Answered step by step

Verified Expert Solution

Question

1 Approved Answer

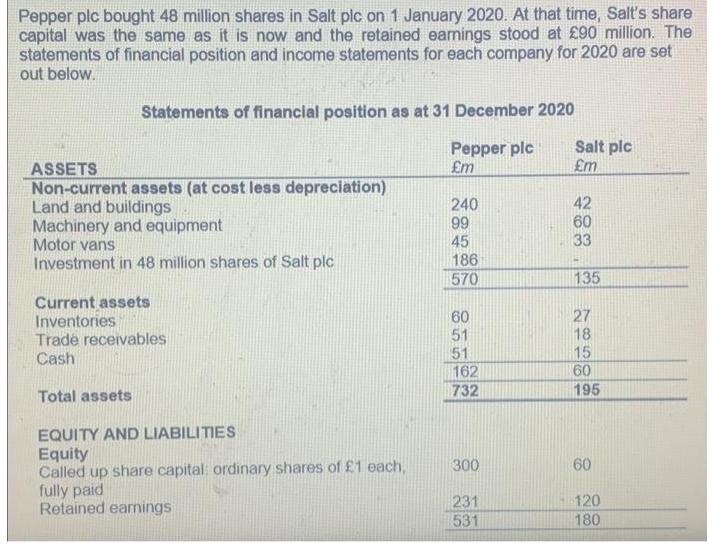

Pepper plc bought 48 million shares in Salt plc on 1 January 2020. At that time, Salt's share capital was the same as it

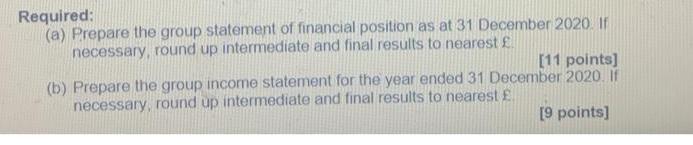

Pepper plc bought 48 million shares in Salt plc on 1 January 2020. At that time, Salt's share capital was the same as it is now and the retained earnings stood at 90 million. The statements of financial position and income statements for each company for 2020 are set out below. Statements of financial position as at 31 December 2020 Pepper plc m ASSETS Non-current assets (at cost less depreciation) Land and buildings Machinery and equipment Motor vans Investment in 48 million shares of Salt plc Current assets Inventories Trad receivables Cash Total assets EQUITY AND LIABILITIES Equity Called up share capital: ordinary shares of 1 each, fully paid Retained earnings 240 99 45 186 570 60 51 51 162 732 300 231 531 Salt pic m 42 60 33 135 27 18 15 60 195 60 120 180 Non-current liabilities Loan notes Current liabilities Trade payables Total equity and liabilities Sales revenue Cost of sales Gross profit 150 51 732 Income statements for the year ended 31 December 2020 Salt plc m 159 (72) 87 Pepper plc m 273 (138) 135 (30) (21) 84 (8) 76 (27) 49 15 195 Administration expenses Distribution expenses Operating profit Interest Net profit before taxation Taxation Profit for the year No dividends were paid by either company. At the time of the acquisition, the fair value of the assets of Salt plc was the same as their statement of financial position values, except for land and buildings that have a fair value of 72 million. Goodwill arising on consolidation has been judged not to have been impaired in value. Pepper uses the proportionate method. (21) (12) 54 (-) 54 (24) 30 Required: (a) Prepare the group statement of financial position as at 31 December 2020. If necessary, round up intermediate and final results to nearest [11 points] (b) Prepare the group income statement for the year ended 31 December 2020. If necessary, round up intermediate and final results to nearest . [9 points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started