Answered step by step

Verified Expert Solution

Question

1 Approved Answer

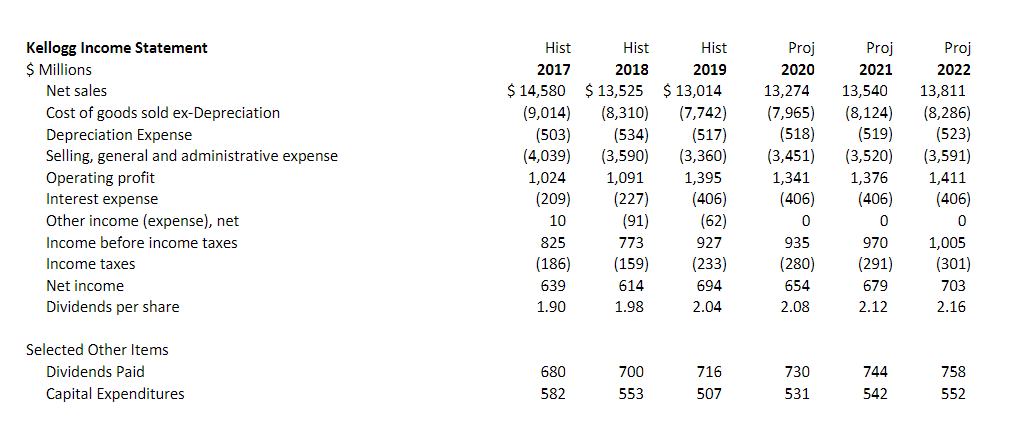

Perform a Fama-French factor model analysis of Kellogg. Assume a value premium of 3 and size premium of 2.? 1. Given what you know about

Perform a Fama-French factor model analysis of Kellogg. Assume a value premium of 3 and size premium of 2.?

1. Given what you know about Kellogg, what is a reasonable value beta and size beta??

2. Given your assumptions above, what is Kellogg's Fama-French required return? Comment on why this required return is different from the required return derived from CAPM.

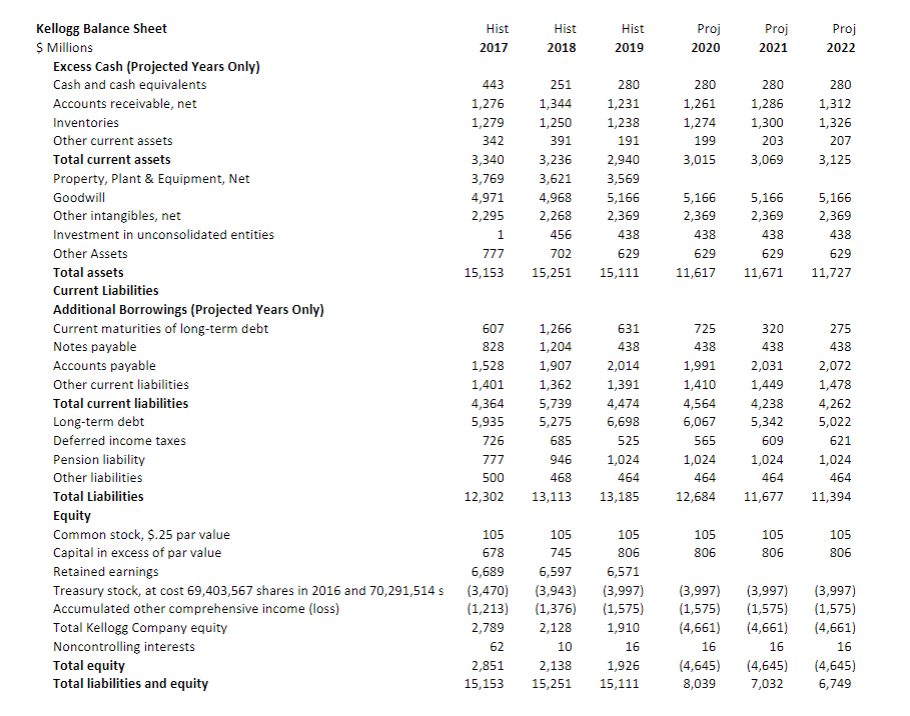

Kellogg Balance Sheet $ Millions Excess Cash (Projected Years Only) Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Property, Plant & Equipment, Net Goodwill Other intangibles, net Investment in unconsolidated entities Other Assets Total assets Current Liabilities Additional Borrowings (Projected Years Only) Current maturities of long-term debt Notes payable Accounts payable Other current liabilities Total current liabilities Long-term debt Deferred income taxes Pension liability Other liabilities Total Liabilities Equity Common stock, $.25 par value Capital in excess of par value Retained earnings Treasury stock, at cost 69,403,567 shares in 2016 and 70,291,514 s Accumulated other comprehensive income (loss) Total Kellogg Company equity Noncontrolling interests Total equity Total liabilities and equity Hist 2017 443 1,276 1,279 342 3,340 3,769 4,971 2,295 1 777 15,153 607 828 1,528 1,401 4,364 5,935 726 777 500 12,302 105 678 Hist 2018 2,851 15,153 251 1,344 1,250 391 280 1,231 1,238 191 3,236 2,940 3,621 3,569 4,968 2,268 456 702 15,251 Hist 1,266 1,204 1,907 1,362 2019 5,166 2,369 438 629 15,111 631 438 2,014 1,391 4,474 6,698 525 105 745 6,689 6,597 6,571 (3,997) (3,470) (3,943) (1,213) (1,376) (1,575) 2,789 1,910 62 2,128 10 16 2,138 1,926 15,251 15,111 5,739 5,275 685 946 1,024 468 464 13,113 13,185 105 806 Proj 2020 280 1,261 1,274 199 3,015 725 438 1,991 1,410 4,564 6,067 565 1,024 464 12,684 Proj 2021 5,166 2,369 438 438 629 629 11,617 11,671 105 806 280 1,286 1,300 203 3,069 5,166 2,369 320 438 2,031 1,449 4,238 5,342 609 1,024 464 11,677 105 806 (3,997) (3,997) (1,575) (1,575) (4,661) (4,661) 16 16 (4,645) (4,645) 8,039 7,032 Proj 2022 280 1,312 1,326 207 3,125 5,166 2,369 438 629 11,727 275 438 2,072 1,478 4,262 5,022 621 1,024 464 11,394 105 806 (3,997) (1,575) (4,661) 16 (4,645) 6,749

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A reasonable value beta and size beta for Kellogg can be estimated by looking at the companys financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started