Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pepper Corp. is an Australian dog toy producer specializing in kangaroo-shaped dog toys. It is looking to set up operations in New Zealand. The investment

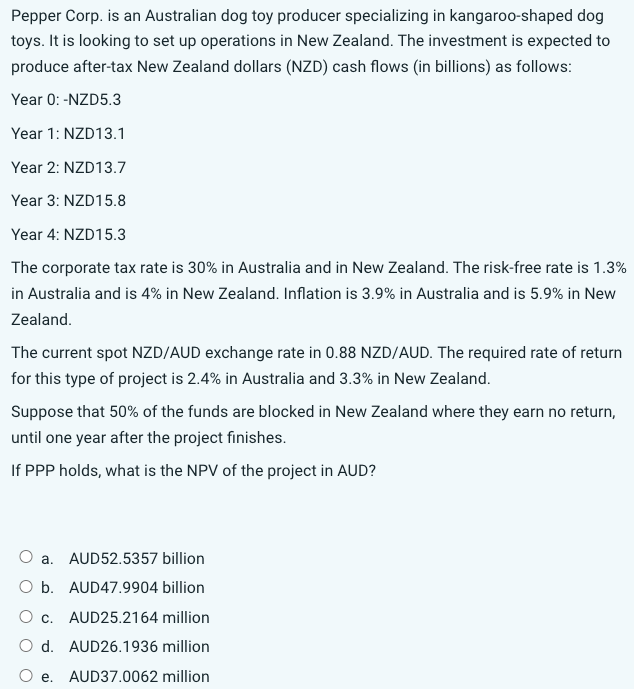

Pepper Corp. is an Australian dog toy producer specializing in kangaroo-shaped dog toys. It is looking to set up operations in New Zealand. The investment is expected to produce after-tax New Zealand dollars (NZD) cash flows (in billions) as follows: Year 0: -NZD5.3 Year 1: NZD13.1 Year 2: NZD13.7 Year 3: NZD15.8 Year 4: NZD15.3 The corporate tax rate is \30 in Australia and in New Zealand. The risk-free rate is \1.3 in Australia and is \4 in New Zealand. Inflation is 3.9\\% in Australia and is \5.9 in New Zealand. The current spot NZD/AUD exchange rate in 0.88 NZD/AUD. The required rate of return for this type of project is \2.4 in Australia and 3.3\\% in New Zealand. Suppose that \50 of the funds are blocked in New Zealand where they earn no return, until one year after the project finishes. If PPP holds, what is the NPV of the project in AUD? a. AUD52.5357 billion b. AUD47.9904 billion c. AUD25.2164 million d. AUD26.1936 million e. AUD37.0062 million

Pepper Corp. is an Australian dog toy producer specializing in kangaroo-shaped dog toys. It is looking to set up operations in New Zealand. The investment is expected to produce after-tax New Zealand dollars (NZD) cash flows (in billions) as follows: Year 0: -NZD5.3 Year 1: NZD13.1 Year 2: NZD13.7 Year 3: NZD15.8 Year 4: NZD15.3 The corporate tax rate is \30 in Australia and in New Zealand. The risk-free rate is \1.3 in Australia and is \4 in New Zealand. Inflation is 3.9\\% in Australia and is \5.9 in New Zealand. The current spot NZD/AUD exchange rate in 0.88 NZD/AUD. The required rate of return for this type of project is \2.4 in Australia and 3.3\\% in New Zealand. Suppose that \50 of the funds are blocked in New Zealand where they earn no return, until one year after the project finishes. If PPP holds, what is the NPV of the project in AUD? a. AUD52.5357 billion b. AUD47.9904 billion c. AUD25.2164 million d. AUD26.1936 million e. AUD37.0062 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started