: 1 million ordinary shares currently trading at N$1.30 each. The last dividend paid amounted to 15.5 cents and the earnings and dividends of Peoples are expected to grow at 4% per annum. 250 000 non-redeemable 7% preference shares with a nominal value of N$1.10 each. These shares are currently trading at N$0.65 per share. 1 550 12% unsecured bonds with a nominal value of N$100 each currently trading at N$85 each. These bonds are redeemable in 3 years' time at the nominal value. Required: (a) Calculate the weighted average cost of capital for Peoples Limited using market values. (10 marks) (b) Is there another way to calculate the weighted average cost of capital? Support your answer with a brief explanation. Define all terms used in your answer. (8 marks)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Weighted average cost of capital WACC using market value of capital components 866 b Another way t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started