Answered step by step

Verified Expert Solution

Question

1 Approved Answer

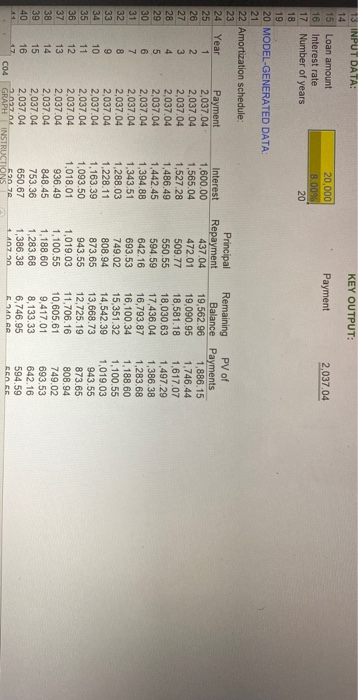

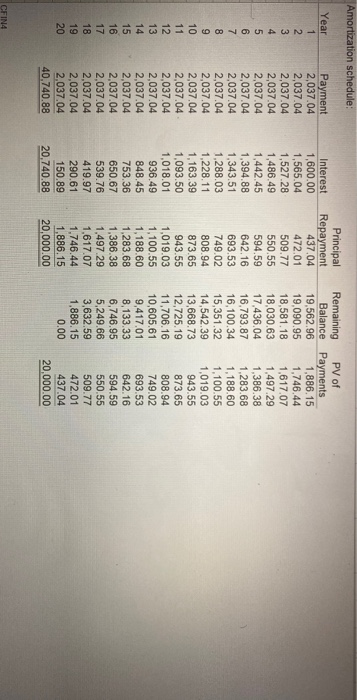

Percentages need to be entered in decimal format, for instance 3% would be entered as .03 in cell B12.) Set up an amortization schedule for

Percentages need to be entered in decimal format, for instance 3% would be entered as .03 in cell B12.)

Set up an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 10%. What is the annual payment?

Set up an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 20%. What is the annual payment?

Set up an amortization schedule for a $60,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 10%. What is the annual payment?

Set up an amortization schedule for a $60,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 20%. What is the annual payment?

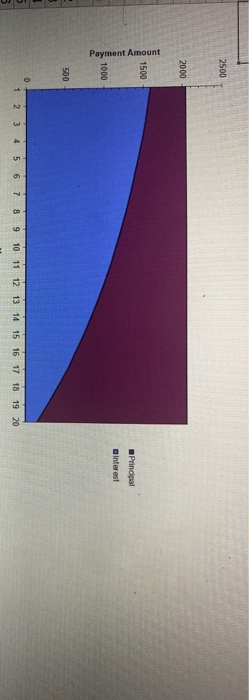

After you input the data for each scenario, click on the Graph tab (second tab on the worksheet) and look at the Principal and Interest portions of the payments throughout the years. What do you notice about the amount of Principal and Interest over the years (which amount is higher in the early years, and which amount is higher in the later years) of the loan? What do you notice about the difference in Principal and Interest in the 10% scenarios compared to 20% scenarios?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started