Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for May are as follows: Inventory May 1 4,100 units

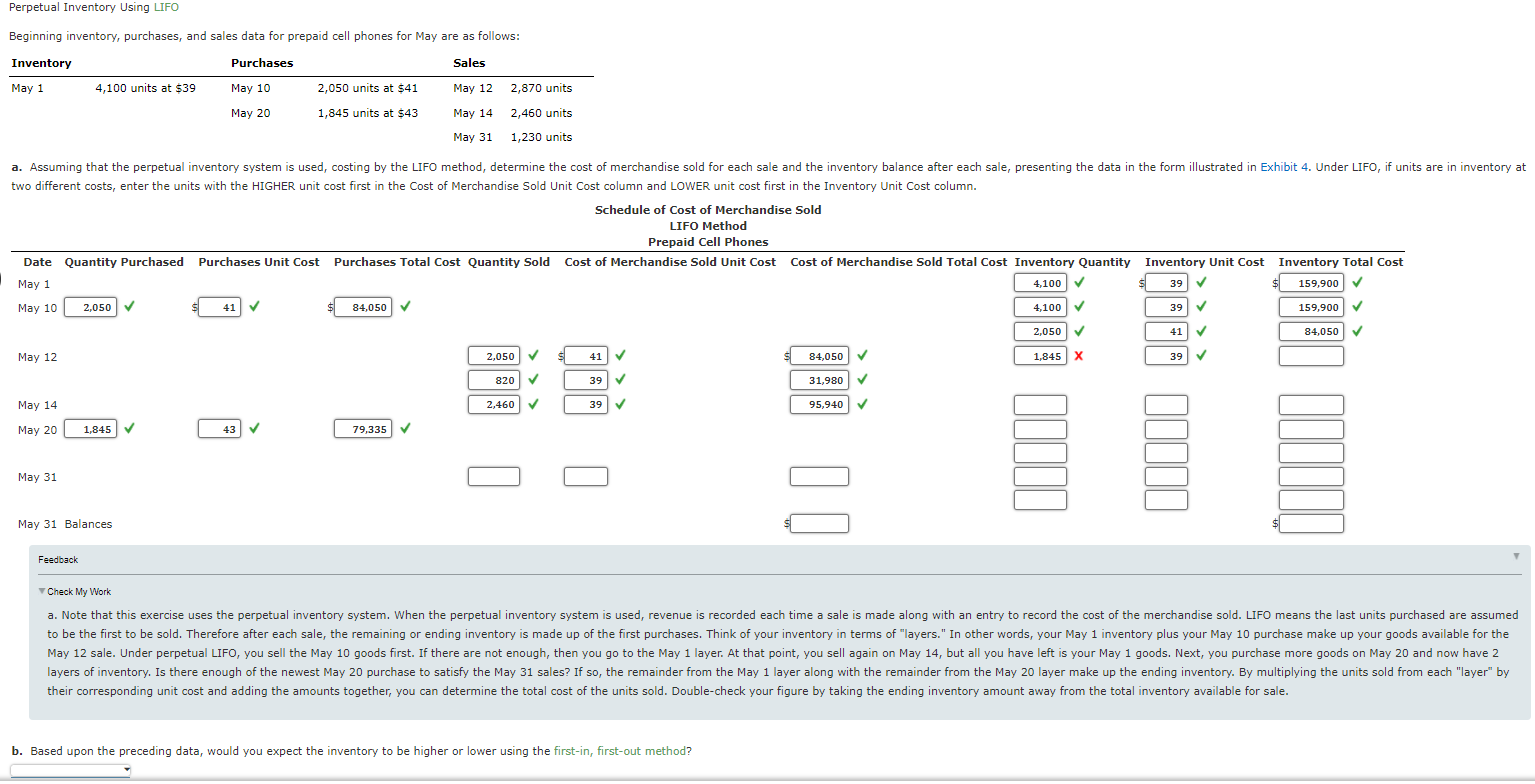

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for May are as follows: Inventory May 1 4,100 units at $39 Purchases May 10 May 20 Sales 2,050 units at $41 1,845 units at $43 May 12 May 14 May 31 2,870 units 2,460 units 1,230 units a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Prepaid Cell Phones Date Quantity Purchased Purchases Unit Cost Purchases Total Cost Quantity Sold Cost of Merchandise Sold Unit Cost Cost of Merchandise Sold Total Cost Inventory Quantity Inventory Unit Cost Inventory Total Cost May 1 May 10 2,050 41 84,050 May 12 2,050 41 84,050 820 39 31,980 May 14 May 20 2,460 39 95,940 1,845 43 79,335 May 31 May 31 Balances Feedback 4,100 39 159,900 4,100 39 159,900 2,050 41 84,050 1,845 X 39 Check My Work a. Note that this exercise uses the perpetual inventory system. When the perpetual inventory system is used, revenue is recorded each time a sale is made along with an entry to record the cost of the merchandise sold. LIFO means the last units purchased are assumed to be the first to be sold. Therefore after each sale, the remaining or ending inventory is made up of the first purchases. Think of your inventory in terms of "layers." In other words, your May 1 inventory plus your May 10 purchase make up your goods available for the May 12 sale. Under perpetual LIFO, you sell the May 10 goods first. If there are not enough, then you go to the May 1 layer. At that point, you sell again on May 14, but all you have left is your May 1 goods. Next, you purchase more goods on May 20 and now have 2 layers of inventory. Is there enough of the newest May 20 purchase to satisfy the May 31 sales? If so, the remainder from the May 1 layer along with the remainder from the May 20 layer make up the ending inventory. By multiplying the units sold from each "layer" by their corresponding unit cost and adding the amounts together, you can determine the total cost of the units sold. Double-check your figure by taking the ending inventory amount away from the total inventory available for sale. b. Based upon the preceding data, would you expect the inventory to be higher or lower using the first-in, first-out method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started