Question

Perry Company has always prepared its income statement on the current operating performance basis Because the statements have been used strictly for internal purposes, adherence

Perry Company has always prepared its income statement on the current operating performance basis Because the statements have been used strictly for internal purposes, adherence to GAAP has not been a major consideration.

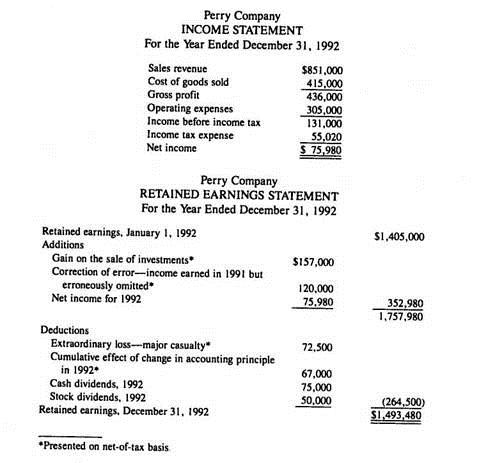

In early 1993 the company’s accountant contacts you for advice in preparing income and retained earnings statements for 1992 in accordance with generally accepted accounting principles for use with a bank loan application. The accountant presents you with the following statements, which had been prepared for internal use:

You determine that all items are appropriately described and that all items subject to income tax appropriately reflect a 42% income tax rate and that the company had 75,000 shares of common stock outstanding throughout 1992.

Instructions

Prepare income and retained earnings statements for 1992 in accordance with generally accepted accounting principles, including all relevant disclosures which can be determined from the given data. Provide computations to support your financial-statement items.

Perry Company INCOME STATEMENT For the Year Ended December 31, 1992 Sales revenue Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income Retained earnings, January 1, 1992 Additions Gain on the sale of investments* Correction of error-income earned in 1991 but Perry Company RETAINED EARNINGS STATEMENT For the Year Ended December 31, 1992 erroneously omitted* Net income for 1992 Deductions Extraordinary loss-major casualty Cumulative effect of change in accounting principle in 1992. Cash dividends, 1992 Stock dividends, 1992 Retained earnings, December 31, 1992 $851,000 415,000 436,000 305,000 *Presented on net-of-tax basis 131,000 55,020 $ 75,980 $157,000 120,000 75,980 72,500 67,000 75,000 50,000 $1,405,000 352,980 1,757,980 (264,500) $1,493,480

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ink we y 41 use follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started