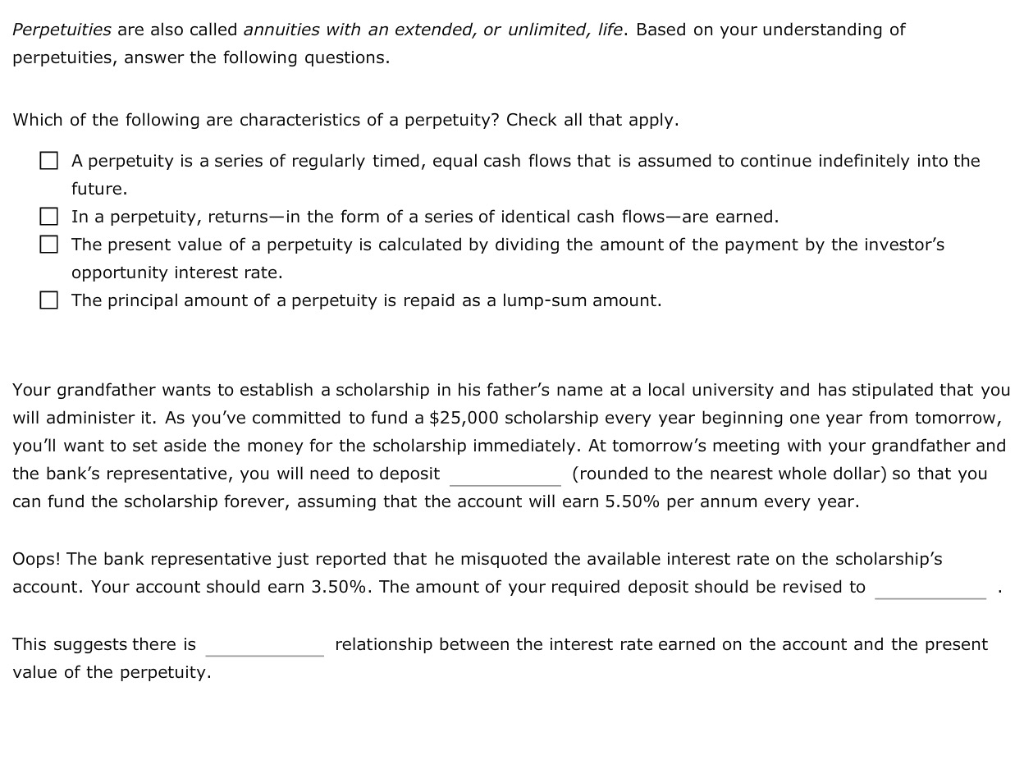

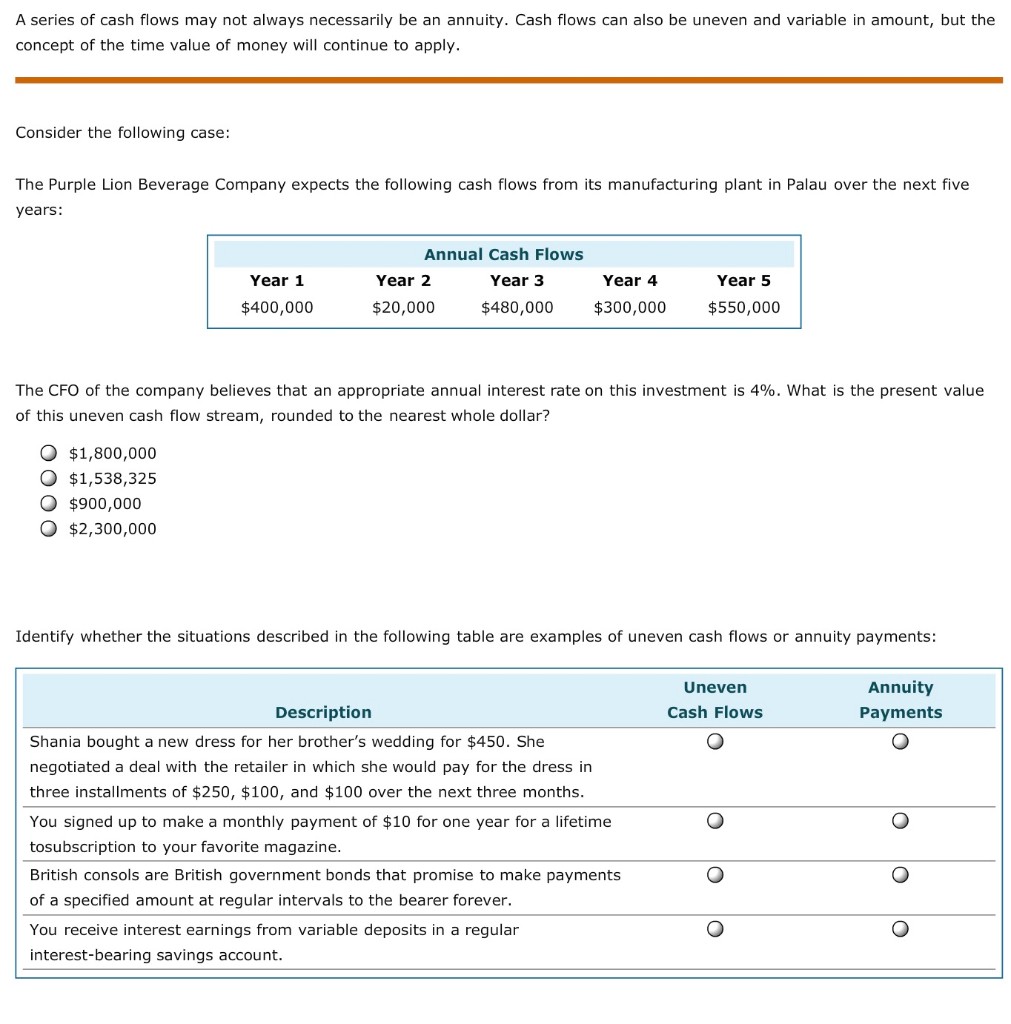

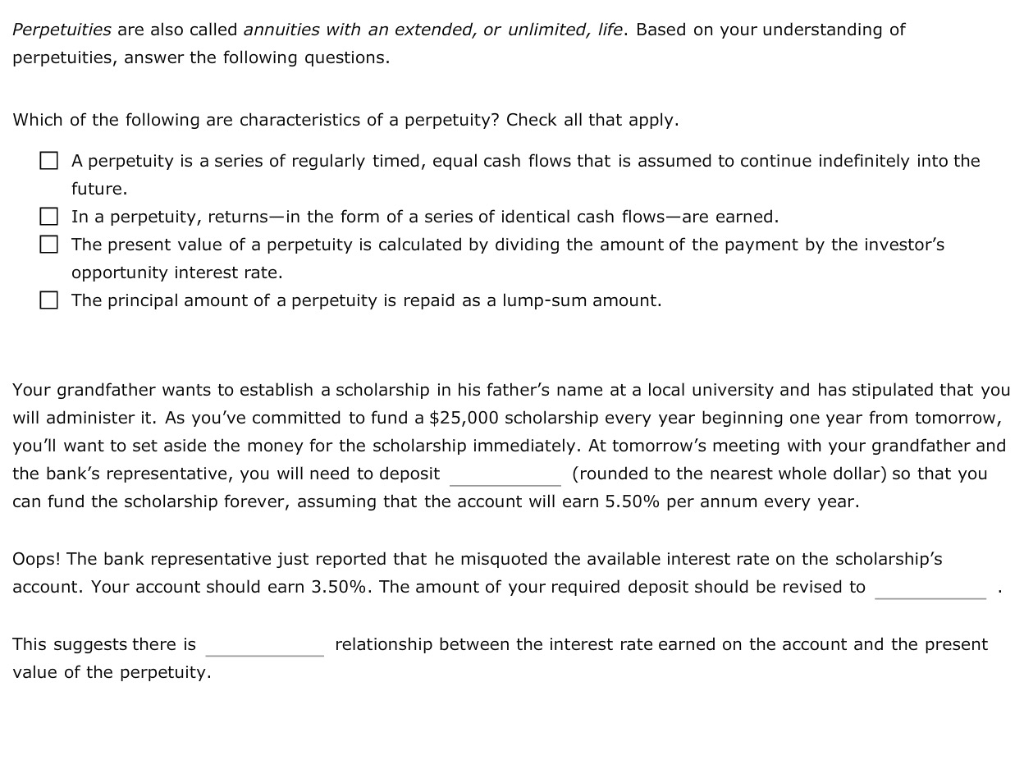

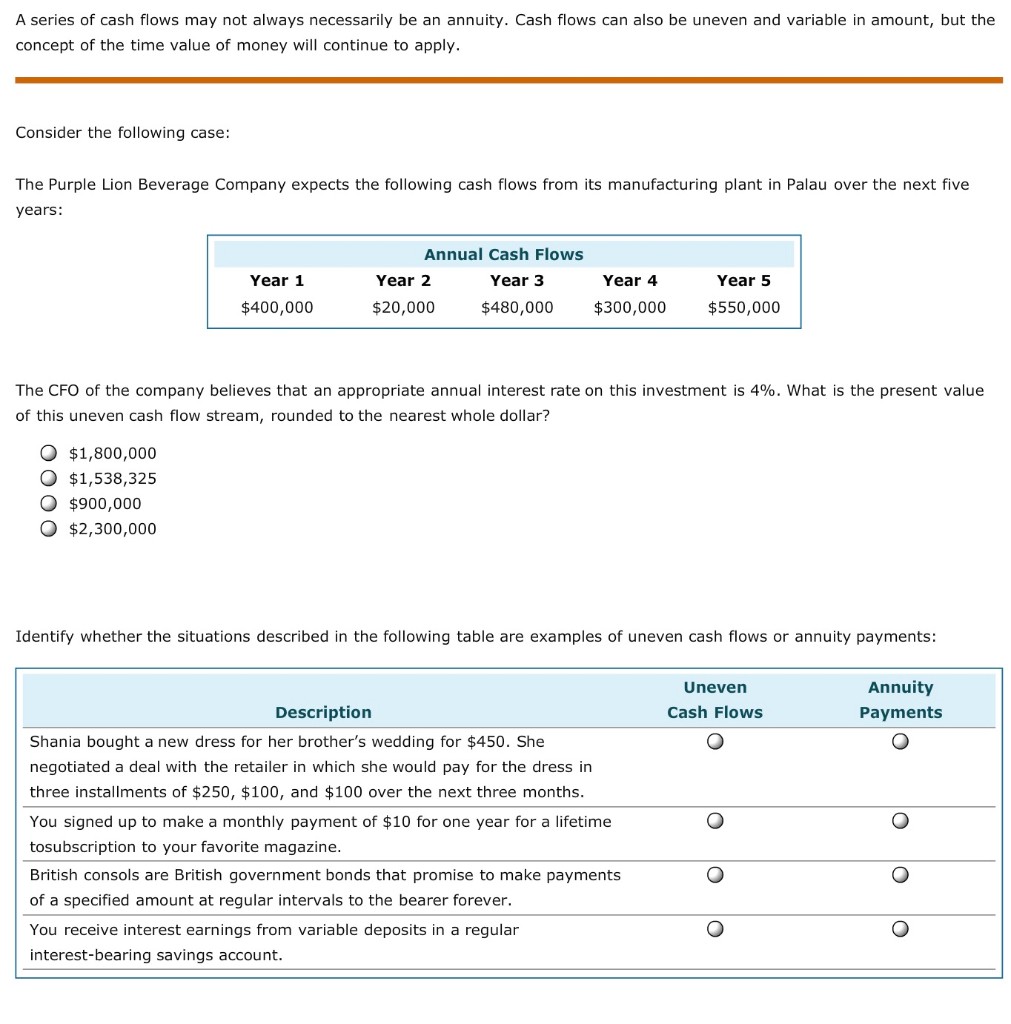

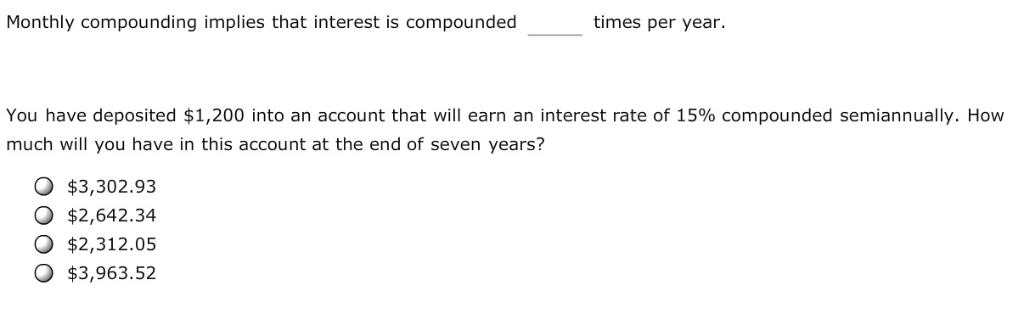

Perpetuities are also called annuities with an extended, or unlimited, life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. A perpetuity is a series of regularly timed, equal cash flows that is assumed to continue indefinitely into the future. In a perpetuity, returns-in the form of a series of identical cash flows-are earned The present value of a perpetuity is calculated by dividing the amount of the payment by the investor's opportunity interest rate. The principal amount of a perpetuity is repaid as a lump-sum amount. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $25,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and the bank's representative, you will need to deposit can fund the scholarship forever, assuming that the account will earn 5.50% per annum every year. (rounded to the nearest whole dollar) so that you Oops! The bank representative just reported that he misquoted the available interest rate on the scholarship's account. Your account should earn 3.50%. The amount of your required deposit should be revised to This suggests there is value of the perpetuity relationship between the interest rate earned on the account and the present A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time value of money will continue to apply. Consider the following case: The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next five years: Annual Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 $400,000 $20,000 $480,000 $300,000 $550,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 4%, what is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $1,800,000 o $1,538,325 O $900,000 $2,300,000 Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments: Annuity Payments Uneven Description Cash Flows Shania bought a new dress for her brother's wedding for $450. She negotiated a deal with the retailer in which she would pay for the dress in three installments of $250, $100, and $100 over the next three months You signed up to make a monthly payment of $10 for one year for a lifetime tosubscription to your favorite magazine British consols are British government bonds that promise to make payments of a specified amount at regular intervals to the bearer forever. You receive interest earnings from variable deposits in a regular interest-bearing savings account. Monthly compounding implies that interest is compounded times per year. You have deposited $1,200 into an account that will earn an interest rate of 15% compounded semiannually. How much will you have in this account at the end of seven years? O $3,302.93 o $2,642.34 o $2,312.05 O $3,963.52