Answered step by step

Verified Expert Solution

Question

1 Approved Answer

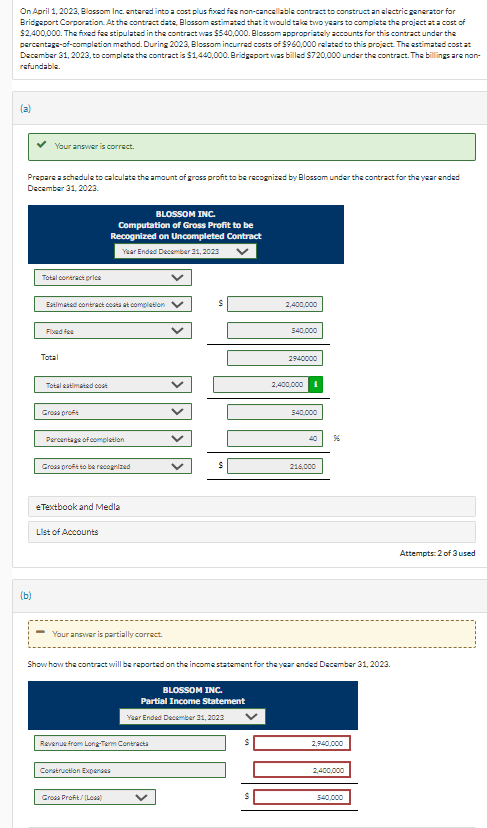

percentage - of - completion method. During 2 0 2 3 , Blossom incurred costs of $ 9 6 0 , 0 0 0 ralated

percentageofcompletion method. During Blossom incurred costs of $ ralated to this project. The estimatad cost at

December to complete the contract is $ Eridgeport was billad $ under the contract. The billings are nan

refundable.

a

Your answer is correct.

Prepare a schedule to calculate the amount of gross profit to be recosnized by Blossom under the contract for the year ended

December

BLOSSOM INC.

Computation of Gross Profit to be

Recognized on Uncompleted Contract

Year Endad Docimber

Total contract prics

Estimatad controct costa at complistion

Flued for:

$

Total

Total catimetad cost

Grow prof:

Percantise of oemeletion

Grow proft to be racopined

eTextbook and Medla

Llst of Accounts

b

Your ancwer is partially correct.

Show how the contract will be reported on the income statement for the year ended Decamber

BLOSSOM INC.

Partial Income Statement

Year Endad Dosember

Ravenus from LencTerm Contract

$

Construction Exporass

Grow Profit ILow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started