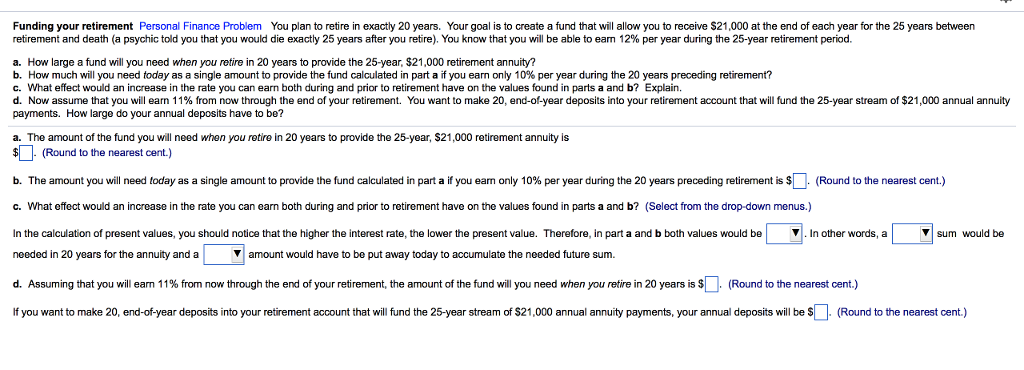

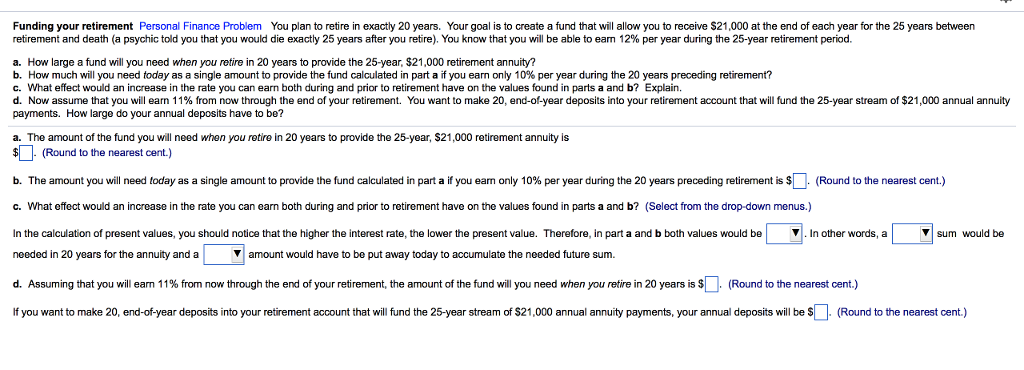

Personal Finance Problem You plan to retire in exactly 20 years. Your goal is to create a fund that will allow you to receive $21,000 at the end of each year for the 25 years between retirement and death (a psychic told you that you would die exactly 25 years after you retire). You know that you will be able to earn 12% per year during the 25-year retirement period. How large a fund will you need when you retire in 20 years to provide the 25-year, $21,000 retirement annuity? How much will you need today as a single amount to provide the fund calculated in part a if you earn only 10% per year during the 20 years preceding retirement? What effect would an increase in the rate you can earn both during and prior to retirement have on the values found in parts a and b? Explain. Now assume that you will earn 11% from now through the end of your retirement. You want to make 20, end-of-year deposits into your retirement account that will fund the 25-year stream of $21,000 annual annuity payments. How largo do your annual deposits have to be? The amount of the fund you will need when you retire in 20 years to provide the 25-year, $21,000 retirement annuity is (Round to the nearest cent.) The amount you will need today as a single amount to provide the fund calculated in part a if you earn only 10% per year during the 20 years preceding retirement is (Round to the nearest cent.) What effect would an increase in the rate you can earn both during and prior to retirement have on the values found in parts a and b? (Select from the drop-down menus.). In the calculation of present values, you should notice that the higher the interest rate, the lower the present value. Therefore, in part a and b both values would be. In other words, a sum would be needed in 20 years for the annuity and a amount would have to be put away today to accumulate the needed future sum. Assuming that you will earn 11% from now through the end of your retirement, the amount of the fund will you need when you retire in 20 years is (Round to the nearest cent.) If you want to make 20, end-of-year deposits into your retirement account that will fund the 25-year stream of $21,000 annual annuity payments, your annual deposits will be (Round to the nearest cent.)