Answered step by step

Verified Expert Solution

Question

1 Approved Answer

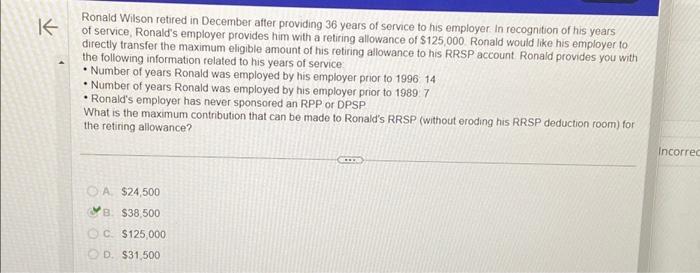

PERSOON K Ronald Wilson retired in December after providing 36 years of service to his employer. In recognition of his years of service, Ronald's employer

PERSOON K Ronald Wilson retired in December after providing 36 years of service to his employer. In recognition of his years of service, Ronald's employer provides him with a retiring allowance of $125,000. Ronald would like his employer to directly transfer the maximum eligible amount of his retiring allowance to his RRSP account. Ronald provides you with the following information related to his years of service: Number of years Ronald was employed by his employer prior to 1996: 14 Number of years Ronald was employed by his employer prior to 1989: 7 Ronald's employer has never sponsored an RPP or DPSP. What is the maximum contribution that can be made to Ronald's RRSP (without eroding his RRSP deduction room) for the retiring allowance? OA. $24,500 B. $38,500 OC. $125,000 OD. $31,500 ... Incorrec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started