Answered step by step

Verified Expert Solution

Question

1 Approved Answer

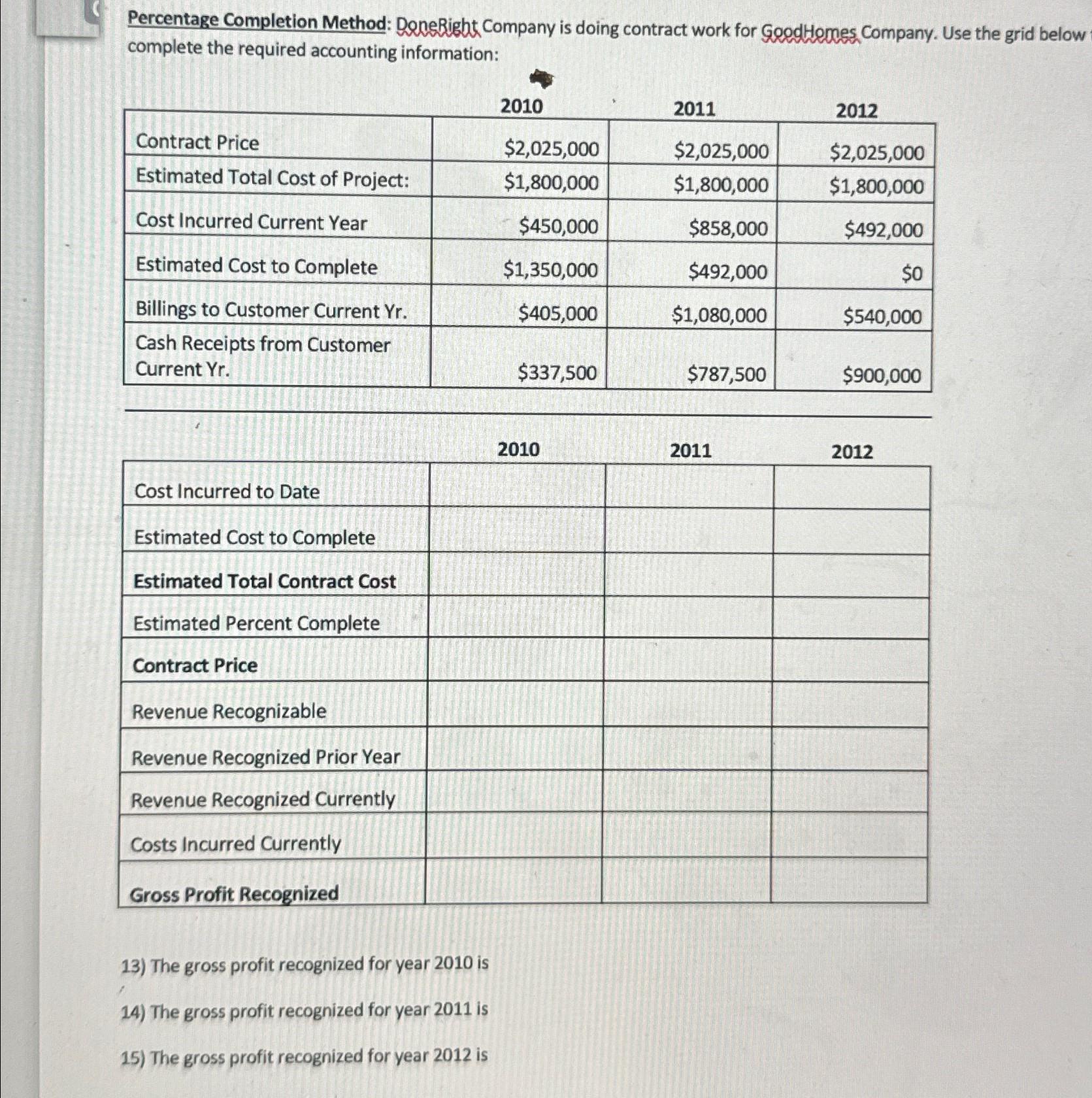

Percentage Completion Method: Done Right Company is doing contract work for GoodHomes Company. Use the grid below complete the required accounting information: 2010 2011

Percentage Completion Method: Done Right Company is doing contract work for GoodHomes Company. Use the grid below complete the required accounting information: 2010 2011 2012 Contract Price $2,025,000 $2,025,000 $2,025,000 Estimated Total Cost of Project: $1,800,000 $1,800,000 $1,800,000 Cost Incurred Current Year $450,000 $858,000 $492,000 Estimated Cost to Complete $1,350,000 $492,000 $0 Billings to Customer Current Yr. $405,000 $1,080,000 $540,000 Cash Receipts from Customer Current Yr. $337,500 $787,500 $900,000 Cost Incurred to Date Estimated Cost to Complete Estimated Total Contract Cost Estimated Percent Complete Contract Price Revenue Recognizable Revenue Recognized Prior Year Revenue Recognized Currently Costs Incurred Currently Gross Profit Recognized 13) The gross profit recognized for year 2010 is 14) The gross profit recognized for year 2011 is 15) The gross profit recognized for year 2012 is 2010 2011 2012

Step by Step Solution

★★★★★

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the gross profit recognized for each year using the percentage of completion met...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started