Answered step by step

Verified Expert Solution

Question

1 Approved Answer

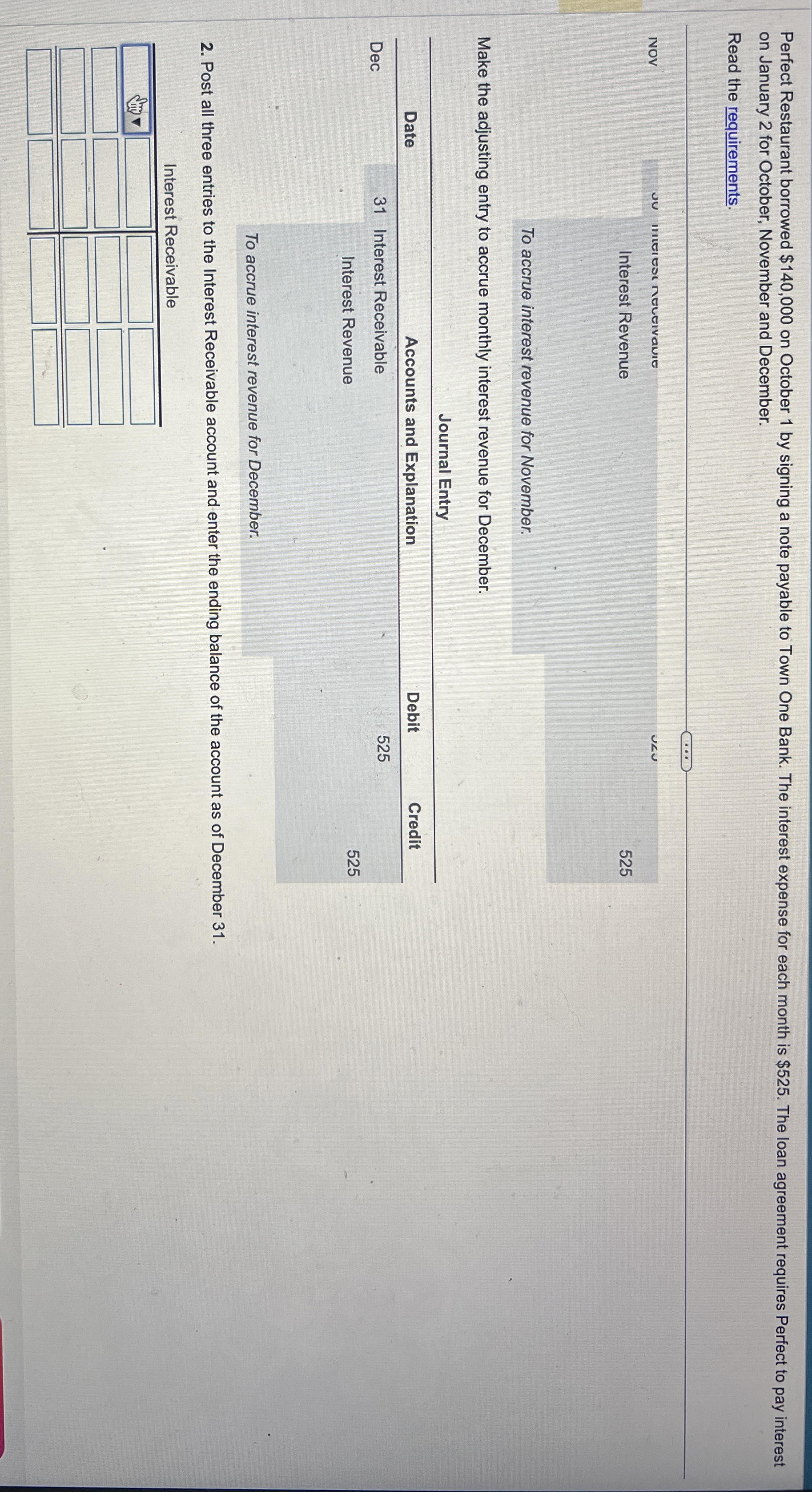

Perfect Restaurant borrowed $ 1 4 0 , 0 0 0 on October 1 by signing a note payable to Town One Bank. The interest

Perfect Restaurant borrowed $ on October by signing a note payable to Town One Bank. The interest expense for each month is $ The loan agreement requires Perfect to pay interest on January for October, November and December.

Read the requirements.

NOV

Interest Revenue

To accrue interest revenue for November.

Make the adjusting entry to accrue monthly interest revenue for December.

Journal Entry

tableDate,Accounts and Explanation,Debit,CreditDecInterest Receivable,Interest Revenue,,,

Post all three entries to the Interest Receivable account and enter the ending balance of the account as of December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started