Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Periodic cash inflows Scenic Tours, Inc., is a provider of bus tours throughout New England. The corporation is considering the replacement of 11 of

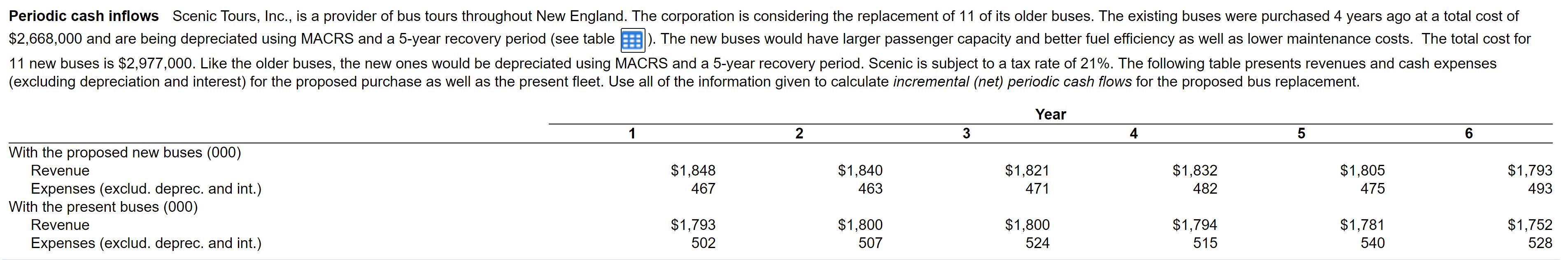

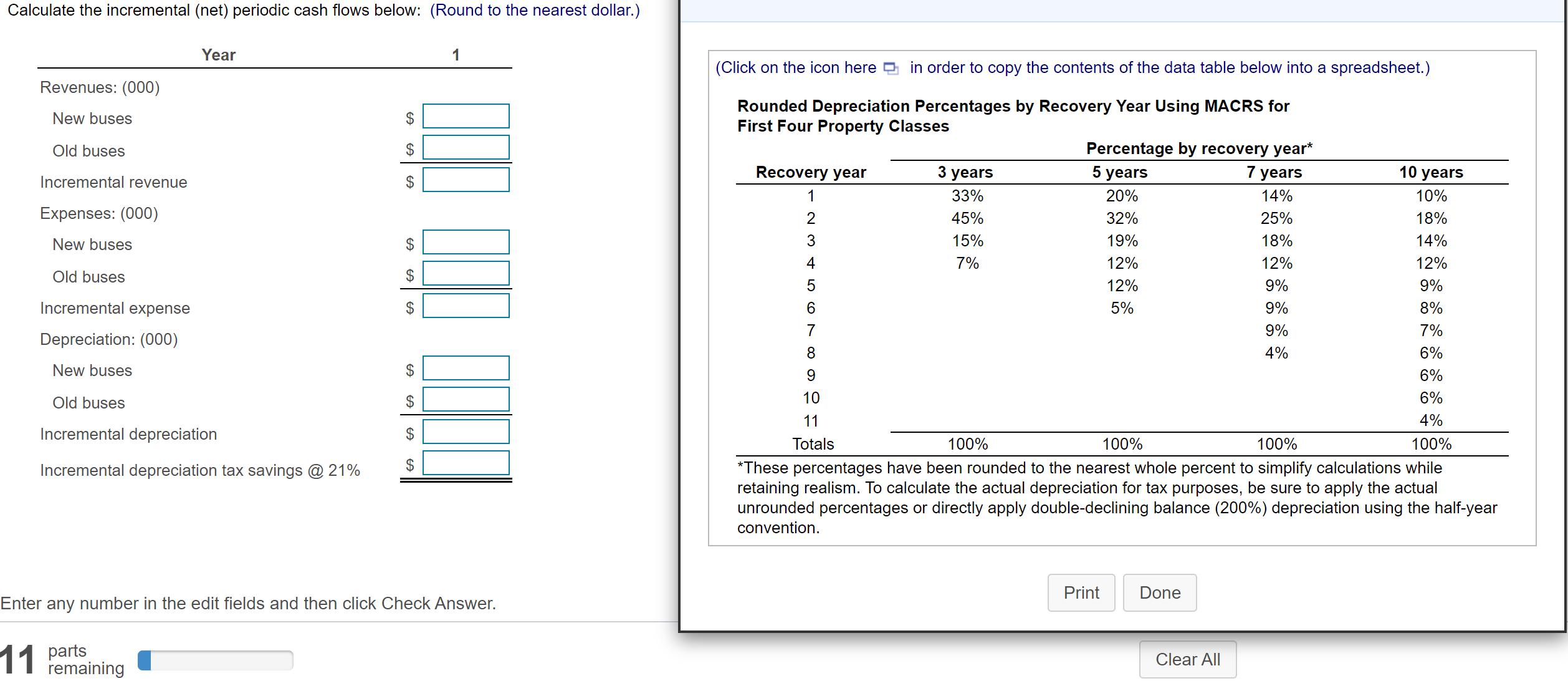

Periodic cash inflows Scenic Tours, Inc., is a provider of bus tours throughout New England. The corporation is considering the replacement of 11 of its older buses. The existing buses were purchased 4 years ago at a total cost of $2,668,000 and are being depreciated using MACRS and a 5-year recovery period (see table ). The new buses would have larger passenger capacity and better fuel efficiency as well as lower maintenance costs. The total cost for 11 new buses is $2,977,000. Like the older buses, the new ones would be depreciated using MACRS and a 5-year recovery period. Scenic is subject to a tax rate of 21%. The following table presents revenues and cash expenses (excluding depreciation and interest) for the proposed purchase as well as the present fleet. Use all of the information given to calculate incremental (net) periodic cash flows for the proposed bus replacement. With the proposed new buses (000) Revenue Expenses (exclud. deprec. and int.) With the present buses (000) Revenue Expenses (exclud. deprec. and int.) 1 2 Year 3 4 5 6 $1,848 467 $1,840 463 $1,821 471 $1,832 $1,805 482 475 $1,793 493 $1,793 $1,800 $1,800 502 507 524 $1,794 515 $1,781 $1,752 540 528 Calculate the incremental (net) periodic cash flows below: (Round to the nearest dollar.) Year Revenues: (000) 1 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes New buses Old buses Incremental revenue Expenses: (000) SA $ $ $ Recovery year 3 years Percentage by recovery year* 5 years 7 years 10 years 1 33% 20% 14% 10% 23 45% 32% 25% 18% 3 15% 19% 18% 14% New buses Old buses Incremental expense $ $ $ Depreciation: (000) New buses $ 45678 od 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 9% 7% 4% 6% 9 6% 10 6% Old buses $ 11 4% Incremental depreciation $ Totals 100% 100% 100% 100% $ Incremental depreciation tax savings @ 21% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. Enter any number in the edit fields and then click Check Answer. parts 11 remaining Print Done Clear All

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started