PERSONAL FINANCIAL PLANNING

PERSONAL FINANCIAL PLANNING

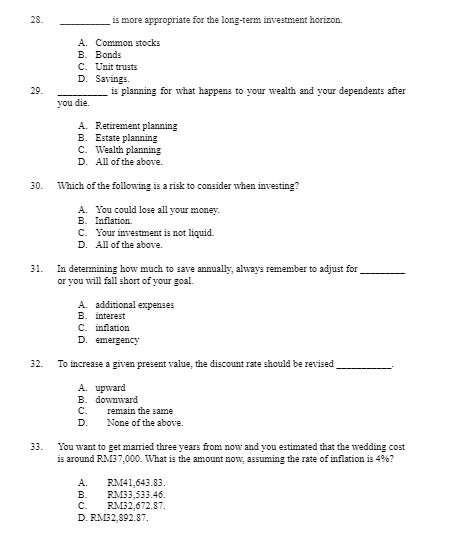

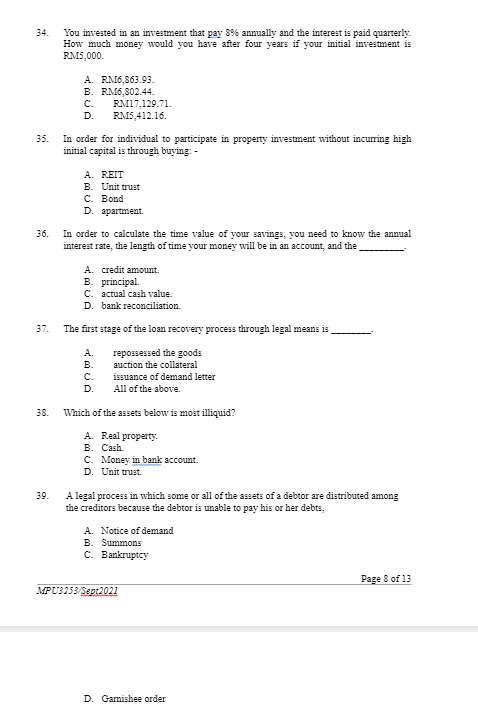

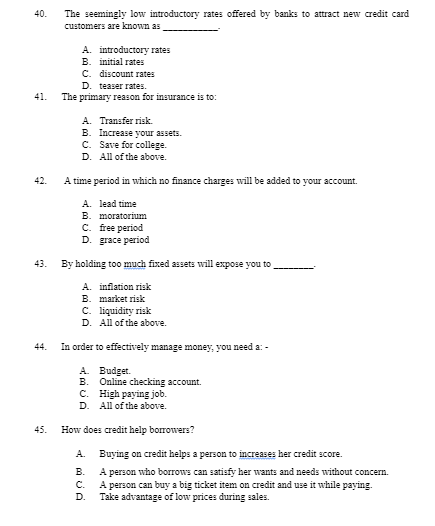

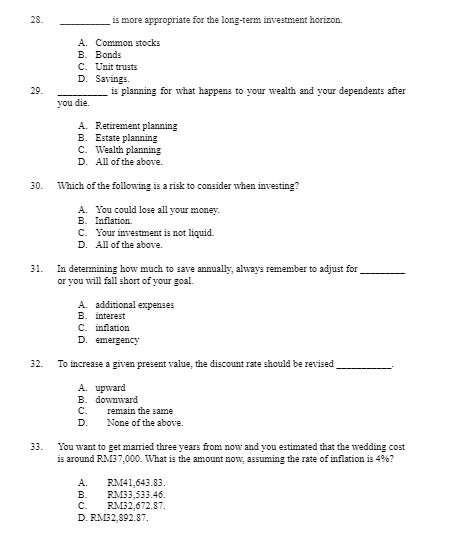

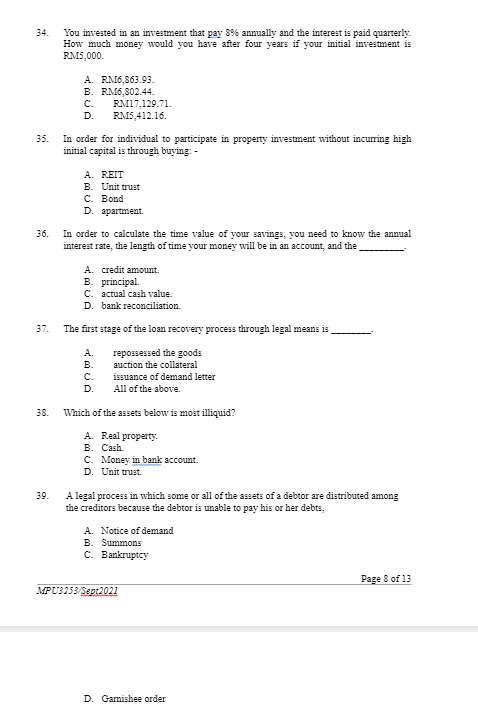

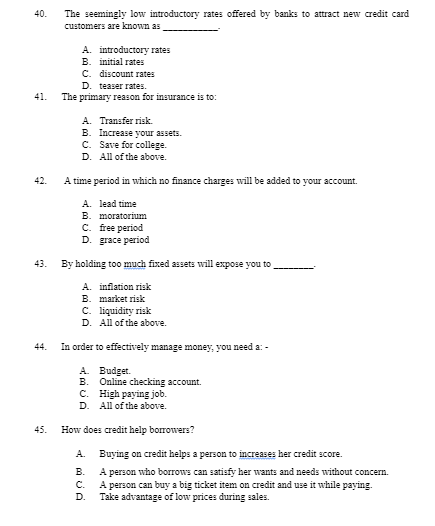

28. is more appropriate for the long-term investment horizon. A. Common stocks B. Bonds C. Unit trusts D. Savings. is planning for what happens to your wealth and your dependents after 29. . you die 30. A. Retirement planning B. Estate planning c. Wealth planning D. All of the above. Which of the following is a risk to consider when investing? A. You could lose all your money. B. Inflation C. Your investment is not liquid. D. All of the above. 31. In determining how much to save annually, always remember to adjust for or you will fall short of your goal. A. additional expenses B interest C. inflation D. emergency 32 To increase a given present value the discount rate should be revised A upward B. downward C. remain the same D. None of the above 33. You want to get married three years from now and you estimated that the wedding cost is around RM137,000. What is the amount now, assuming the rate of inflation is 4%? AUA A. RM41,643.83. B RM33,533.46. RM32,672.87. D. RM32.892.87. 34. You invested in an investment that pay 8% annually and the interest is paid quarterly How much money would you have after four years if your initial investment is RM5,000. A. RM6,863.93. B. RM6,802.44 C. RM17,129.71. D RM5,412.16. 35. . In order for individual to participate in property investment without incurring high initial capital is through buying: - A. REIT B. Unit trust C. Bond D. apartment 36. . In order to calculate the time value of your savings, you need to know the annual interest rate, the length of time your money will be in an account, and the A credit amount. B. principal. C. actual cash value. D. bank reconciliation 37. The first stage of the loan recovery process through legal means is A repossessed the goods B. auction the collateral C issuance of demand letter D All of the above. 38. Which of the assets below is most illiquid? A. Real property B. Cash C. Money in bank account. D. Unit trust. 39. A legal process in which some or all of the assets of a debtor are distributed among the creditors because the debtor is unable to pay his or her debts, A. Notice of demand B. Summons C. Bankruptcy Page 3 of 13 MPU3253/Sept2021 D. Garnishee order . 40. The seemingly low introductory rates offered by banks to attract new credit card customers are known as 41. A. introductory rates B. initial rates C. discount rates D. teaser rates. The primary reason for insurance is to: A. Transfer risk B. Increase your assets. C. Save for college D. All of the above A time period in which no finance charges will be added to your account. A. lead time B. moratorium C. free period D. grace period 42. . 43. By holding too much fixed assets will expose you to A. inflation risk B. market risk C. liquidity risk D. All of the above 44. In order to effectively manage money, you need a: A Budget B. Online checking account C. High paying job. D. All of the above. 45. A How does credit help borrowers? Buying on credit helps a person to increases her credit score. B. A person who borrows can satisfy her wants and needs without concern. A person can buy a big ticket item on credit and use it while paying. Take advantage of low prices during sales. UA D

PERSONAL FINANCIAL PLANNING

PERSONAL FINANCIAL PLANNING