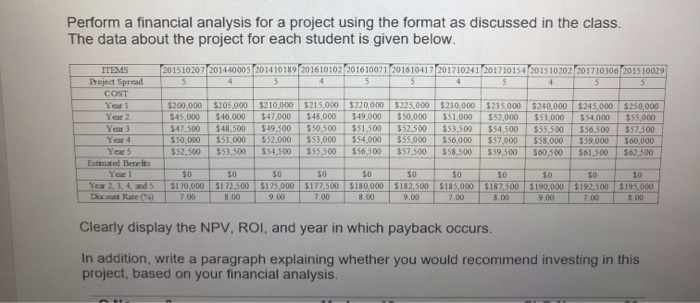

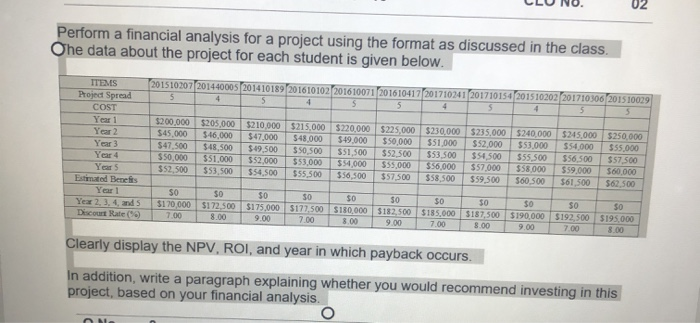

Perform a financial analysis for a project using the format as discussed in the class. The data about the project for each student is given below. ITEMS 201510207201440005 201410189 201610102 201610071 201610417201710241 201710154 201510202 201710306/201510029 5 5 Project Spread COST Year 1 Year 2 Year 3 Year 4 Year 5 Estimated Benefits Yearl Yea 23.4 and 5 Discount Rate (36) $200.000 $45,000 $47.500 $50,000 $52,500 $205.000 $46.000 $48.500 $51.000 $53,500 $210.000 $47,000 $49,500 $52,000 $54,500 $215,000 $48.000 $50,500 $53,000 $55,500 $220,000 $49.000 $51.500 $54.000 $56,500 $225,000 350,000 $52,500 $55,000 $57,500 $230,000 $51.000 $53,500 $56,000 $58,500 $235 000 $52,000 $54,500 $57,000 $59.500 $240,000 $53,000 $55 500 $58,000 560,500 $245,000 $54,000 $56.500 $59.000 561,500 $250,000 $55.000 $57.500 $60,000 $62,500 SO $170.000 7.00 SO 5172500 8.00 $0 $175,000 9.00 $0 $177,500 7.00 $0 $180,000 8.00 $0 $182.500 9.00 $0 $185.000 7.00 $0 $187.500 800 SO $190.000 900 SO $192 500 7.00 SO $195.000 8.00 Clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Ohe data about the project for each student is given below. 201510207201440005 201410189 201610102201610071 201610417201710241 201710154 201510202201710306201510029 55 ITEMS Project Spread COST Year 1 $200,000 $45.000 $47.500 $50,000 $52500 $205,000 $46,000 $4.500 $51.000 $53 500 $210,000 $47.000 $49.500 552,000 $54.500 $215,000 548.000 $50.500 $53,000 $55 500 $220,000 $49.000 1.500 $54,000 556.500 $225,000 $230,000 350.000 551,000 $522500 5 53.500 $55,000 $56,000 $57500358500 $235.000 $52.000 $4.500 $57,000 $59500 $240,000 $245,000 53.000 554.000 $55.500 556.500 $58,000 $59.000 $60500 561 500 $250,000 555.000 $57 500 $60.000 $62 500 Year 4 Years med Beness Yer Year 23 and 5 Descourt Rate ( SO 5170 000 7.00 SO $172 500 8.00 SO $175.000 9.00 30 $177500 7.00 30 STB0000 8.00 30 $182500 9.00 30 $185.000 7.00 30 $187.500 8.00 30 $190.000 9.00 30 $192 500 7.00 30 $195.000 8.00 Clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis