Answered step by step

Verified Expert Solution

Question

1 Approved Answer

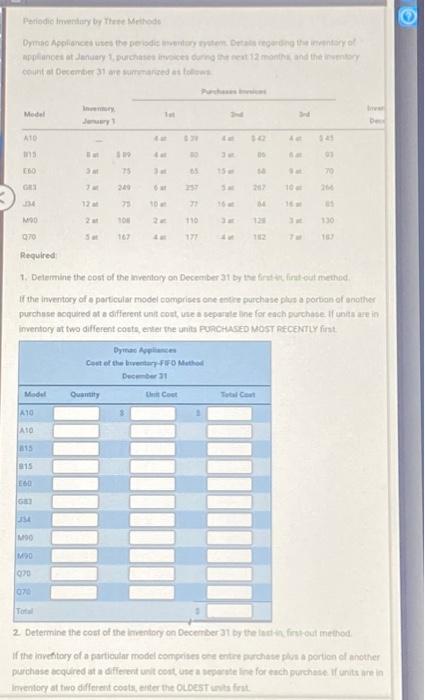

Periodic Inventory by Three Methods Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the

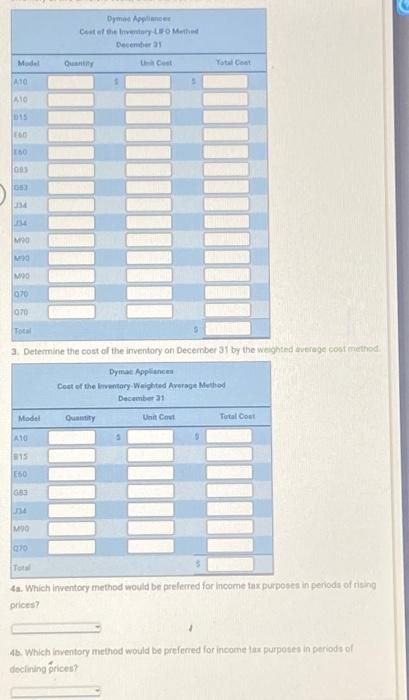

Periodic Inventory by Three Methods Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows Model A10 B15 E60 G83 J34 M90 Q70 Required: Model A10 A10 B15 815 E60 683 J34 M90 M90 070 070 Inventory, January 1 Total Bat 3 at 7 at 12 at 2 at 5 at $ 89 75 Quantity 249 75 108 167 1st 4 at $ 3 at 6 at 10 at 2 at 4 at $ 39 80 Unit Cost 65 257 77 110 177 Dymac Appliances Cost of the Inventory-FIFO Method December 31 Purchases Invelces 2nd $ 4 at 3 at 15 at 5 at 16 at 3 at 4 at $42 86 68 267 1. Determine the cost of the inventory on December 31 by the first-in, first-out method If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. If units are in Inventory at two different costs, enter the units PURCHASED MOST RECENTLY first 84 128 Totul Cost 182 3rd 4 at 6 at 9 at 10 at 16 at 3 at $45 93 70 266 85 130 187 Inver Dece 2. Determine the cost of the inventory on December 31 by the last-in, first-out method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. If units are in inventory at two different costs, enter the OLDEST units first.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started