Question

Perform a 3-stage DuPont analysis. Note that this needs appropriate analysis, not just a calculation. Comment on any areas of strength or weakness of the

Perform a 3-stage DuPont analysis. Note that this needs appropriate analysis, not just a calculation.

Comment on any areas of strength or weakness of the company, based on your results of Steps 2 and 3 . Make sure to look, not just at absolute levels, but also trends over time in solvency, liquidity, profitability, and asset management ratios

Compare your results with the management discussion and analysis in the annual report. Examine any differences between their comments and your analysis. You will be assessed on correct use of financial statement analysis tools from the course material, providing thoughtful analysis that draws on the theories discussed in the course as well as links to what is happening with Telus in the current market.

Explain whether there would be any difference to your analysis if you were an investor or if you were the CFO. How would the data quality differ in those two roles?

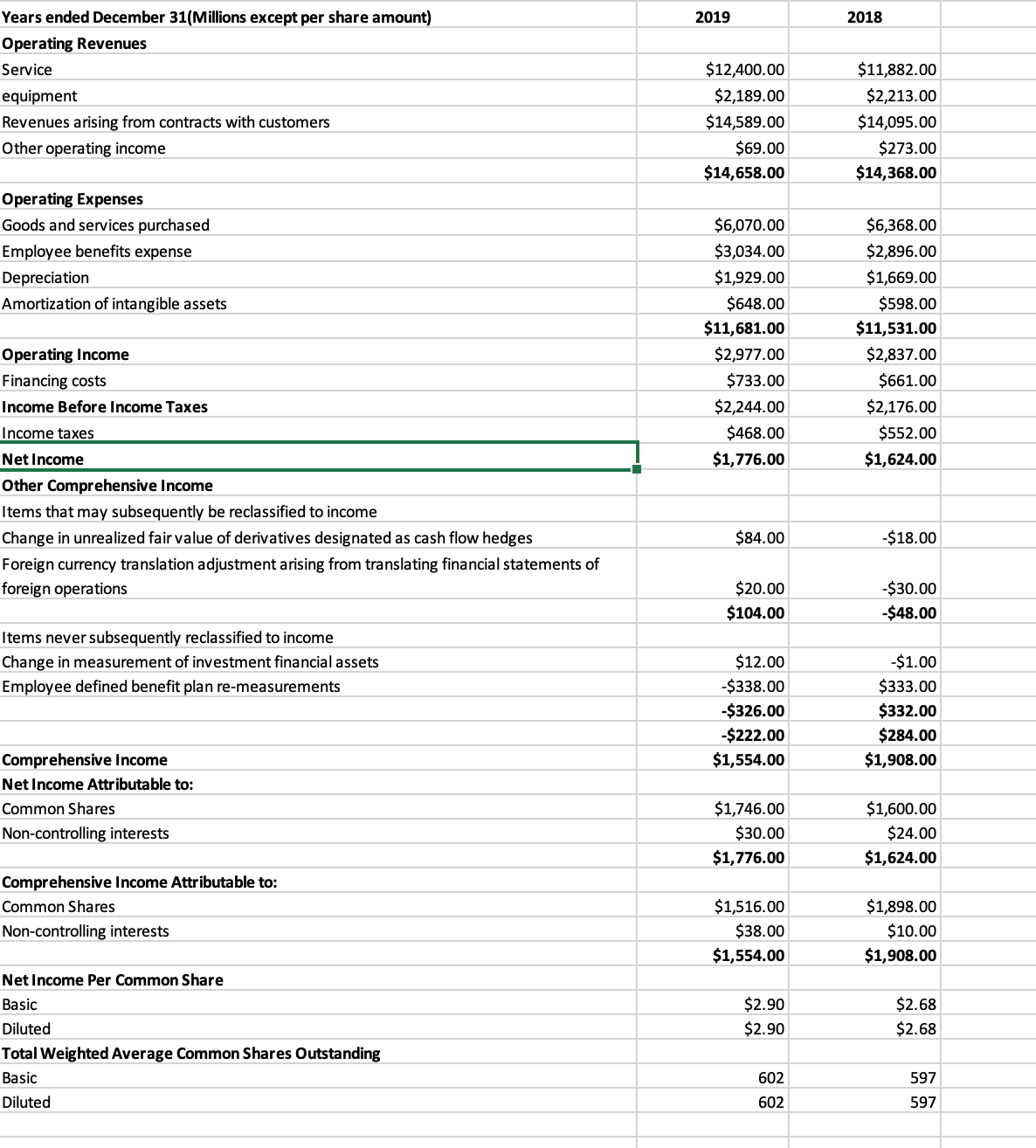

Years ended December 31(Millions except per share amount) Operating Revenues Service equipment Revenues arising from contracts with customers Other operating income Operating Expenses Goods and services purchased Employee benefits expense Depreciation Amortization of intangible assets Operating Income Financing costs Income Before Income Taxes Income taxes 2019 $12,400.00 $2,189.00 2018 $11,882.00 $2,213.00 $14,589.00 $14,095.00 $69.00 $273.00 $14,658.00 $14,368.00 $6,070.00 $6,368.00 $3,034.00 $2,896.00 $1,929.00 $1,669.00 $648.00 $598.00 $11,681.00 $11,531.00 $2,977.00 $733.00 $2,837.00 $661.00 $2,176.00 $2,244.00 Net Income $468.00 $1,776.00 $552.00 $1,624.00 Other Comprehensive Income Items that may subsequently be reclassified to income Change in unrealized fair value of derivatives designated as cash flow hedges Foreign currency translation adjustment arising from translating financial statements of $84.00 -$18.00 foreign operations $20.00 -$30.00 $104.00 -$48.00 Items never subsequently reclassified to income Change in measurement of investment financial assets $12.00 -$1.00 Employee defined benefit plan re-measurements -$338.00 $333.00 -$326.00 $332.00 -$222.00 $284.00 Comprehensive Income $1,554.00 $1,908.00 Net Income Attributable to: Common Shares $1,746.00 $1,600.00 Non-controlling interests $30.00 $1,776.00 $24.00 $1,624.00 Comprehensive Income Attributable to: Common Shares $1,516.00 $1,898.00 Non-controlling interests $38.00 $1,554.00 $10.00 $1,908.00 Net Income Per Common Share Basic $2.90 $2.68 Diluted $2.90 $2.68 Total Weighted Average Common Shares Outstanding Basic Diluted 602 597 602 597

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

his analysis will dissect TELUSs profitability using the DuPont framework highlighting strengths weaknesses and potential discrepancies with the compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started