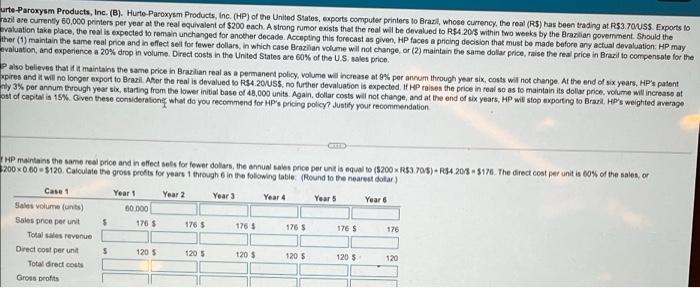

per year at the rest equivalent of $200 each. A strong rumors that the real will be devand to R54 205 within two weeks by Bragevement should the deviation take place, the real is expected to remain unchanged for wo Hurto Parokyum Products, Inc. Hure Proxysm Products in Pof the United Statesexports computer printers to Brazi, whose currency. The real (R$) has been trading at R33 TOUS Exports to Black we currently 60.000 printer decade. Accepting this forecast as given, HP races apreng decision that must be made before my chi devaluation: HP may the maintain the same real price and in effect al for fewer dollars, in which cale Brasilian volume will not change, or (2) martan te same dollar price.rasa heral price in Brail to compensate for the develation, and experience a 20% drop in volume Direct costs in the United States are 60% of the US price HP so believe maintain the same price in Brazilian real as a permanent policy, volume will increase at per annum through you si costs will not change. At the end of six years, Pupatentpires and it will no longer export to Brazil Aher areasdevalued to RS4 2005, neturther devaluation is expected. This the price in real so as to maintain its doorprio volume will increase at only 3% per annum tvough your iting from the lowerintabase 41.000 unts Again dollar con will not change and at the end of six years. HP wil op exporting to Brasil Ps weighted average cost of capital a 15%. Given these considerations, what do you recommend forsprong policy Atty yo recommendation CASE 1 Harta e erre and intellets for wows new a proper und in equal (8200 R$ 708) R$4201-51%. The red coal per una cone e me $300060 3120 Code pose proti for years tough the wing table Mound to the nearest Cust Year 1 Year Year Yeart Years Yeart Sales volume 60.000 Sale price per 5 170 1765 1765 11$ 170 Tous Director 5 1201 120 1205 120 $ 1205 - 120 Tout decco Cross profile urte-Paroxysm Products, Inc. (B). Hurto Paroxysm Products, Inc. (HP) of the United States, exports computer printers to Brasil, whose currency, the real (R$) has been trading at R$3.70 USS Exports to razil are currently 60.000 printers per year at the real equivalent of $200 each. A strong rumor exists that the real will be devalued to R$420$ within two weeks by the Brazilian government. Should the evaluation take place, the real is expected to remain unchanged for another decade. Accepting this forecast as given, HP faces a pricing decision that must be made before any actual devaluation: HP may ther (1) maintain the same real price and in effect sell for fewer dollars, in which case Brazilian volume will not change, or (2) maintain the same dollar price, raise the real price in Brazil to compensate for the evaluation, and experience a 20% drop in volume Direct costs in the United States are 60% of the US, sales price Palso believes that it maintains the same price in Brazilian real as a permanent policy, volume will increase at 9% per annum through year six, costs will not change. At the end of six years, HP's patent wpires and it will no longer export to Brazil. After the real is devalued to R$4.20USS, no further devaluation is expected. If Praises the price in real so as to maintain its dollar price, volume will increase at nly 3% per annum through year slx, starting from the lower initial base of 48,000 units. Again, dollar costs will not change, and at the end of six years, HP will stop exporting to Brasil, HP's weighted average ost of capital is 15%. Given these consideration, what do you recommend for HP's pricing policy? Justify your recommendation HP maintains the same real price and in effect set for tower dotters, the annual sale price per une in equal to (5200 153,7018) + R$4 205-3176. The direct cont per unit is 60% of the sale or 2000.00 120. Calculate the gross profits for years through in the following table (Round to the nearest dotar) Year 2 Year 3 Year 4 Year 5 Year Year 1 60.000 5 1765 176 5 176 $ 176 5 1765 Case 1 Sales volume units) Sales price per unit Total sales revenue Direct cost per unit Total direct costs Gross profits 176 5 120 5 120 5 120$ 120 5 120 5 120