Question

Perform a Horizontal analysis for the year 2018 to year 2021 Income Statement and Balance sheet. Perform a Vertical analysis (common size statements) for the

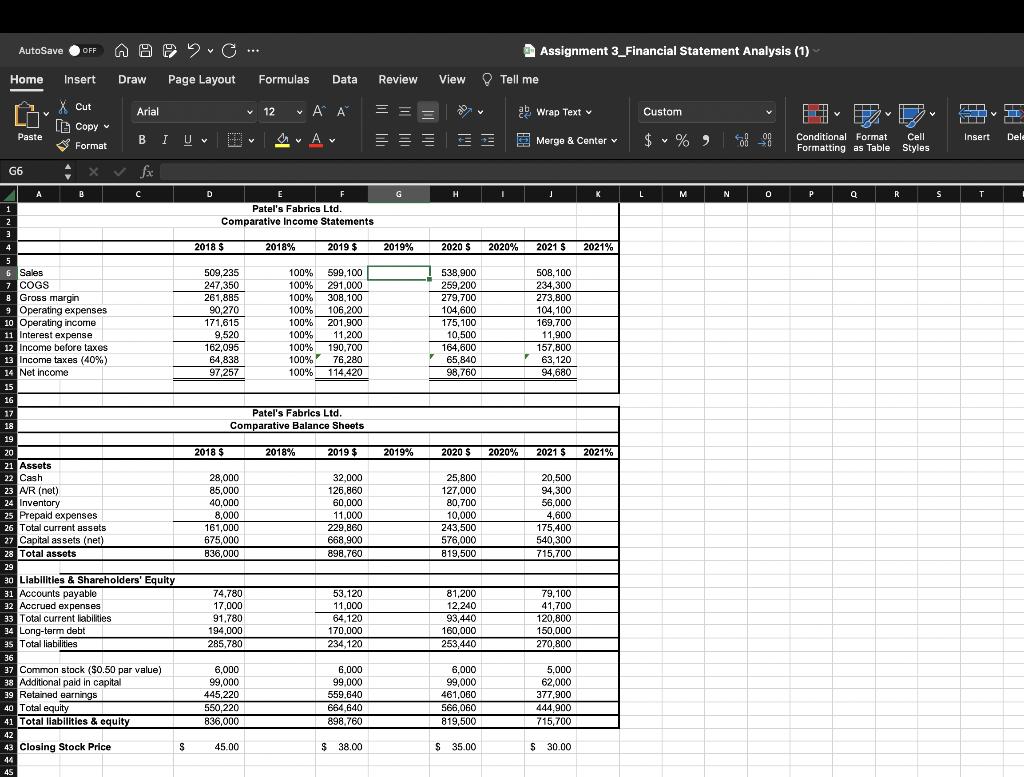

Perform a Horizontal analysis for the year 2018 to year 2021 Income Statement and Balance sheet. Perform a Vertical analysis (common size statements) for the year 2018 to year 2021 Income Statement and Balance sheet. Always consider the first year as the base year for the horizontal analysis. Provide your observations on the trends of the business, based on your horizontal and vertical analysis. Assess the business' liquidity by using liquidity ratios. Is the company's position improving or deteriorating? Explain the answer. Assess the business' profitability by using profitability ratios. Is the company's position improving or deteriorating? Explain the answer. Based on the above analysis (horizontal, vertical, and ratios), type a brief financial summary of the business, and explain any observed risks/weaknesses for the business. Can you please show me where to put everything Im having a hard time figuring out where to put the answer

AutoSave OFF 50... Assignment 3 Financial Statement Analysis (1) Home Insert Draw Page Layout Formulas Data Review View Tell me G X Cut Arial 12 A A Wrap Text Custom Paste G6 Copy Format fx BIU Merge & Center $ % 9 A B C D E V Conditional Format Formatting as Table. Cell Styles Insert Dele F G H 1 J K L M N P a R S T 1 2 3 4 5 Patel's Fabrics Ltd. Comparative Income Statements 2018 $ 2018% 2019 $ 2019% 2020 $ 2020% 2021 $ 2021% 6 Sales 509,235 7 COGS 8 Gross margin 247,350 261,885 9 Operating expenses 90,270 10 Operating income 171,615 11 Interest expense 9,520 12 Income before taxes 162,095 13 Income taxes (40%) 64,838 14 Net income 97,257 100% 599,100 100% 291,000 100% 308,100 100% 106,200 100% 201,900 100% 11,200 100% 190,700 100% 76,280 100% 114,420 538,900 508,100 259,200 234,300 279,700 273,800 104,600 104,100 175,100 169,700 10,500 11,900 164,600 157,800 65,840 63,120 98,760 94,680 15 16 17 18 Patel's Fabrics Ltd. Comparative Balance Sheets 19 20 2018 $ 2018% 2019 $ 2019% 2020 $ 2020% 2021 $ 2021% 21 Assets 22 Cash 23 A/R (net) 24 Inventory 25 Prepaid expenses 28,000 32,000 25,800 20,500 85,000 126,860 127,000 94,300 40,000 60,000 80,700 56,000 8,000 11,000 10,000 4,600 26 Total current assets 161,000 229,860 243,500 175,400 27 Capital assets (net) 675,000 668,900 576,000 540,300 28 Total assets 836,000 898,760 819,500 715,700 29 30 Liabilities & Shareholders' Equity 31 Accounts payable 74,780 53,120 81,200 79,100 32 Accrued expenses 17,000 11,000 12,240 41,700 33 Total current liabilities 91,780 64,120 93,440 120,800 34 Long-term debt 194,000 170,000 160,000 150,000 35 Total liabilities 285,780 234,120 253,440 270,800 36 37 Common stock ($0.50 par value) 6,000 6,000 6,000 5,000 38 Additional paid in capital 99,000 99,000 99,000 62,000 39 Retained earnings 445,220 559,640 461,060 377,900 42 40 Total equity 41 Total liabilities & equity 43 Closing Stock Price 550,220 664,640 566,060 444,900 836,000 898,760 819,500 715,700 S 45.00 $ 38.00 $ 35.00 $ 30.00 44 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started