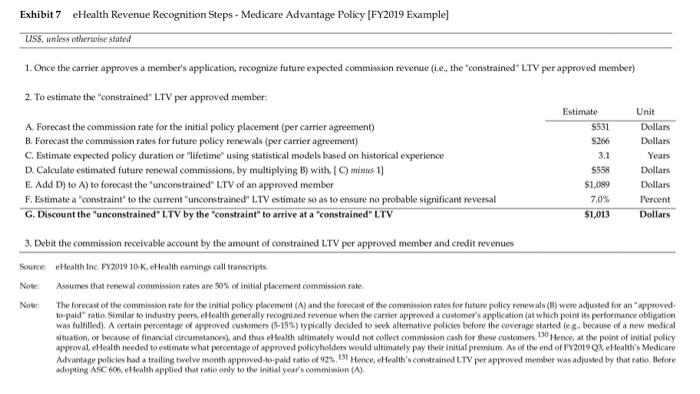

Perform the annual journal entries for eHealth under the old and new (606) standards for one Medicare Advantage policy using the information given in the exhibit below

Exhibit? eHealth Revenue Recognition Steps - Medicare Advantage Policy [FY2019 Example] USS, unless otherwise stated 1. Once the carrier approves a member's application, recognize future expected commission revenue (ie, the constrained" LTV per approved member) 2. To estimate the constrained" LTV per approved member: A. Forecast the commission rate for the initial policy placement (per carrier agreement) B. Forecast the commission rates for future policy renewals (per carrier agreement) C. Estimate expected policy duration or "lifetime" using statistical models based on historical experience D. Calculate estimated future renewal commissions, by multiplying t) with. (C) mm 11 E. Add D) to A) to forecast the unconstrained" LTV of an approved member F. Estimate a constraint to the current "unconstrained" LIV estimate so as to ensure no probable significant reversal G. Discount the "unconstrained" LTV by the constraint" to arrive at a constrained" LTV Estimate $531 $266 3.1 5558 $1,089 7.0% $1,013 Unit Dollars Dollars Years Dollars Dollars Percent Dollars 3. Debit the commission receivable account by the amount of constrained LTV per approved member and credit revenues Source Health Inc FY2019 10-K, Health earnings call transcripts. Note Assumes that renewal commission rates are 50% of initial placement commission rate. Note: The Forecast of the commission rate for the initial policy placement (A) and the forecast of the commission rates for future policy renewals () were adjusted for an approved to-paid" ratio Similar to industry peers Health generally recognized revenue when the carrier approved a customer's application (at which point is performance obligation was fulfilled). A certain percentage of approved customers (5-15%) typically decided to seek alternative policies before the coverage started (eg, because of a new medical situation, or because of financial circumstances), and thus Health ultimately would not collect commission cash for these customers 190 Hence, at the point of initial policy approval Health needed to estimate what percentage of approved policyholders would ultimately pay their initial premium. As of the end of FY201904, Health's Medicare Advantage policies had a trailing twelve month approved-to-paid ratio of 92%. Hence, Health's constrained LTV per apprewed member was adjusted by that ratio. Before adopting ASC 606 eHealth applied that ratio only to the initial year's comminion (A) Exhibit? eHealth Revenue Recognition Steps - Medicare Advantage Policy [FY2019 Example] USS, unless otherwise stated 1. Once the carrier approves a member's application, recognize future expected commission revenue (ie, the constrained" LTV per approved member) 2. To estimate the constrained" LTV per approved member: A. Forecast the commission rate for the initial policy placement (per carrier agreement) B. Forecast the commission rates for future policy renewals (per carrier agreement) C. Estimate expected policy duration or "lifetime" using statistical models based on historical experience D. Calculate estimated future renewal commissions, by multiplying t) with. (C) mm 11 E. Add D) to A) to forecast the unconstrained" LTV of an approved member F. Estimate a constraint to the current "unconstrained" LIV estimate so as to ensure no probable significant reversal G. Discount the "unconstrained" LTV by the constraint" to arrive at a constrained" LTV Estimate $531 $266 3.1 5558 $1,089 7.0% $1,013 Unit Dollars Dollars Years Dollars Dollars Percent Dollars 3. Debit the commission receivable account by the amount of constrained LTV per approved member and credit revenues Source Health Inc FY2019 10-K, Health earnings call transcripts. Note Assumes that renewal commission rates are 50% of initial placement commission rate. Note: The Forecast of the commission rate for the initial policy placement (A) and the forecast of the commission rates for future policy renewals () were adjusted for an approved to-paid" ratio Similar to industry peers Health generally recognized revenue when the carrier approved a customer's application (at which point is performance obligation was fulfilled). A certain percentage of approved customers (5-15%) typically decided to seek alternative policies before the coverage started (eg, because of a new medical situation, or because of financial circumstances), and thus Health ultimately would not collect commission cash for these customers 190 Hence, at the point of initial policy approval Health needed to estimate what percentage of approved policyholders would ultimately pay their initial premium. As of the end of FY201904, Health's Medicare Advantage policies had a trailing twelve month approved-to-paid ratio of 92%. Hence, Health's constrained LTV per apprewed member was adjusted by that ratio. Before adopting ASC 606 eHealth applied that ratio only to the initial year's comminion (A)