Answered step by step

Verified Expert Solution

Question

1 Approved Answer

People's Transportation Company runs holiday excursion trips to seaside resorts and offers about 80% of its monthly sales on credit. The company is experiencing

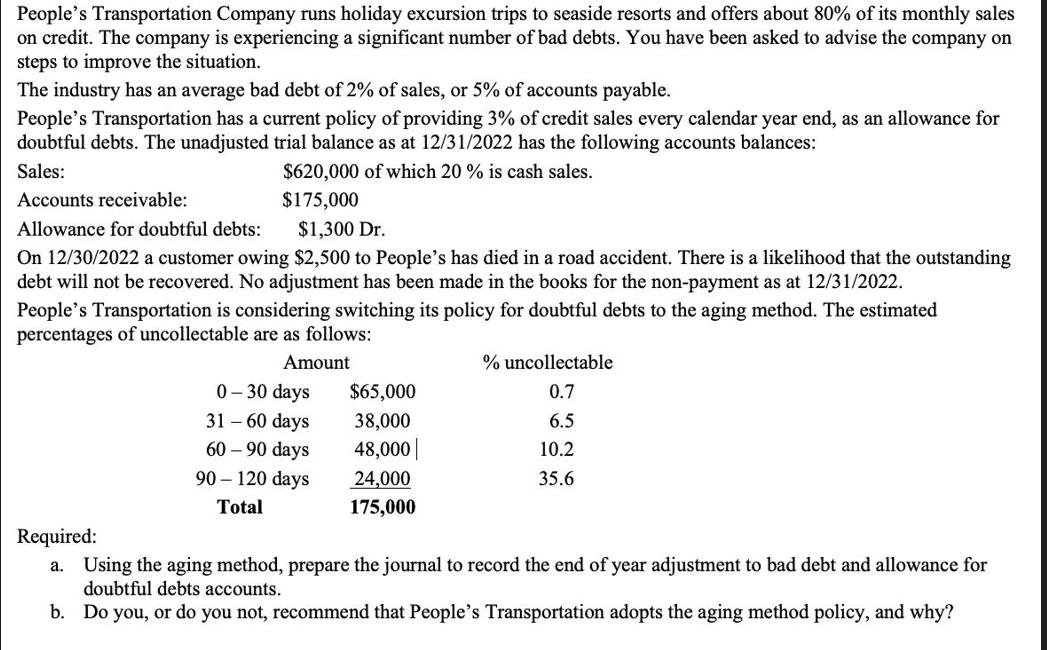

People's Transportation Company runs holiday excursion trips to seaside resorts and offers about 80% of its monthly sales on credit. The company is experiencing a significant number of bad debts. You have been asked to advise the company on steps to improve the situation. The industry has an average bad debt of 2% of sales, or 5% of accounts payable. People's Transportation has a current policy of providing 3% of credit sales every calendar year end, as an allowance for doubtful debts. The unadjusted trial balance as at 12/31/2022 has the following accounts balances: Sales: $620,000 of which 20 % is cash sales. $175,000 Accounts receivable: Allowance for doubtful debts: $1,300 Dr. On 12/30/2022 a customer owing $2,500 to People's has died in a road accident. There is a likelihood that the outstanding debt will not be recovered. No adjustment has been made in the books for the non-payment as at 12/31/2022. People's Transportation is considering switching its policy for doubtful debts to the aging method. The estimated percentages of uncollectable are as follows: Amount Required: a. 0-30 days 31-60 days 60-90 days 90-120 days Total $65,000 38,000 48,000 24,000 175,000 % uncollectable 0.7 6.5 10.2 35.6 Using the aging method, prepare the journal to record the end of year adjustment to bad debt and allowance for doubtful debts accounts. b. Do you, or do you not, recommend that People's Transportation adopts the aging method policy, and why?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entry to record the end of year adjustment to bad debt and allowance for doubtful debts ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started