Answered step by step

Verified Expert Solution

Question

1 Approved Answer

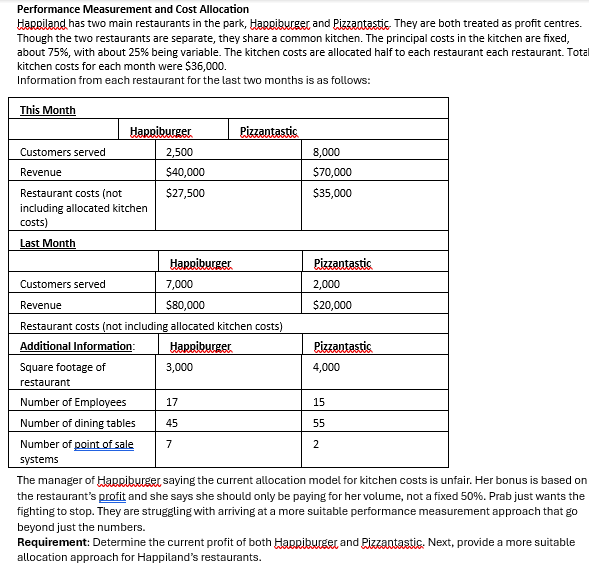

Performance Measurement and Cost Allocation Happiland has two main restaurants in the park, Happiburger and Pizzantastic. They are both treated as profit centres. Though

Performance Measurement and Cost Allocation Happiland has two main restaurants in the park, Happiburger and Pizzantastic. They are both treated as profit centres. Though the two restaurants are separate, they share a common kitchen. The principal costs in the kitchen are fixed, about 75%, with about 25% being variable. The kitchen costs are allocated half to each restaurant each restaurant. Total kitchen costs for each month were $36,000. Information from each restaurant for the last two months is as follows: This Month Happiburger Pizzantastic Customers served 2,500 8,000 Revenue $40,000 $70,000 Restaurant costs (not $27,500 $35,000 including allocated kitchen costs) Last Month Customers served Revenue Happiburger 7,000 $80,000 Restaurant costs (not including allocated kitchen costs) Additional Information: Happiburger Square footage of 3,000 restaurant Number of Employees 17 Number of dining tables 45 Number of point of sale systems 7 Pizzantastic 2,000 $20,000 Pizzantastic 4,000 15 55 2 The manager of Happiburger saying the current allocation model for kitchen costs is unfair. Her bonus is based on the restaurant's profit and she says she should only be paying for her volume, not a fixed 50%. Prab just wants the fighting to stop. They are struggling with arriving at a more suitable performance measurement approach that go beyond just the numbers. Requirement: Determine the current profit of both Happiburger and Pizzantastic. Next, provide a more suitable allocation approach for Happiland's restaurants.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started