Question

Perpetual Inventory Method: Record/journal each transaction and adjustment entry. During the month of March 2017, the following transactions occur. 4 Buy five deluxe mixers on

Perpetual Inventory Method: Record/journal each transaction and adjustment entry.

During the month of March 2017, the following transactions occur.

4 Buy five deluxe mixers on account from Kzinski Supply Co. for $2,875, terms n/30.

5 Teaches class at YMCA for which a $60 deposit was received in February

6 Pay $100 freight on the March 4 purchase (check #301).

7 Return one of the mixers to Kzinski because it was damaged during shipping. Kzinski issues a credit for the cost of the mixer plus $20 for the cost of freight that was paid on March 6 for one mixer.

8 Collects the amount due from the neighborhood community center that was accrued at the end of February.

10 Teaches the last two classes for the Stoughton schools

12 Sell three deluxe mixers on account to Samantha French for $3,450, FOB destination, terms n/30. The mixers cost $595 each (including freight).

13 Pay cell phone bill previously accrued in the February adjusting journal entries. (check #302)

14 Pay $75 of delivery charges for the three mixers that were sold on February 12. (check #303)

14 Buy four deluxe mixers on account from Kzinski Supply Co. for $2,300, terms n/30.

17 Concerned that there is not enough cash available to pay for all of the mixers purchased, issues additional common stock for $1,000.

18 Pays $80 freight on the March 14 purchase. (check #304)

19 Teaches a class for $150 and collects cash payment

20 Sells two deluxe mixers for $2,300 cash.

28 Issues a check to the assistant. The assistant worked 20 hours in March and is also paid for amounts owing at February 30, 2010. The assistant earns $8 an hour. (check #305)

28 Collects amounts due from customers in the March 12 transaction.

31 Pay Kzinski all amounts due. (check #306)

31 Cash dividends of $750 are paid. (check #307)

Adjusting entries:

As of March 31st, the following adjusting entry data are available.

1. A count of baking supplies reveals that $300 were used in March.

2. Another months worth of depreciation needs to be recorded on the baking equipment bought in January. (Recall that the baking equipment has a useful life of 5 years or 60 months.)

3. One months worth of amortization (write-off) needs to be recorded on the website. (Recall that the

website has a useful life of 2 years or 24 months.)

4. An additional months worth of interest on the loan needs to be accrued. (The interest rate is 9%.)

5. One months worth of insurance has expired.

6. The cell phone bill, $75 is received. The bill is for services provided in March and is due April 15. (Recall that the cell phone is used only for business purposes.)

7. An inventory count of mixers at the end of March reveals three mixers remaining at a cost of $595 each.

(The answers I have are incorrect and I would like to get a second opinion. Plus a calculation for #8, 12 , 20, 28 & 31 please. The master sheet is below)

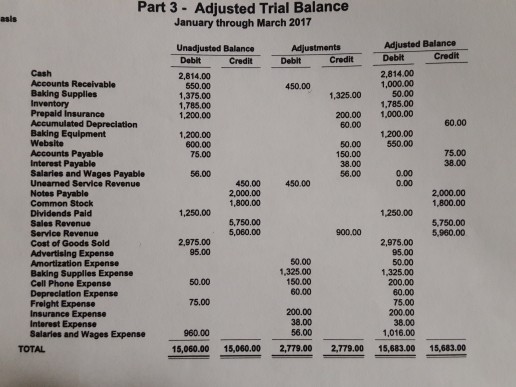

Part 3 - Adjusted Trial Balance January through March 2017 Adjustments Deblt Adjusted Balance Debit Unadjusted Balance Credit Credit Credit Cash Accounts Receivable Baking Supplies 2,814.00 550.00 1,375.00 1,785.00 1,200.00 2,814.00 1,000.00 50.00 1,785.00 200.00 1,000.00 450.00 1,325.00 Prepaid Insurance 60.00 Baking Equipment Website Accounts Payable Interest Payable Salaries and Wages Payable Unearned Service Revenue Notes Payable Common Stock Dividends Paid Sales Revenue Service Revenue Cost of Goods Sold Advertising Expense Amortization Expense Baking Supplies Expense Cell Phone Expense Depreclation Expense Freight Expense Insurance Expense Interest Expense Salaries and Wages Expense 1,200.00 600.00 1,200.00 550.00 50.00 150.00 38.00 56.00 56.00 450.00 1,800.00 5,750.00 450.00 0.00 2,000.00 1,800.00 1,250.00 1,250.00 5,750.00 5,960.00 900.00 2,975.00 95.00 50.00 1,325.00 200.00 60.00 95.00 50.00 1,325.00 60.00 75.00 38.00 56.00 38.00 1,016.00 960.00 15,060.00 15060.00 2.779.00 2.779.00 15,083.00 15,083.00 TOTAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started