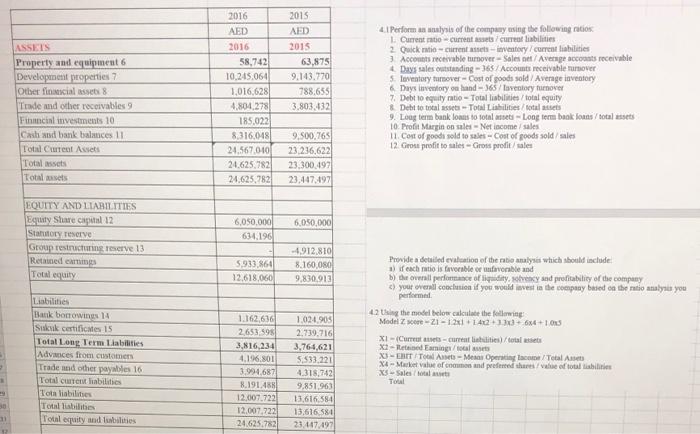

Perform an analysis of the company using the following ratios :

using The model below calculate the following :

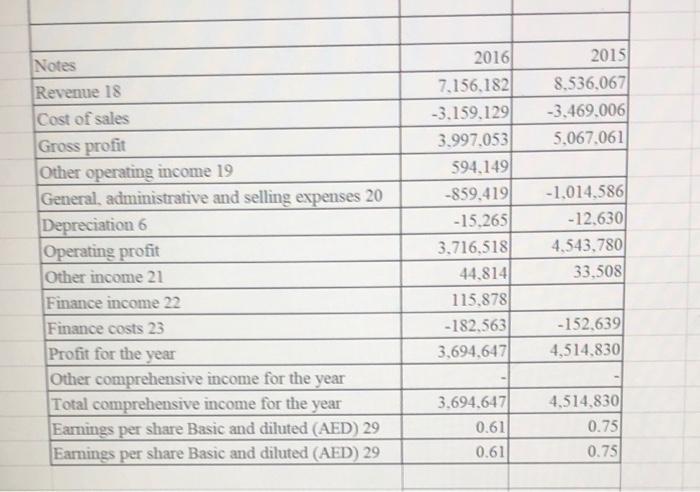

2016 AED 2015 AED 2015 63.875 9.143.770 788.655 3.803,132 ASSEIS Property and equipment 6 Development properties 7 Other finicial asseti 8 Trade and other receivables 9 Fincial mvestments 10 Cash bank balances 11 Total Current Assets Total assets Total sets 2016 58,742 10,245.064 1,016,628 4.804,278 185.022 8316,048 24.567010 24.625.782 24.625,782 4.1 Performan alysis of the company using the following ratios 1. Current ratio-current secret libilities 2 Quicki - Centre-inventory/current liabilities 3 Accounts receivable turnover - Sales net / Average accounts receivable Days sales otstanding - 365/ Accounts receivable mover 5. Lovestory tumover-Cost of goods sold / Average lovestory & Days lovestory on hand - 165/lovestory furnover 7. Debt to equity ratio-Totallibilities/total equity & Debt to totale Total Liabilities/totals 9. Long term bank comes to total assets Long term bank tonns / soal sets 10. Profit Margin on-Net income sales 11. Cost of goods sold to as Cost of goods sold sales 12 Gross profit to sales-Gross prodit/sales 9.500.765 23.236,622 23,300.497 23.447.497 EQUITY AND LIABILITIES Equity Share capital 12 Statutory reserve Group restructure. Terve 13 Remedang Total equity 6,050,000 634.196 6,050.000 5.933.864 12,618,060 -4912.810 8.160,000 9.830.913 Liabilities Bank borowinus 14 Siku certificates 15 Total Long Term Liabilities Advances from customers Trade and other payables 16 Total current abilities Tota liabilities Total abilities Total equity and abilities 1.162,636 2,653 595 3,816,234 4.196.801 3.994687 8.191.458 12.007.722 12.007,722 24.625.782 1.024.905 2.739.716 3,764,621 5.333.221 4,318,742 9.851,963 13,616584 13,616 584 23.447.497 Provide a detailed evalt of the ratio analyses which should include 1) if each ratio is favorable or forble and b) the overall performance of liquidity, solvency and profitability of the company c) your overall conclusion if you would lives in the company based on the ratio analysis you performed 42 in the model below calculate the following Model Zore-21-123114 6x6+1023 XI - Current current lines/totalset x2 - Red Earning X-ETTA - Men Operating Total X4 - Market value of new and pred these of total abilities X Sales Total 30 11 2015 8.536,067 -3.469.006 5,067,061 Notes Revenue 18 Cost of sales Gross profit Other operating income 19 General, administrative and selling expenses 20 Depreciation 6 Operating profit Other income 21 Finance income 22 Finance costs 23 Profit for the year Other comprehensive income for the year Total comprehensive income for the year Earnings per share Basic and diluted (AED) 29 Earnings per share Basic and diluted (AED) 29 2016 7.156.182 -3.159.129 3.997.053 594.149 -859.419 - 15.265 3.716.518 44.814 115.878 -182,563 3,694,647 -1,014,586 -12.630 4.543,780 33,508 -152.639 4,514,830 3.694.647 0.61 0.61 4.514.830 0.75 0.75