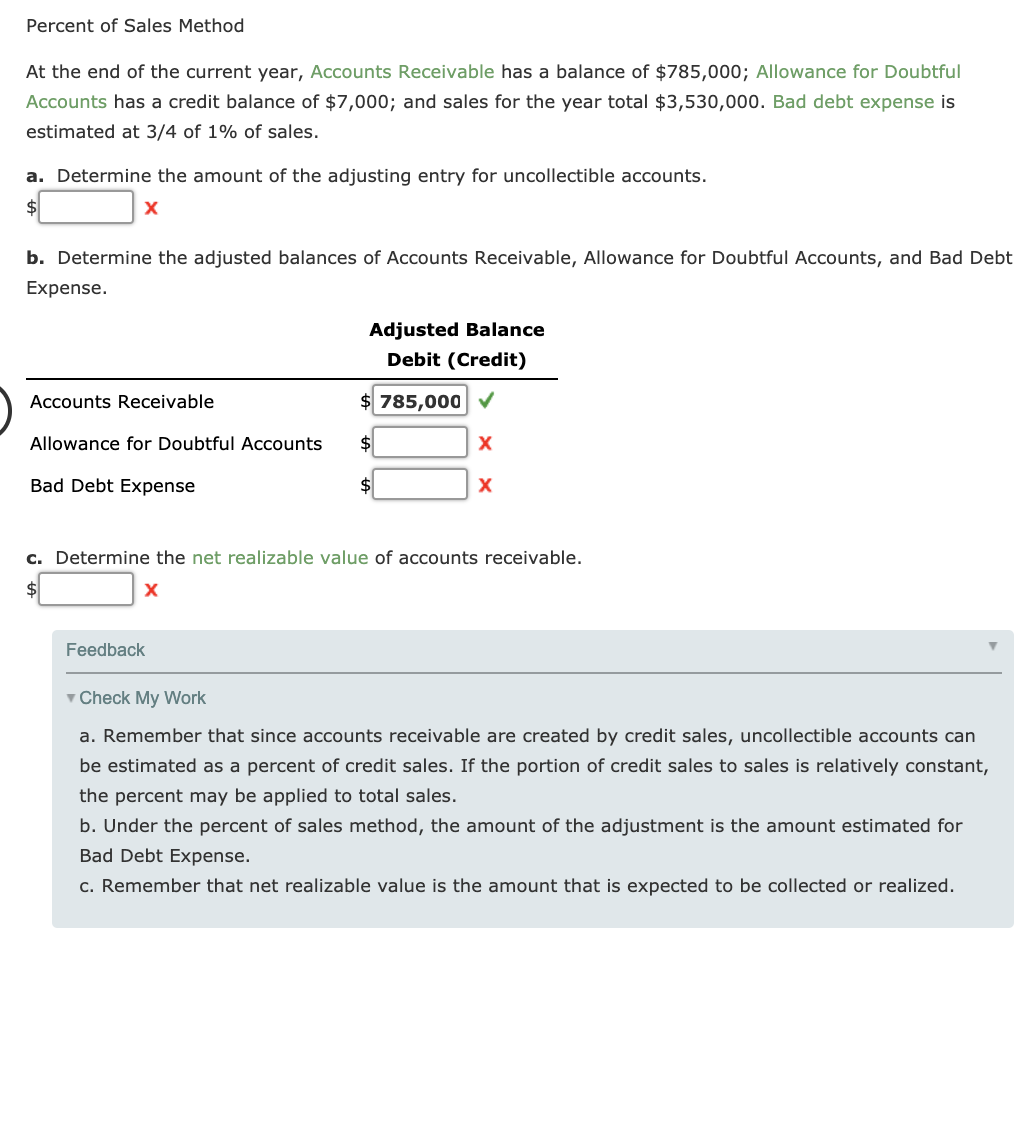

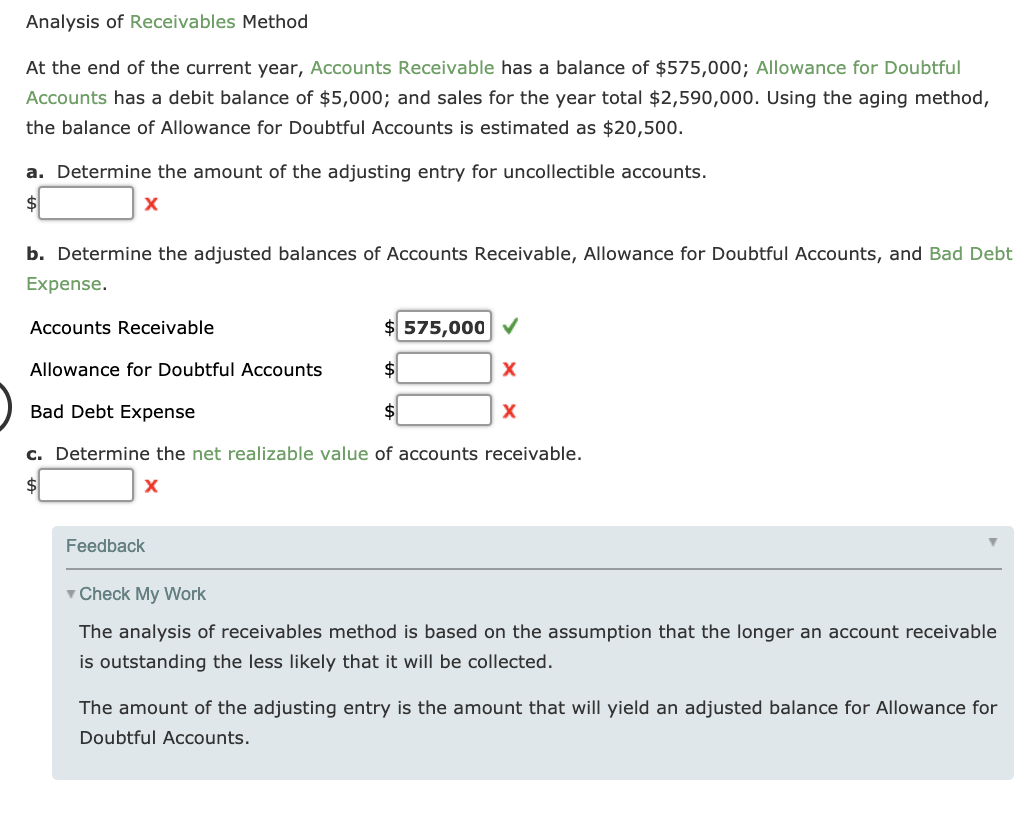

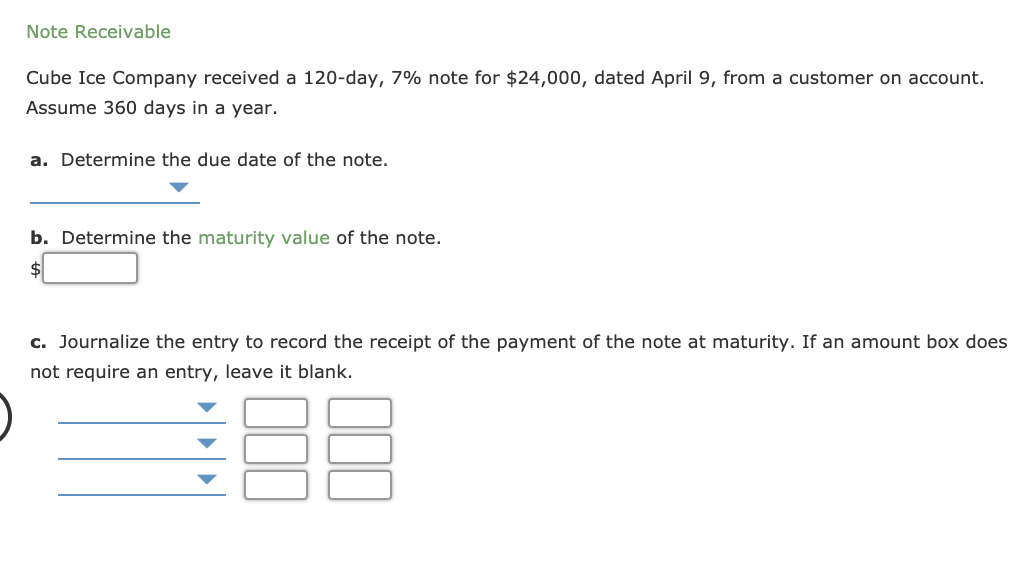

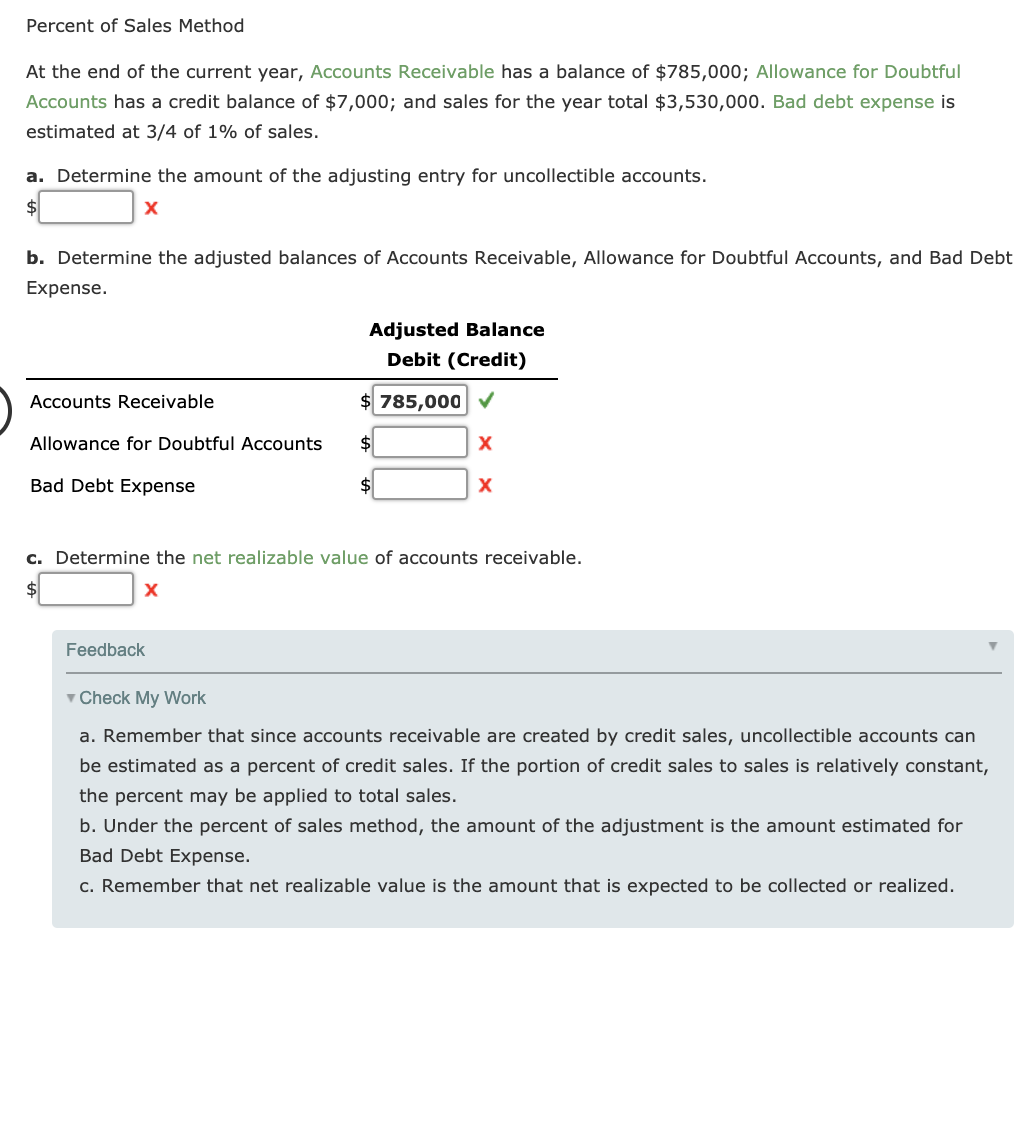

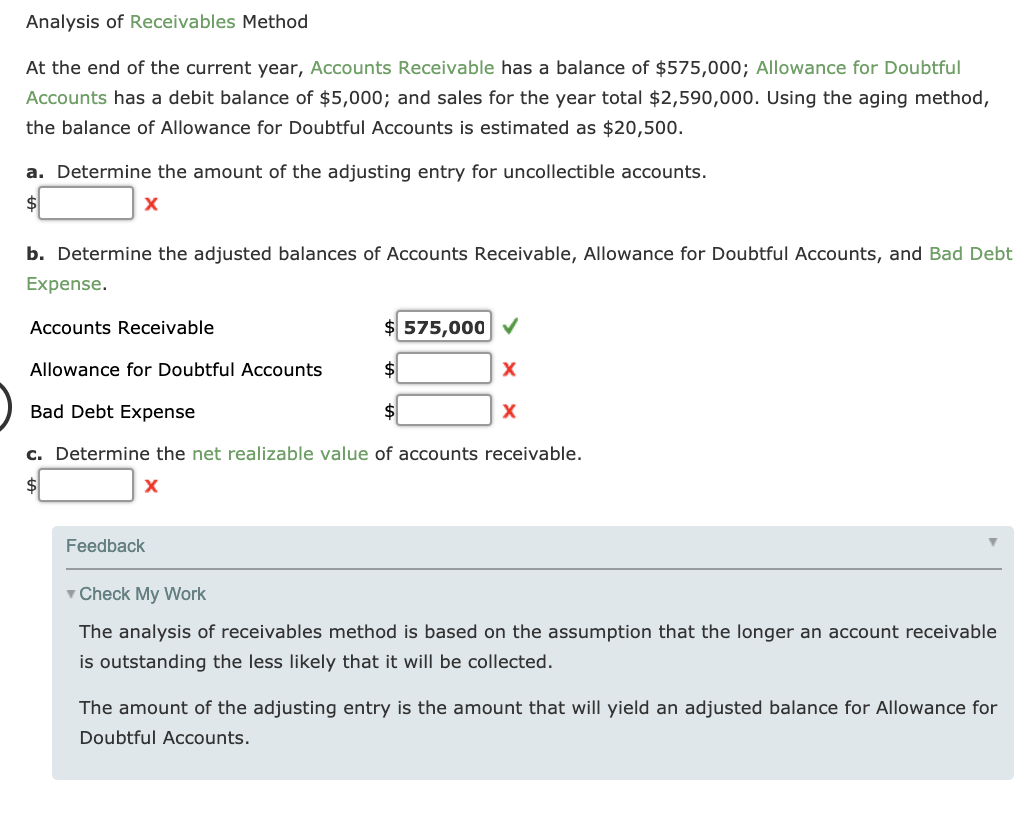

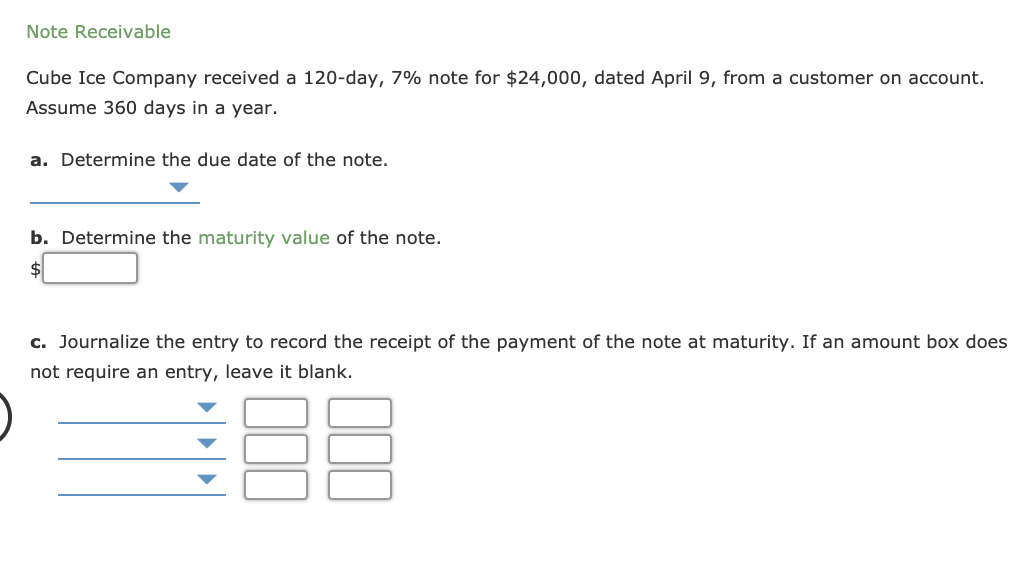

Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $785,000; Allowance for Doubtful Accounts has a credit balance of $7,000; and sales for the year total $3,530,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. x b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable $ 785,000 Allowance for Doubtful Accounts A Bad Debt Expense c. Determine the net realizable value of accounts receivable. Feedback Check My Work a. Remember that since accounts receivable are created by credit sales, uncollectible accounts can be estimated as a percent of credit sales. If the portion of credit sales to sales is relatively constant, the percent may be applied to total sales. b. Under the percent of sales method, the amount of the adjustment is the amount estimated for Bad Debt Expense. c. Remember that net realizable value is the amount that is expected to be collected or realized. Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $575,000; Allowance for Doubtful Accounts has a debit balance of $5,000; and sales for the year total $2,590,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $20,500. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ 575,000 Allowance for Doubtful Accounts A Bad Debt Expense A c. Determine the net realizable value of accounts receivable. Feedback Check My Work The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding the less likely that it will be collected. The amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts. Note Receivable Cube Ice Company received a 120-day, 7% note for $24,000, dated April 9, from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. b. Determine the maturity value of the note. $ c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank