Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: 30

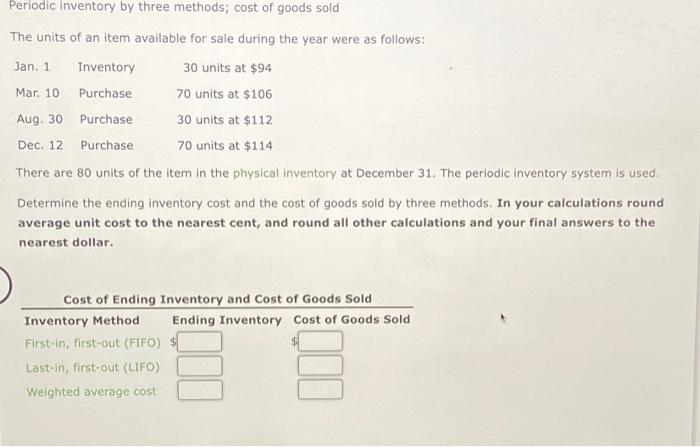

Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: 30 units at $94 Jan. 1 Inventory Mar. 10 Purchase 70 units at $106 Aug. 30 Purchase 30 units at $112 Dec. 12 Purchase 70 units at $114 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. In your calculations round average unit cost to the nearest cent, and round all other calculations and your final answers to the nearest dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost $ Ending Inventory Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer We can calculate the ending inventory cost and cost of goods sold using the FIFO FirstIn FirstOut LIFO LastIn FirstOut and Weighted Average Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e3a862c020_959454.pdf

180 KBs PDF File

663e3a862c020_959454.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started