Answered step by step

Verified Expert Solution

Question

1 Approved Answer

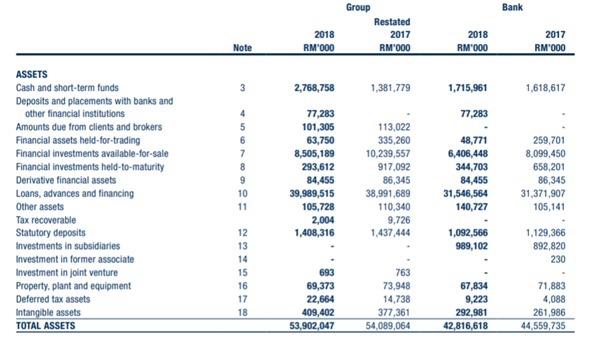

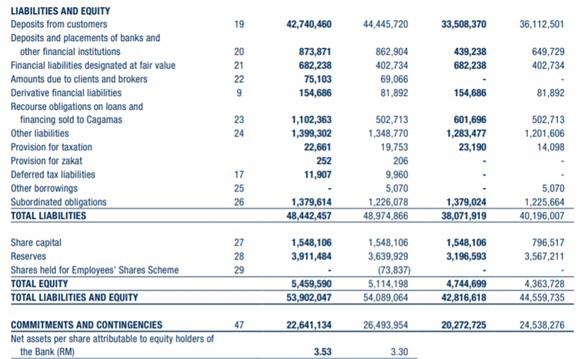

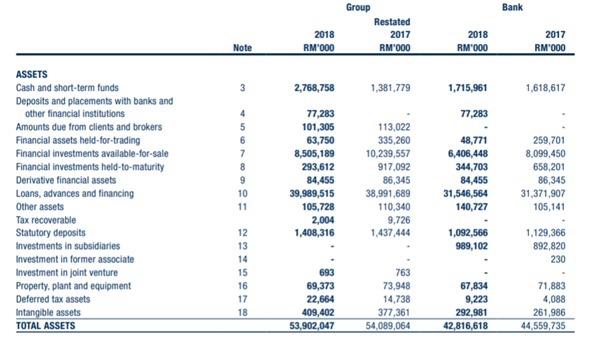

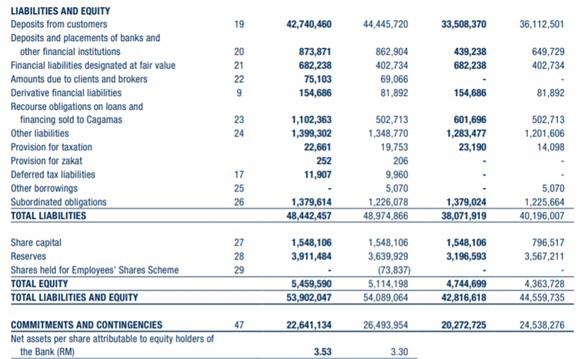

perform horizontal and vertical analysis of this company (alliance Bank) Bank 2018 RM 000 Group Restated 2017 RM 000 2018 RM 000 2017 RM'000 Note

perform horizontal and vertical analysis of this company (alliance Bank)

Bank 2018 RM 000 Group Restated 2017 RM 000 2018 RM 000 2017 RM'000 Note 3 2,768,758 1,381,779 1.715,961 1,618,617 77,283 ASSETS Cash and short-term funds Deposits and placements with banks and other financial institutions Amounts due from clients and brokers Financial assets heid-for-trading Financial investments available-for-sale Financial investments held-to-maturity Derivative financial assets Loans, advances and financing Other assets Tax recoverable Statutory deposits Investments in subsidiaries Investment in former associate Investment in joint venture Property, plant and equipment Deferred tax assets Intangible assets TOTAL ASSETS 4 5 6 7 8 9 10 11 77,283 101,305 63,750 8,505,189 293,612 84,455 39,989,515 105,728 2,004 1,408,316 113,022 335,260 10,239,557 917,092 86,345 38,991,689 110,340 9,726 1.437.444 48,771 6,406,448 344,703 84,455 31,546,564 140,727 259,701 8,099,450 658,201 86,345 31,371,907 105,141 1,092,566 989,102 1,129,366 892,820 230 12 13 14 15 16 17 18 693 69,373 22,664 409,402 53,902,047 763 73.948 14,738 377,361 54,089,064 67,834 9,223 292,981 42,816,618 71,883 4,088 261,986 44,559,735 19 42,740,460 44.445,720 33,508,370 36,112,501 20 21 22 9 439,238 682,238 649,729 402,734 873,871 682,238 75,103 154,686 862,904 402.734 69,066 81.892 154,686 81,892 23 24 1,102,363 1,399,302 22,661 252 11,907 601,696 1,283,477 23,190 LIABILITIES AND EQUITY Deposits from customers Deposits and placements of banks and other financial institutions Financial liabilities designated at fair value Amounts due to clients and brokers Derivative financial liabilities Recourse obligations on loans and financing sold to Cagamas Other liabilities Provision for taxation Provision for zakat Deferred tax liabilities Other borrowings Subordinated obligations TOTAL LIABILITIES Share capital Reserves Shares held for Employees' Shares Scheme TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 502,713 1,201,606 14,098 17 25 26 502,713 1,348,770 19,753 206 9,960 5,070 1,226,078 48,974,866 1,379,614 48,442,457 1,379,024 38,071,919 5,070 1,225,664 40.196,007 27 28 29 1,548,106 3,911,484 1,548,106 3,196,593 796,517 3,567,211 1,548,106 3,639.929 (73.837) 5.114,198 54,089,064 5,459,590 53,902,047 4,744,699 42,816,618 4,363,728 44,559,735 47 22,641,134 26,493.954 20,272,725 24,538,276 COMMITMENTS AND CONTINGENCIES Net assets per share attributable to equity holders of the Bank (RM) 3.53 3.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started