Answered step by step

Verified Expert Solution

Question

1 Approved Answer

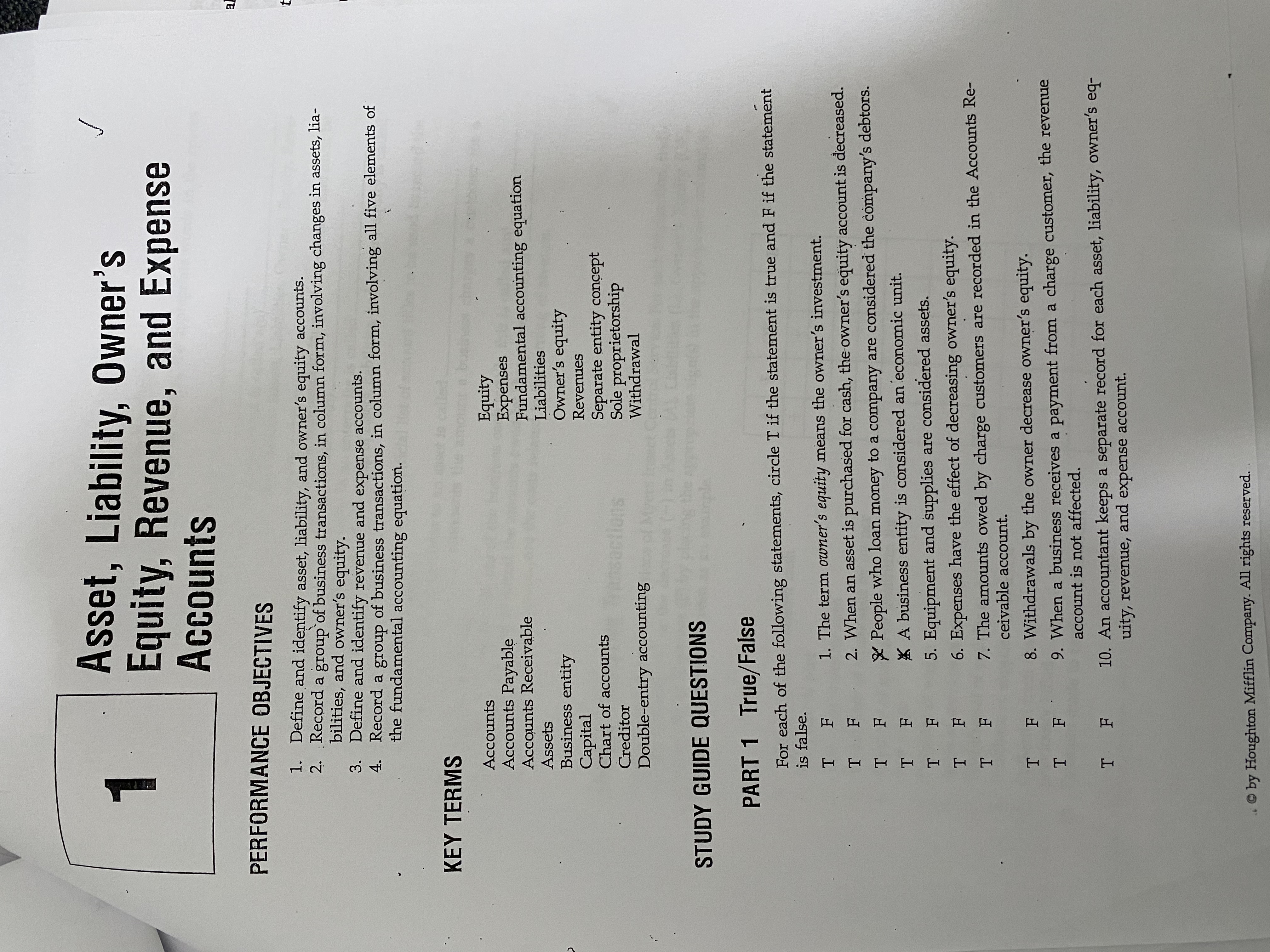

PERFORMANCE OBJECTIVES Define and identify asset, liability, and owner's equity accounts. Record a group of business transactions, in column form, involving changes in assets, lia

PERFORMANCE OBJECTIVES

Define and identify asset, liability, and owner's equity accounts.

Record a group of business transactions, in column form, involving changes in assets, lia

bilities, and owner's equity.

Define and identify revenue and expense accounts.

Record a group of business transactions, in column form, involving all five elements of

the fundamental accounting equation.

KEY TERIMS

Accounts

Accounts Payable

Accounts Receivable

Assets

Business entity

Capital

Chart of accounts

Creditor

Doubleentry accounting

Equity

Expenses

Fundamental accounting equation

Liabilities

Owner's equity

Revenues

Separate entity concept

Sole proprietorship

Withdrawal

STUDY GUIDE QUESTIONS

PART TrueFalse

For each of the following statements, circle if the statement is true and if the statement

is false.

T

T

T F

T

T F

The term owner's equity means the owner's investment.

When an asset is purchased for cash, the owner's equity account is decreased.

People who loan money to a company are considered the company's debtors.

A business entity is considered an economic unit.

Equipment and supplies are considered assets.

Expenses have the effect of decreasing owner's equity.

The amounts owed by charge customers are recorded in the Accounts Re

ceivable account.

Withdrawals by the owner decrease owner's equity.

When a business receives a payment from a charge customer, the revenue

account is not affected.

An accountant keeps a separate record for each asset, liability, owner's eq

uity, revenue, and expense account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started