Answered step by step

Verified Expert Solution

Question

1 Approved Answer

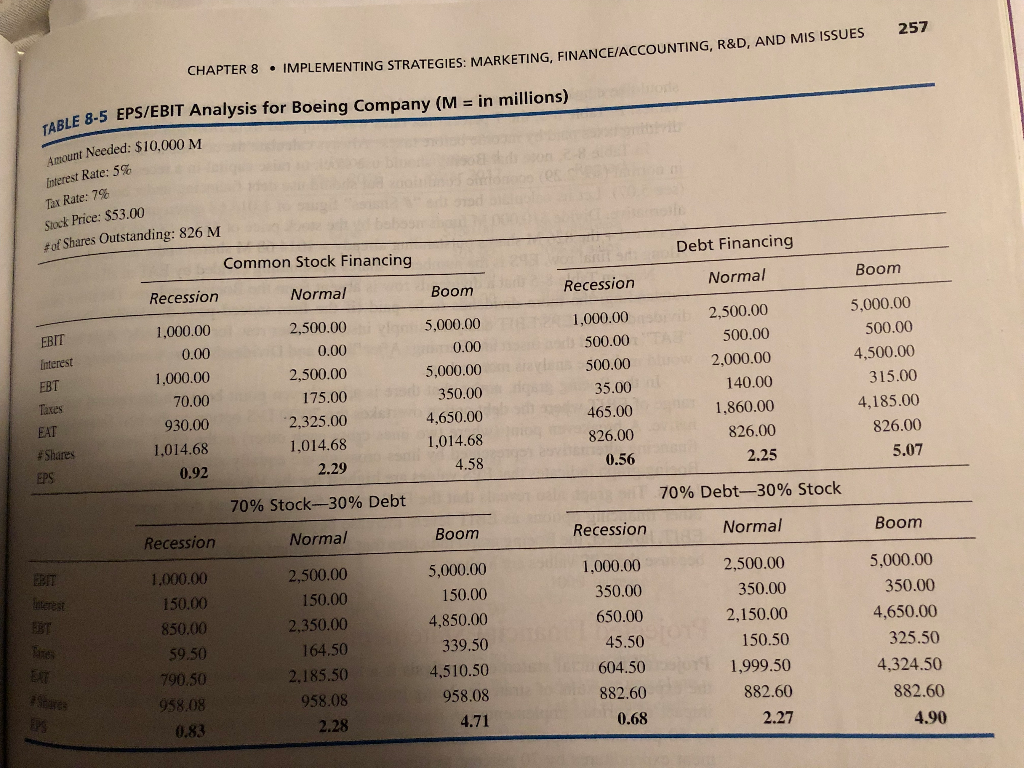

Perform an EPS/EBIT Analysis for Hershey. Read the information on pages 255 - 258 of the text. Following the example on page 257, Table 8-5,

Perform an EPS/EBIT Analysis for Hershey. Read the information on pages 255 - 258 of the text. Following the example on page 257, Table 8-5, perform an EPS/EBIT analysis for Hershey. Use the following information for your analysis.

- Hersheysmanagement wants to raise $1 billion to expand globally.

- Determine whether Hershey should use all debt, all stock, or a 50 percent stock/50 percent debt combinationto finance this market-development strategy.

- Assume a38 percent corporate tax rate.

- Assume PepsiCosinterest rateto borrow long-term debt is 5%.

- The price per share of Hersheys stock is $25 per share.

- Use the following EBIT ranges

- Recession -- $100 million

- Normal -- $500 million

- Boom -- $1 billion

- A total of 60 million shares of common stock are outstanding.

After you have calculated the EPS under each economic scenario for each of the financing options, discuss which financing option is most attractive, and whythat option is the most attractive.

Strategic Management: Concepts and Cases,16th Edition, by Fred R. David, Prentice Hall,

2017, ISBN 978- 0-13-416784-8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started