Answered step by step

Verified Expert Solution

Question

1 Approved Answer

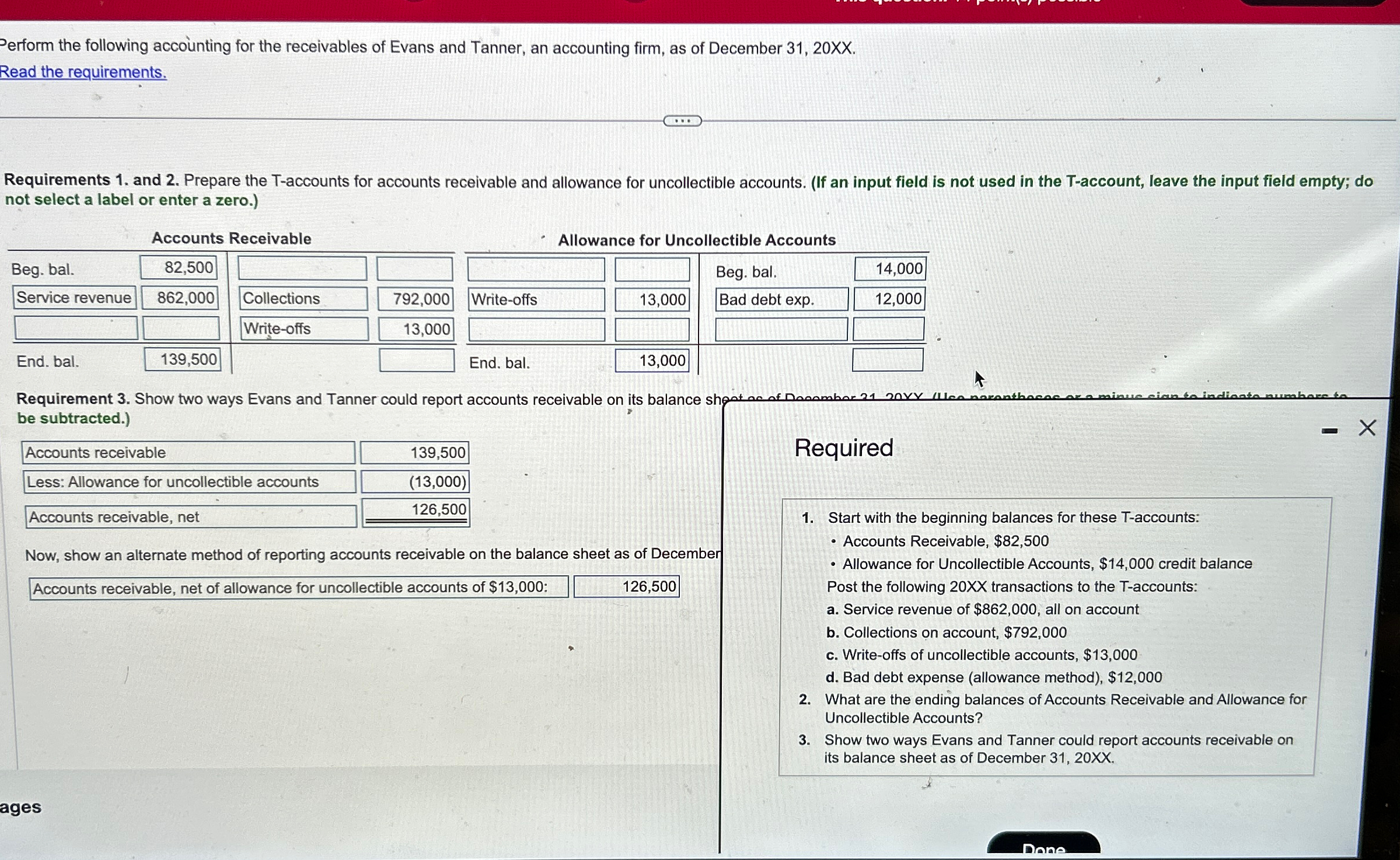

Perform the following accounting for the receivables of Evans and Tanner, an accounting firm, as of December 31, 20XX. Read the requirements. Requirements 1.

Perform the following accounting for the receivables of Evans and Tanner, an accounting firm, as of December 31, 20XX. Read the requirements. Requirements 1. and 2. Prepare the T-accounts for accounts receivable and allowance for uncollectible accounts. (If an input field is not used in the T-account, leave the input field empty; do not select a label or enter a zero.) Accounts Receivable Beg. bal. 82,500 Service revenue 862,000 Collections Write-offs 792,000 Write-offs 13,000 End. bal. 139,500 End. bal. Allowance for Uncollectible Accounts 13,000 Beg. bal. Bad debt exp. 14,000 12,000 13,000 Requirement 3. Show two ways Evans and Tanner could report accounts receivable on its balance sheet an December 21 20XY (Use parentheses or a minus sign to indicate numbers to be subtracted.) Accounts receivable Required Less: Allowance for uncollectible accounts Accounts receivable, net 139,500 (13,000) 126,500 Now, show an alternate method of reporting accounts receivable on the balance sheet as of December Accounts receivable, net of allowance for uncollectible accounts of $13,000: 126,500 ages 1. Start with the beginning balances for these T-accounts: Accounts Receivable, $82,500 Allowance for Uncollectible Accounts, $14,000 credit balance Post the following 20XX transactions to the T-accounts: a. Service revenue of $862,000, all on account b. Collections on account, $792,000 c. Write-offs of uncollectible accounts, $13,000 d. Bad debt expense (allowance method), $12,000 2. What are the ending balances of Accounts Receivable and Allowance for Uncollectible Accounts? 3. Show two ways Evans and Tanner could report accounts receivable on its balance sheet as of December 31, 20XX. Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started