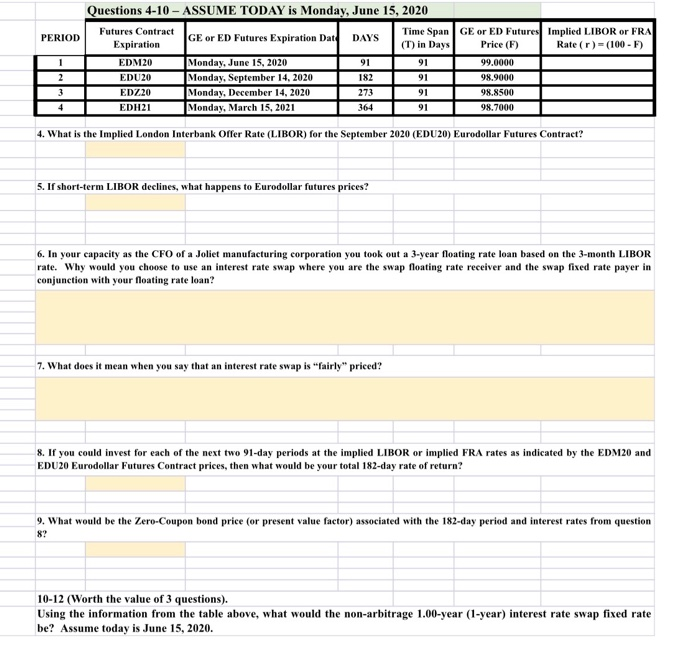

PERIOD Questions 4-10 - ASSUME TODAY is Monday, June 15, 2020 Futures Contract Time Span GE or ED Futures Implied LIBOR or FRA GE or ED Futures Expiration Date DAYS Expiration (T) in Days Rate(r)=(100 - F) EDM20 Monday, June 15, 2020 91 91 T 99.0000 EDU20 Monday, September 14, 2020 182 91 98.9000 EDZ20 Monday, December 14, 2020 2 73 9 1 98.8500 EDH21 Monday, March 15, 2021 364 91 98.7000 T 3 4. What is the Implied London Interbank Offer Rate (LIBOR) for the September 2020 (EDU20) Eurodollar Futures Contract? 5. If short-term LIBOR declines, what happens to Eurodollar futures prices? 6. In your capacity as the CFO of a Joliet manufacturing corporation you took out a 3-year floating rate loan based on the 3-month LIBOR rate. Why would you choose to use an interest rate swap where you are the swap floating rate receiver and the swap fixed rate payer in conjunction with your floating rate loan? 7. What does it mean when you say that an interest rate swap is "fairly priced? 8. If you could invest for each of the next two 91-day periods at the implied LIBOR or implied FRA rates as indicated by the EDM20 and EDU20 Eurodollar Futures Contract prices, then what would be your total 182-day rate of return? 9. What would be the Zero-Coupon bond price (or present value factor) associated with the 182-day period and interest rates from question 10-12 (Worth the value of 3 questions). Using the information from the table above, what would the non-arbitrage 1.00-year (1-year) interest rate swap fixed rate be? Assume today is June 15, 2020. PERIOD Questions 4-10 - ASSUME TODAY is Monday, June 15, 2020 Futures Contract Time Span GE or ED Futures Implied LIBOR or FRA GE or ED Futures Expiration Date DAYS Expiration (T) in Days Rate(r)=(100 - F) EDM20 Monday, June 15, 2020 91 91 T 99.0000 EDU20 Monday, September 14, 2020 182 91 98.9000 EDZ20 Monday, December 14, 2020 2 73 9 1 98.8500 EDH21 Monday, March 15, 2021 364 91 98.7000 T 3 4. What is the Implied London Interbank Offer Rate (LIBOR) for the September 2020 (EDU20) Eurodollar Futures Contract? 5. If short-term LIBOR declines, what happens to Eurodollar futures prices? 6. In your capacity as the CFO of a Joliet manufacturing corporation you took out a 3-year floating rate loan based on the 3-month LIBOR rate. Why would you choose to use an interest rate swap where you are the swap floating rate receiver and the swap fixed rate payer in conjunction with your floating rate loan? 7. What does it mean when you say that an interest rate swap is "fairly priced? 8. If you could invest for each of the next two 91-day periods at the implied LIBOR or implied FRA rates as indicated by the EDM20 and EDU20 Eurodollar Futures Contract prices, then what would be your total 182-day rate of return? 9. What would be the Zero-Coupon bond price (or present value factor) associated with the 182-day period and interest rates from question 10-12 (Worth the value of 3 questions). Using the information from the table above, what would the non-arbitrage 1.00-year (1-year) interest rate swap fixed rate be? Assume today is June 15, 2020