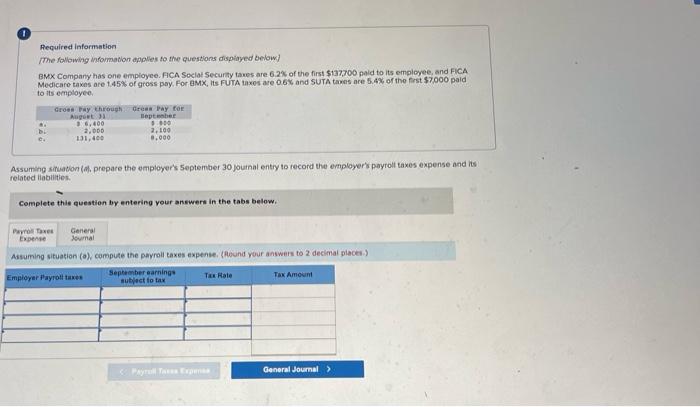

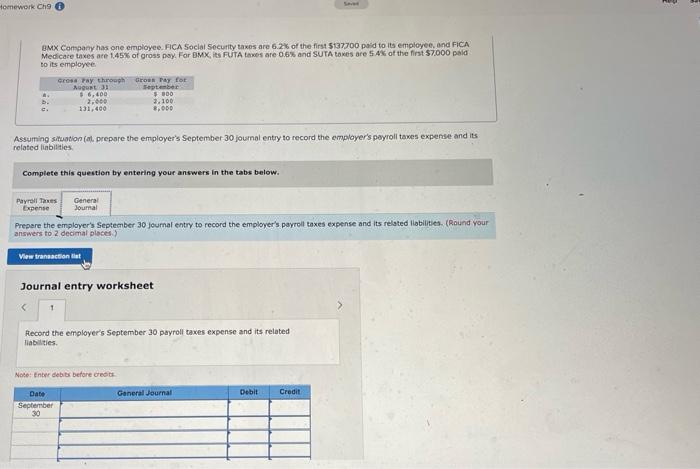

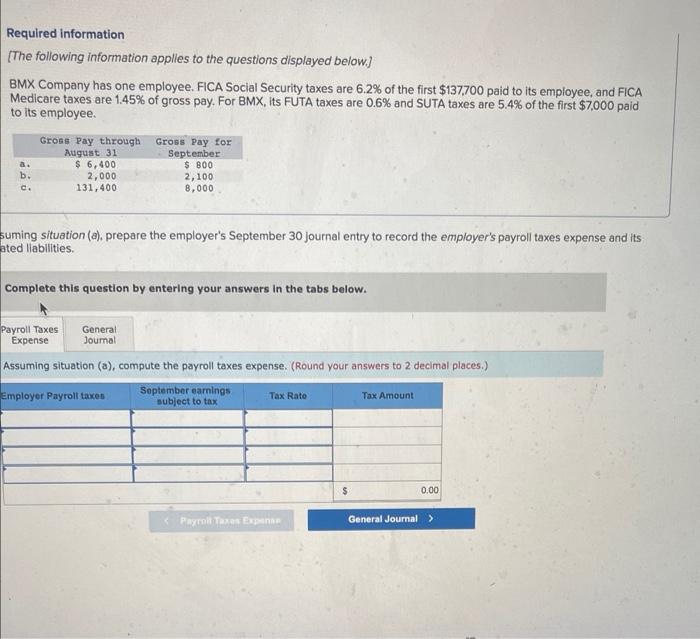

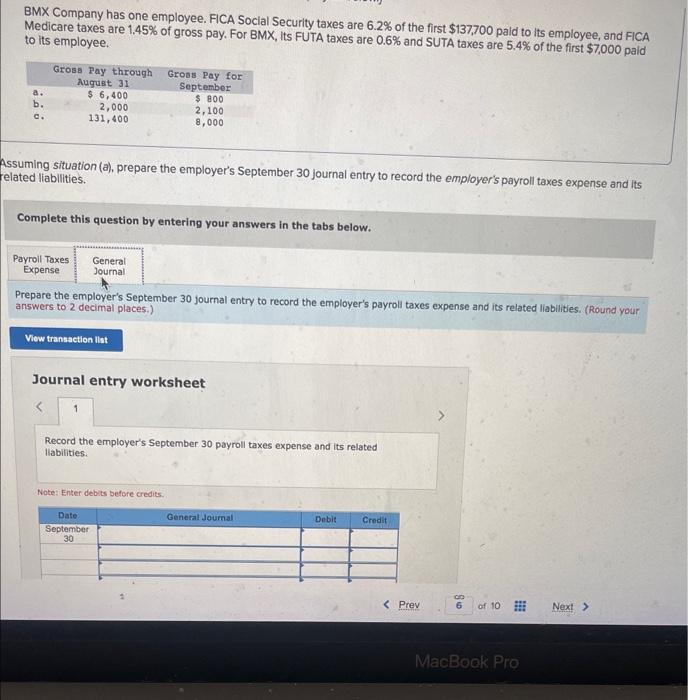

Pequired informstion [The following information applies to the questions dispiayed below] BMX Company has one employee. FCA Soclal Securfy tawes are 6.2% of the first $137700 paid to its employee, and FiCA Medicare taxes are 1.45\% of gross pay. For EMX, Its FUTA tax0s are 0.6x and 5UTA tawas are 5.4x of the frist $7000 paid to its employee. Assuming sinuadion (a), prepare the employer's 5eptember 30 jouthal entry to tecord the employer's payrolt taxes expense and its related llabilities. Complete this euestion by entering your answers in the tabs below. Asuming situation (o), compute the payroll taxes expense, (thound you answhis to 2 decimal placei.) BMx Company has one employee. FiCA Soclal Secuitity taxes are 6.26 of the first 5137700 paid to its employee. and FiCA Medicace taxes ate 1.456 of gross poy. For BMX its FUTA tawes are 0.65 and SUTA toxes are 5.4 of the first 57.000 palia to its employee. Assuming situation (al. prepare the employer's September 30 joumal entry to record the emplayer's peyroll taxes expense and its related linbilities Complete this question by entering your answers in the tabs below. Prepare the employer's September 30 jeumal entry to record the employer's payroll taxes expense and its related liablitites. (Round your answers to 2 decimal oloces ) Journal entry worksheet Fecord the employer's September 30 payroll taxes expense and its related liabilties. Node: Enter debid befare dedith. Required information [The following information applles to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. suming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its ated llabilities. Complete this question by entering your answers in the tabs below. Assuming situation (a), compute the payroll taxes expense. (Round your answers to 2 decimal places.) BMX Company has one employee. FICA Soclal Security taxes are 6.2% of the first $137,700 pald to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. isuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its lated liabilities. Complete this question by entering your answers in the tabs below. Prepare the employer's September 30 journal entry to record the employer's payroli taxes expense and its related liabilities. (Round your answers to 2 decimal places.) Journal entry worksheet Record the employer's September 30 payroll taxes expense and its related llabilities. Note: Enter debits before credits