Question

per unit Your company is selling a product, Product A, at a price of $300 You purchase the product from a manufacturer with whom

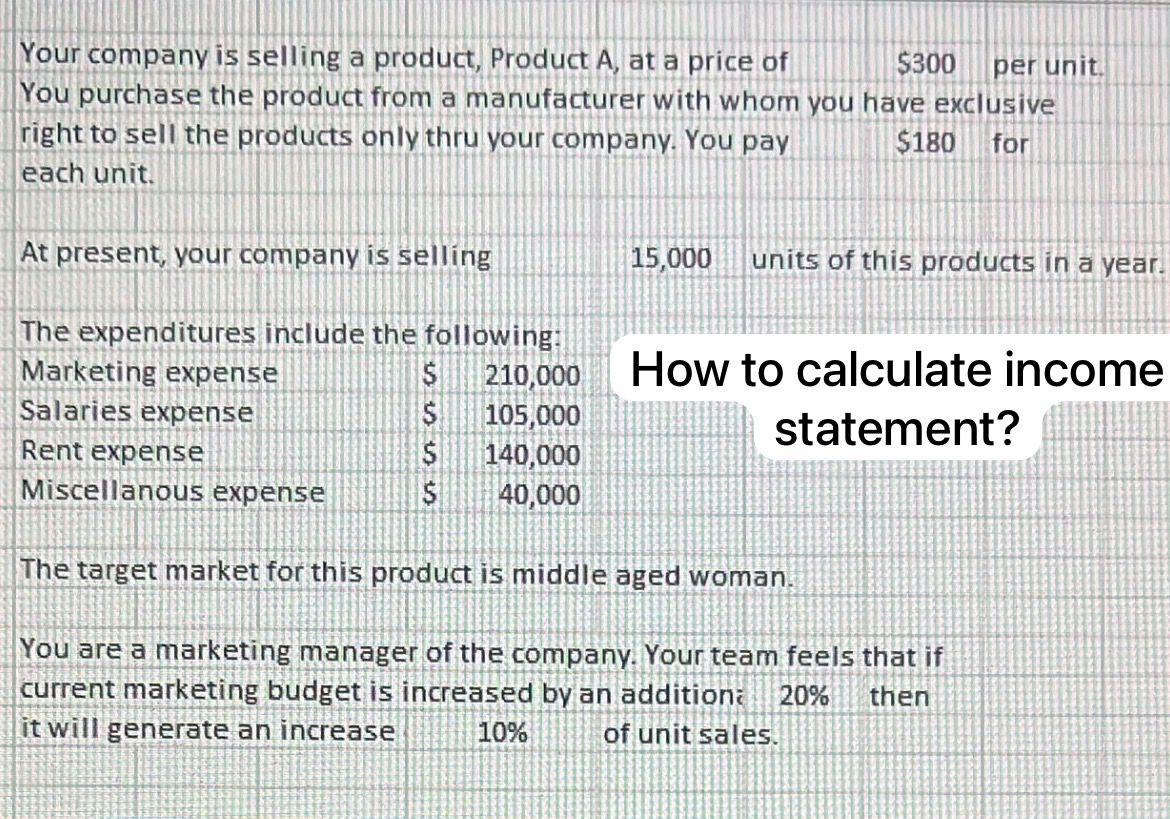

per unit Your company is selling a product, Product A, at a price of $300 You purchase the product from a manufacturer with whom you have exclusive right to sell the products only thru your company. You pay each unit. At present, your company is selling $180 for 15,000 units of this products in a year. The expenditures include the following: Marketing expense $ 210,000 Salaries expense S 105,000 How to calculate income statement? Rent expense $ 140,000 Miscellanous expense $ 40,000 The target market for this product is middle aged woman. You are a marketing manager of the company. Your team feels that if current marketing budget is increased by an addition 20% then it will generate an increase 10% of unit sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App