Answered step by step

Verified Expert Solution

Question

1 Approved Answer

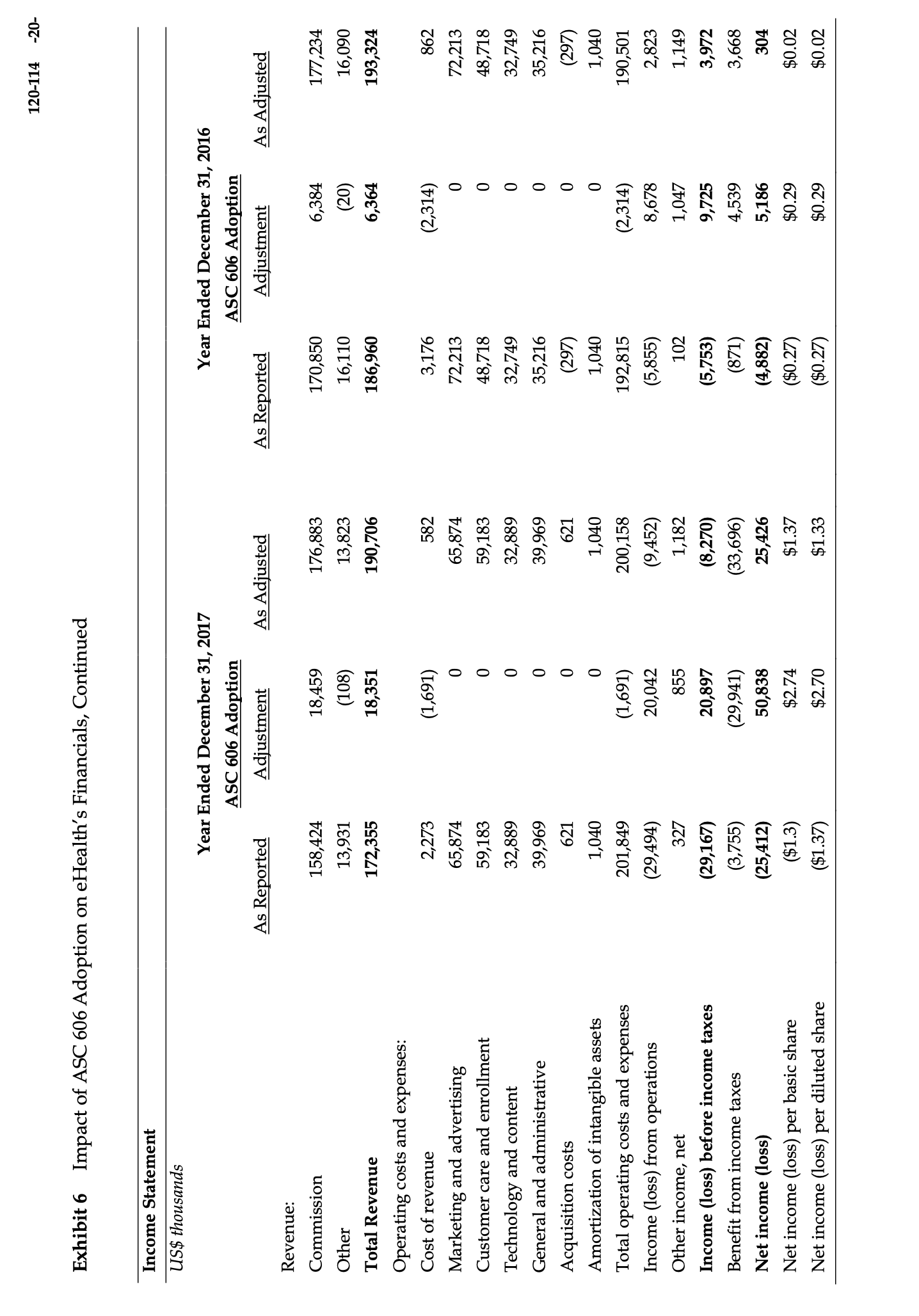

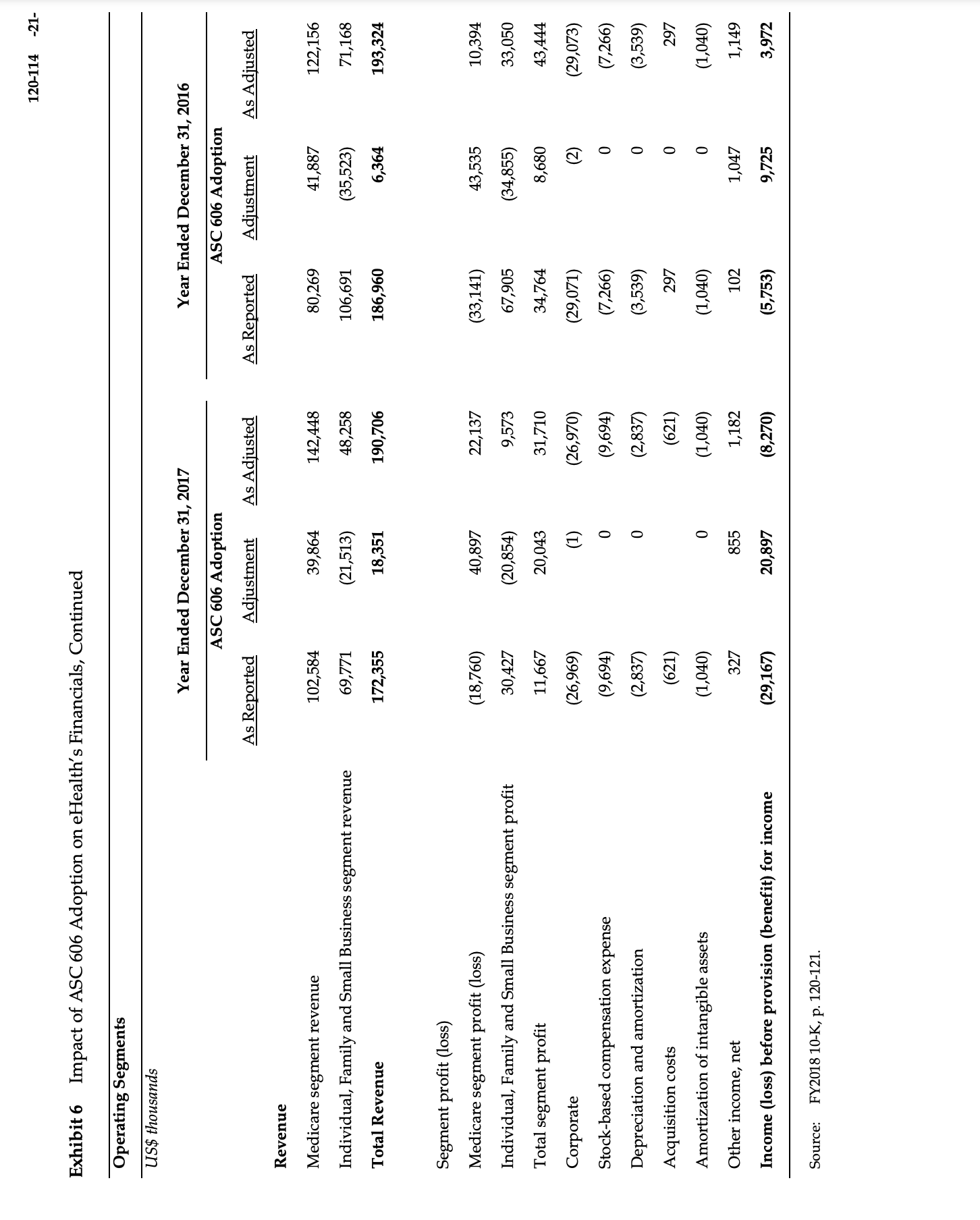

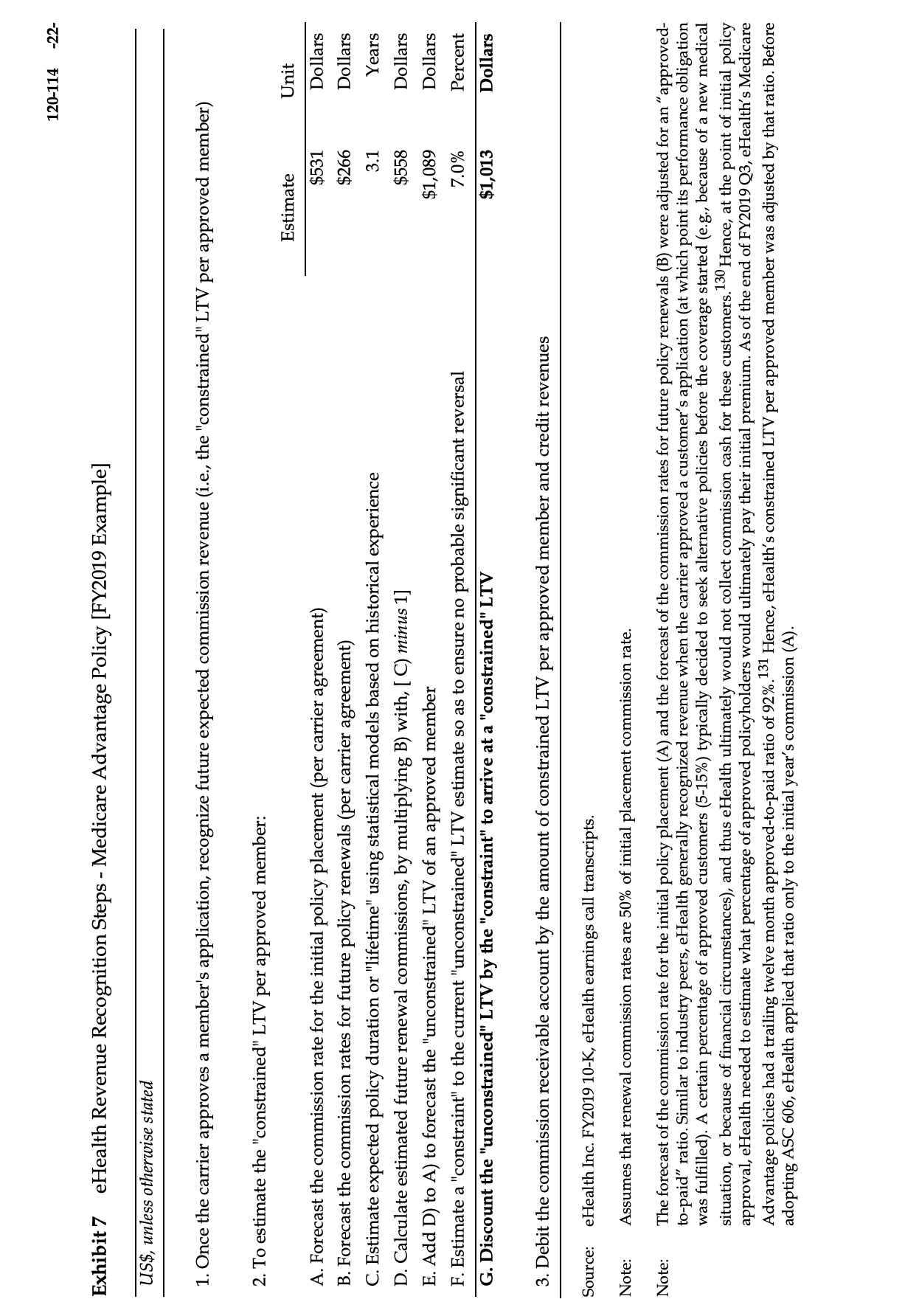

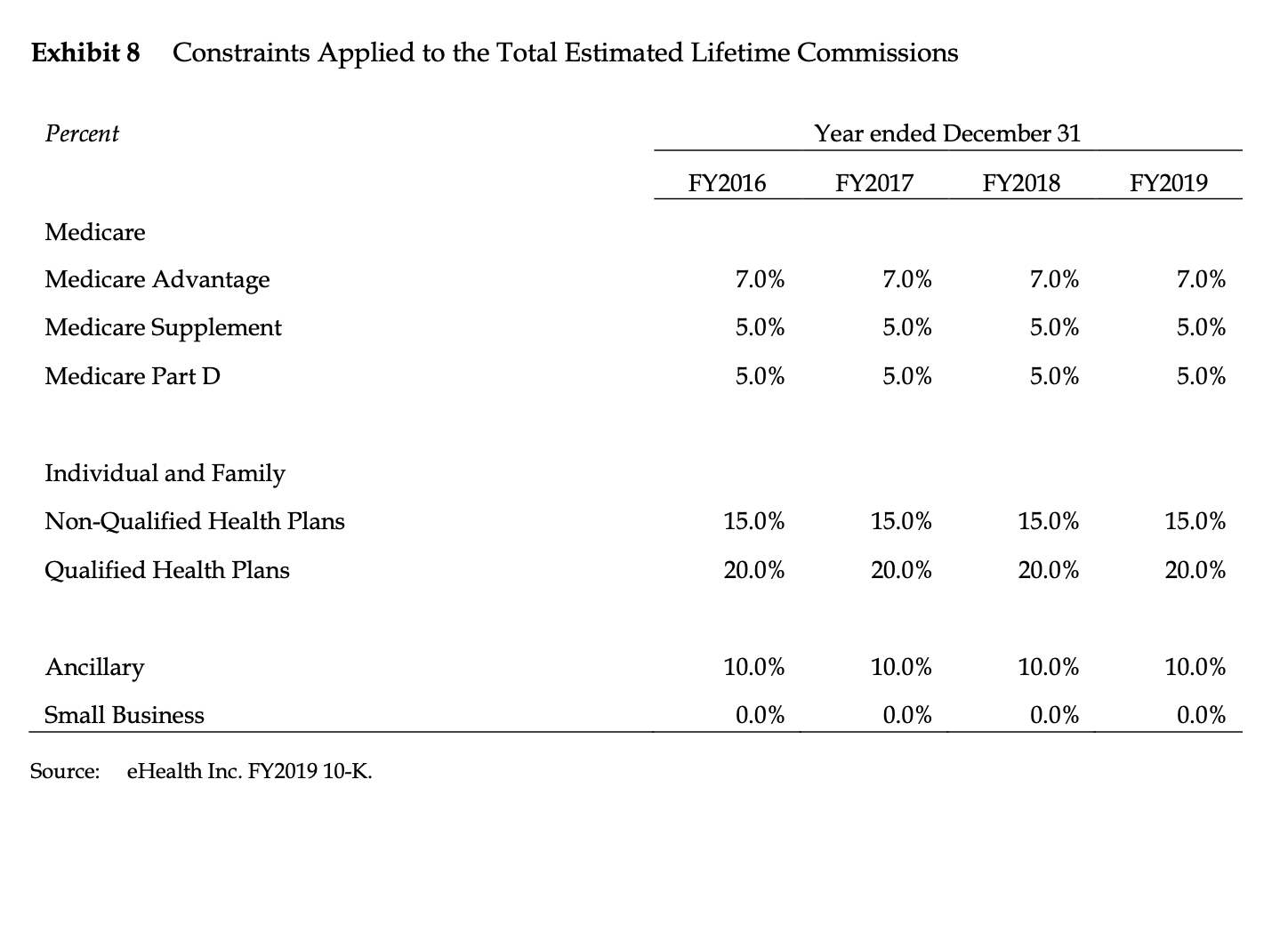

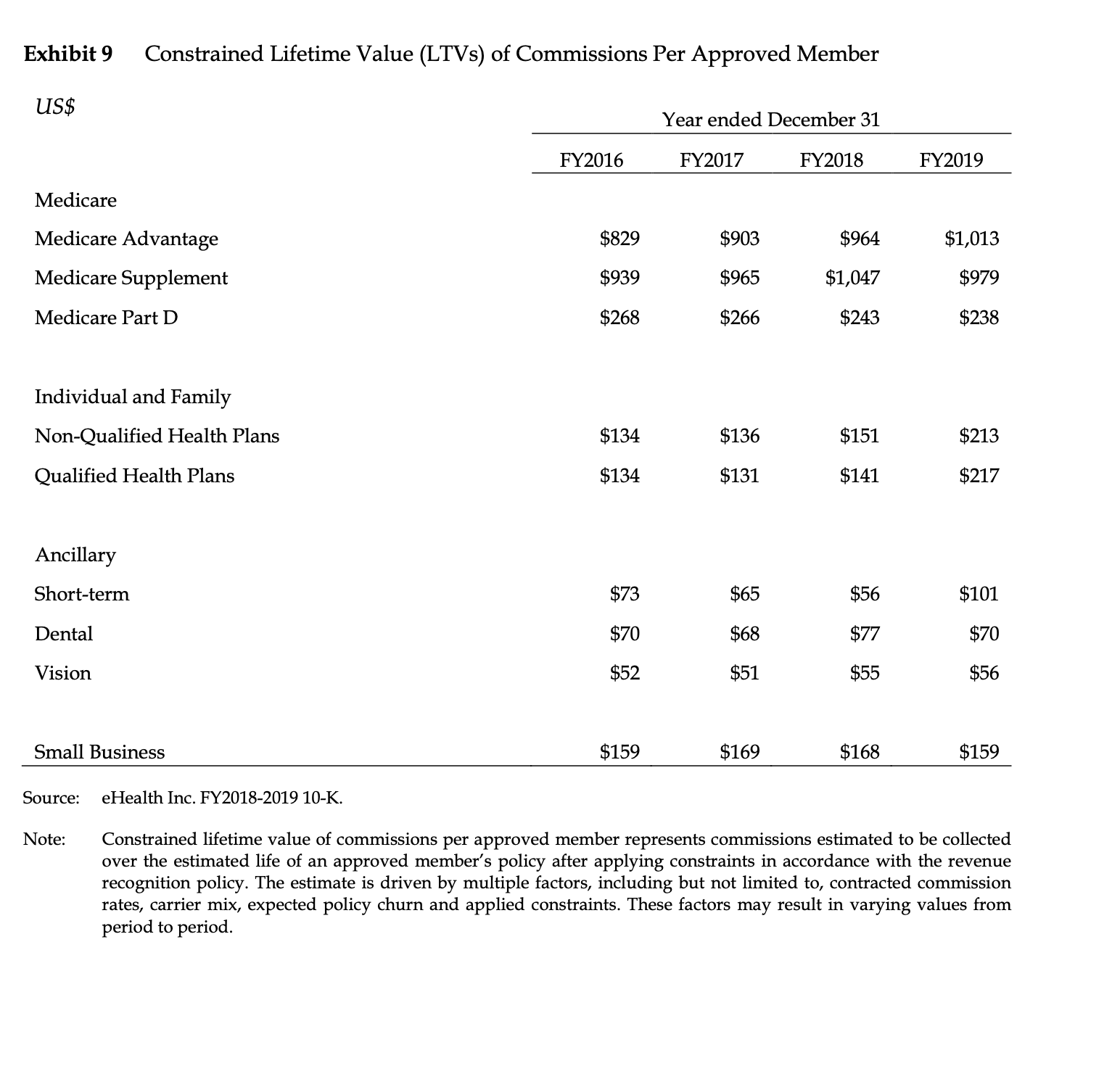

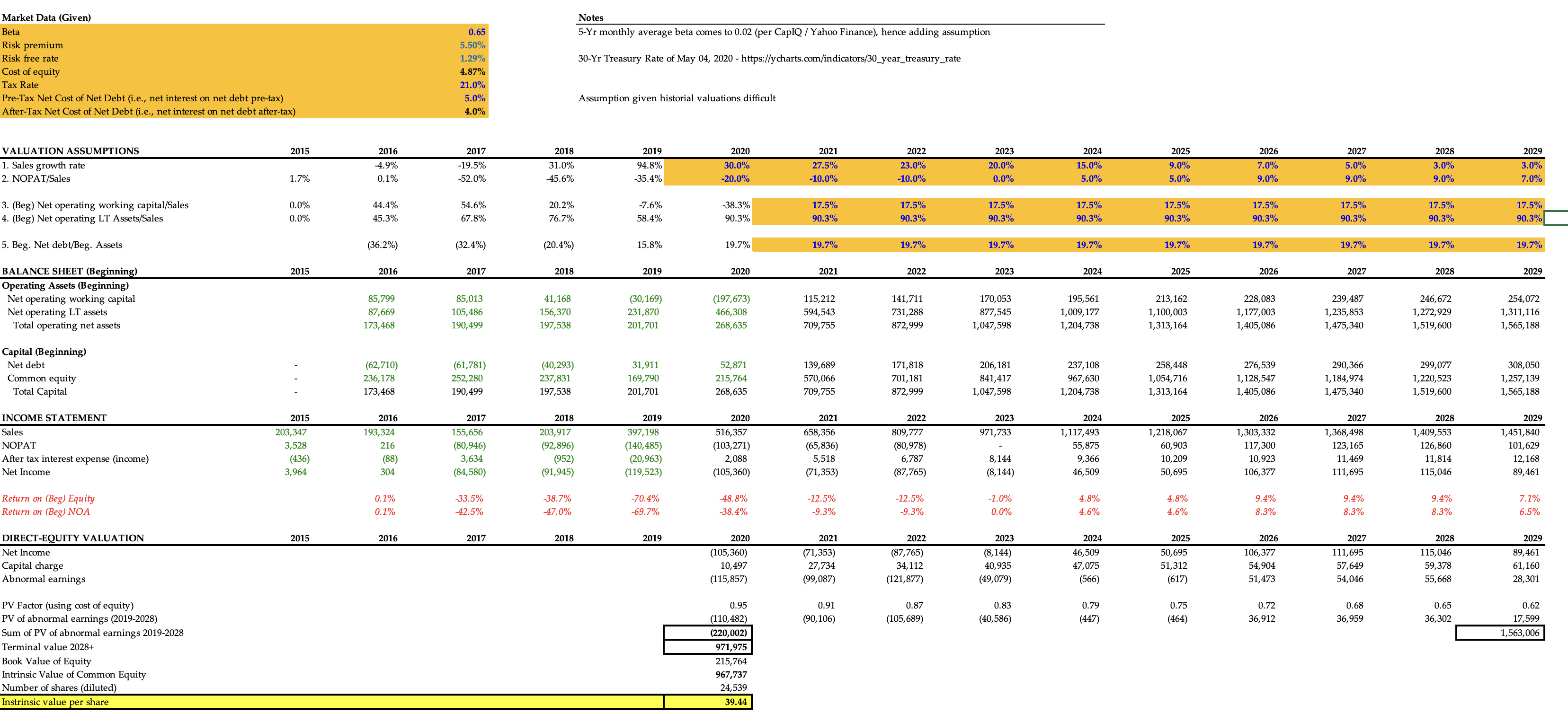

Perform the annual journal entries for eHealth under the old and new revenue recognition standard for one Medicare Advantage policy using the information in Exhibit

- Perform the annual journal entries for eHealth under the old and new revenue recognition standard for one Medicare Advantage policy using the information in Exhibit 7. Under the new standard, how would eHealth account for the following changes in year 2:

- The customer does not renew the policy,

- eHealth assumes that the lifetime drops to two years per policy, and

- eHealth increases its constraints by $50 per policy

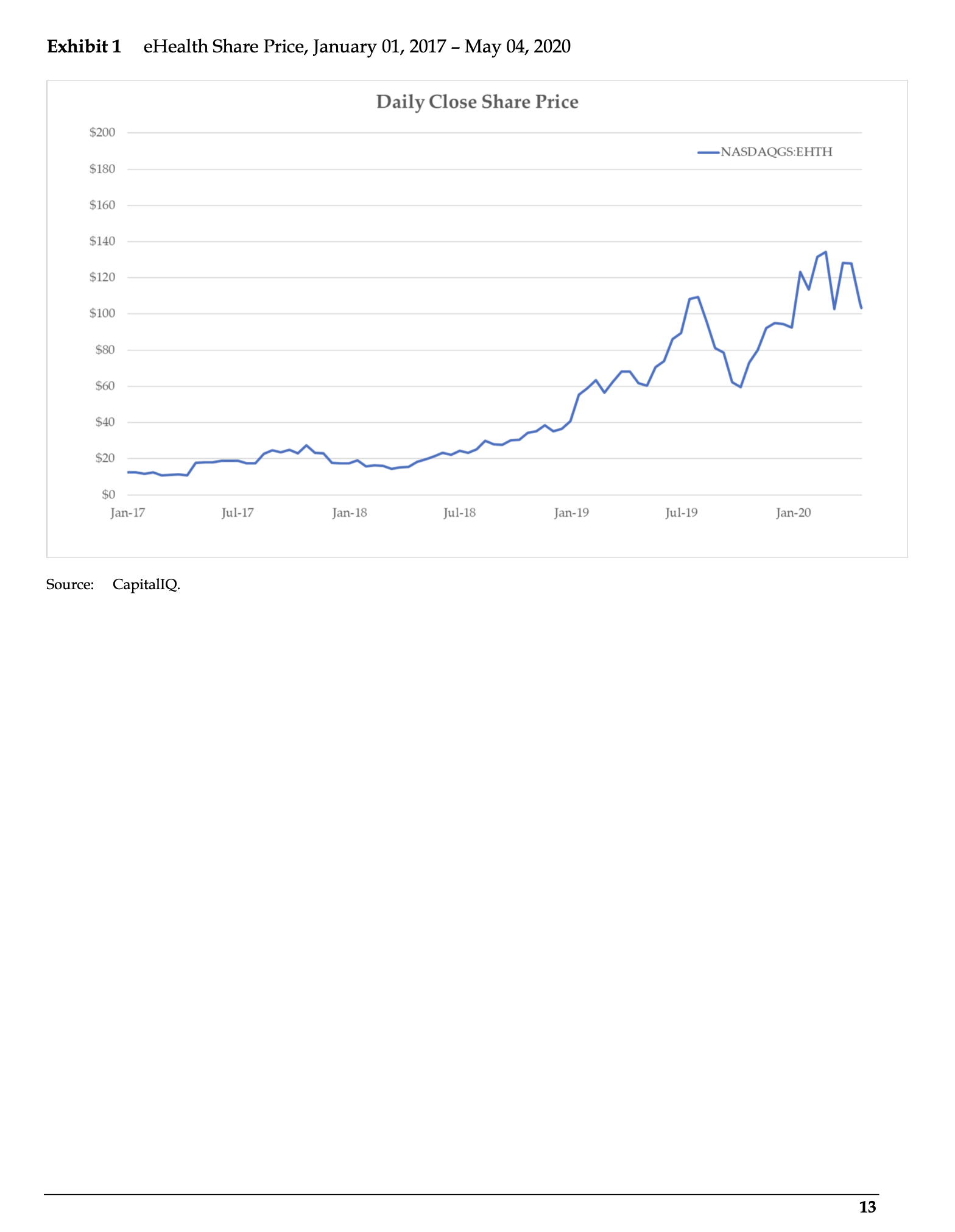

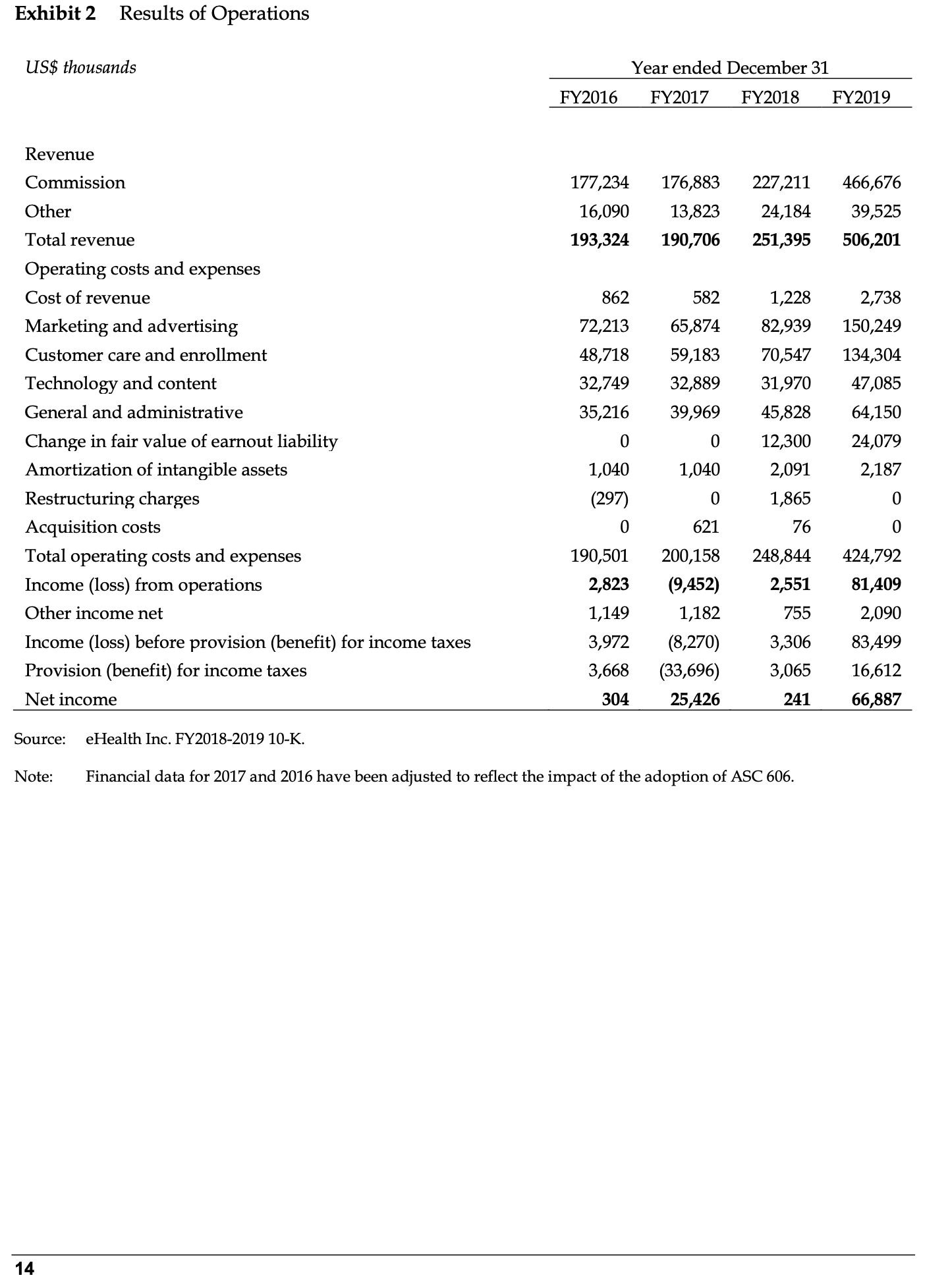

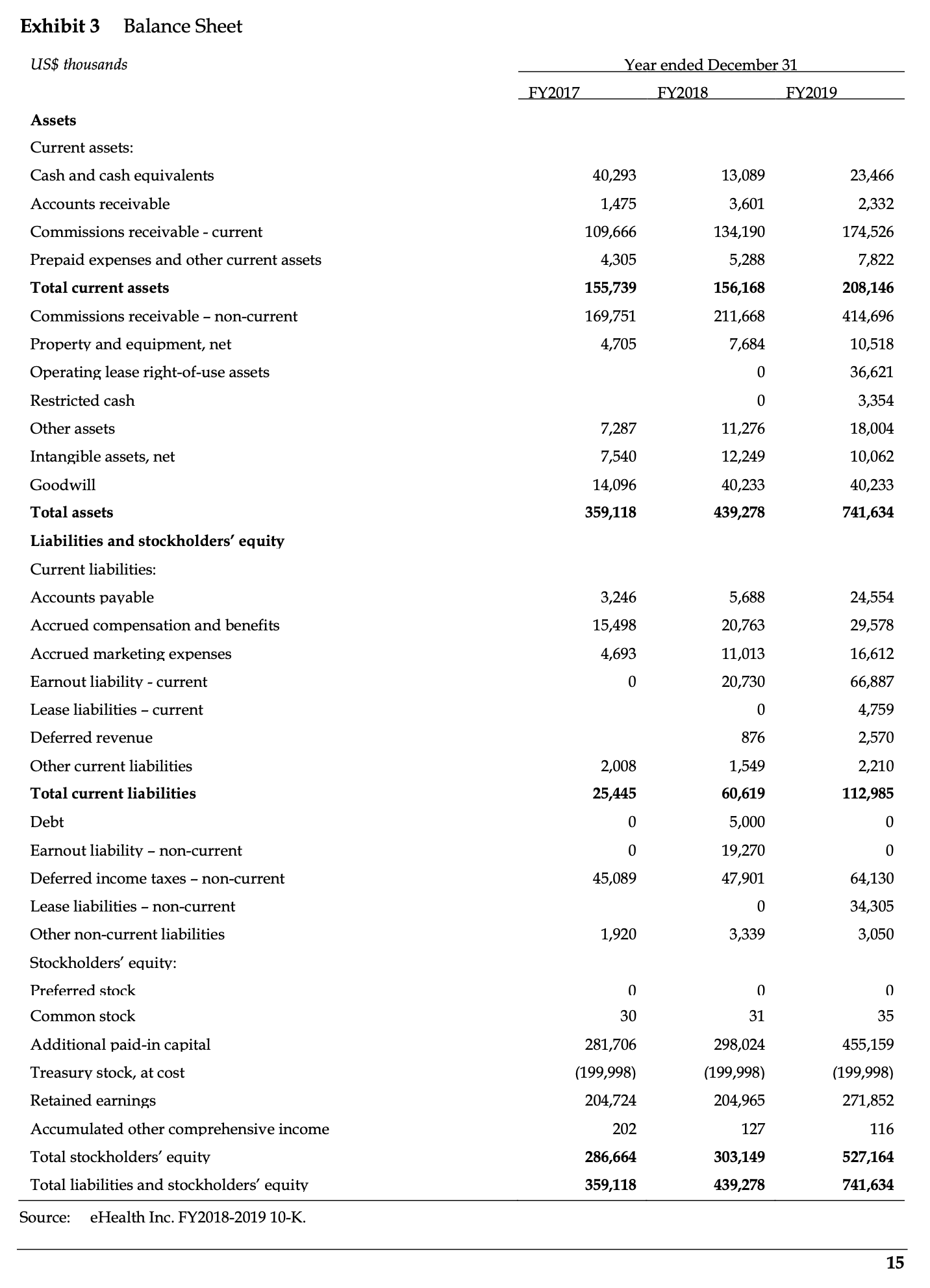

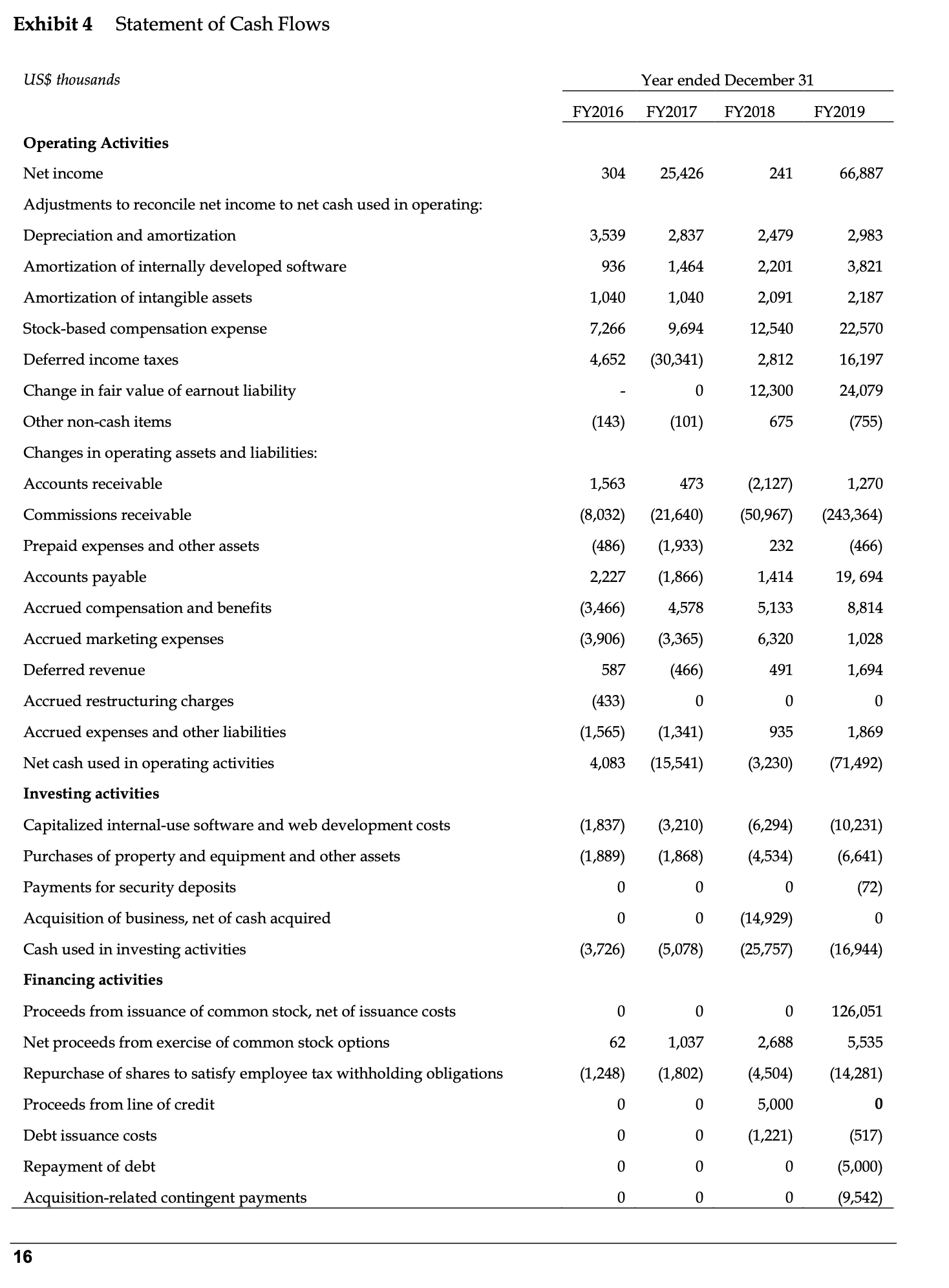

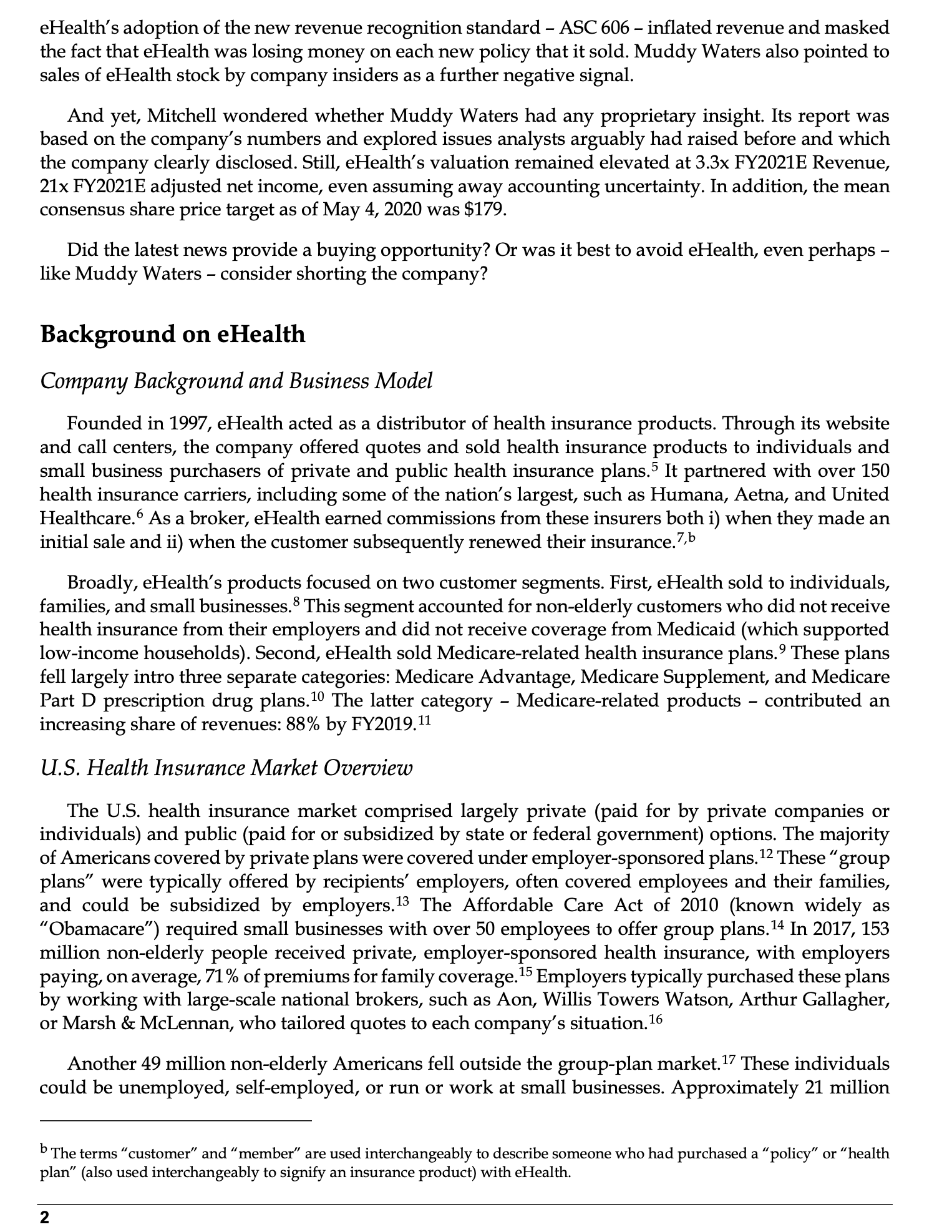

JONAS HEESE CRISTO LIAUTAUD Muddy Waters vs. eHealth: The Debate of a "Lifetime" "Never in my career have I had...a business with the kind of tailwind that eHealth is blessed to be possessed with and positioned for today." - Scott Flanders, eHealth CEO, May 07, 20191 "From a legal perspective it's not a fraud. Intellectually, it's fraudulent." - - Carson Block, Muddy Waters Director of Research, CNBC Interview on eHealth, April 08, 2020 Introduction In May 2020, Jessica Mitchella sat in her New York office looking at two sets of papers: one stack read "long," the other read "short." The papers were prepared for a presentation later that week for her portfolio manager, who had been reviewing a possible position in eHealth (NASDAQ: EHTH), an online tele-sales broker of health insurance products. The company had grown quickly as more seniors explored options for choosing Medicare-based insurance plans online and by phone. The stock had recently hit all-time highs, closing at a peak of $146 on March 4, 2020, and held at $142 on March 30, 2020 - just one week after the market's COVID-19 "low-point in recent months. But now, May 4, 2020, eHealth traded at $103. The recent fall had wiped nearly $1.0B from the company's market capitalization. (See Exhibit 1 for eHealth's stock price performance.) The recent sell-off seemed driven by two factors. First, the company's earnings guidance for FY2020 had disappointed investors and analysts. After significantly outperforming its own guidance and consensus estimates for FY2019, analysts had expected a more ambitious plan for the year. Second, and more importantly, well-known short seller Carson Block, and his research firm Muddy Waters, had recently released a short-report on the company. Muddy Waters had made its name exposing significant accounting frauds at companies. This time, Carson Block told CNBC that eHealth management had undertaken "massive stock promotion."4 In the report, Muddy Waters argued that

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

eHealths business model was unsustainable and raised concerns about its accounting practices particularly regarding the recognition of revenue and mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started