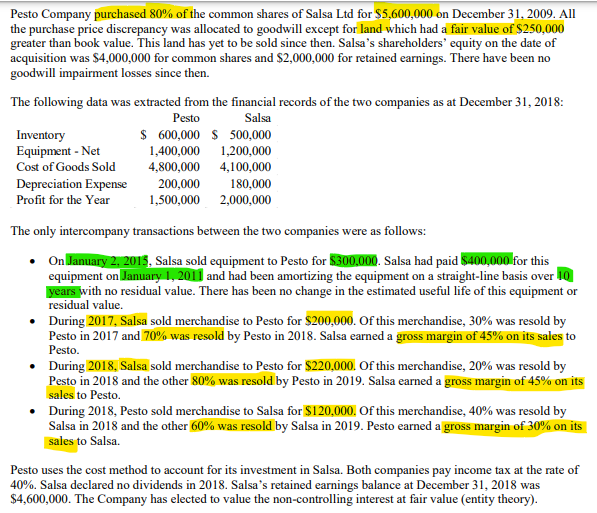

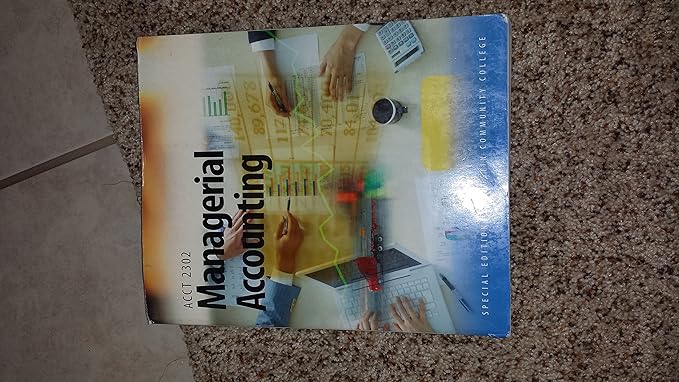

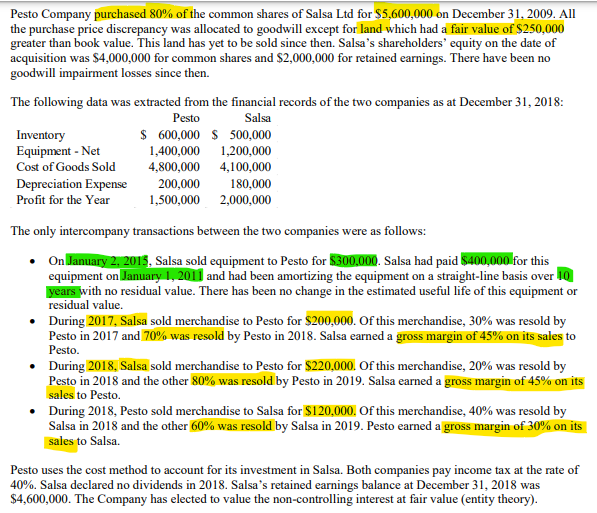

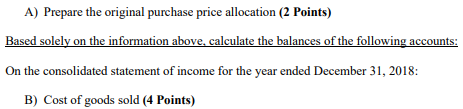

Pesto Company purchased 80% of the common shares of Salsa Ltd for $5,600,000 on December 31, 2009. All the purchase price discrepancy was allocated to goodwill except for land which had a fair value of $250,000 greater than book value. This land has yet to be sold since then. Salsa's shareholders' equity on the date of acquisition was $4,000,000 for common shares and $2,000,000 for retained earnings. There have been no goodwill impairment losses since then. The following data was extracted from the financial records of the two companies as at December 31, 2018: Pesto Salsa Inventory $ 600,000 $ 500,000 Equipment - Net 1,400,000 1,200,000 Cost of Goods Sold 4,800,000 4,100,000 Depreciation Expense 200,000 180,000 Profit for the Year 1,500,000 2,000,000 The only intercompany transactions between the two companies were as follows: On January 2, 2015, Salsa sold equipment to Pesto for $300,000. Salsa had paid $400,000 for this equipment on January 1, 2011 and had been amortizing the equipment on a straight-line basis over 10 years with no residual value. There has been no change in the estimated useful life of this equipment or residual value. During 2017, Salsa sold merchandise to Pesto for $200,000. Of this merchandise, 30% was resold by Pesto in 2017 and 70% was resold by Pesto in 2018. Salsa earned a gross margin of 45% on its sales to Pesto. During 2018, Salsa sold merchandise to Pesto for $220,000. Of this merchandise, 20% was resold by Pesto in 2018 and the other 80% was resold by Pesto in 2019. Salsa earned a gross margin of 45% on its sales to Pesto . During 2018, Pesto sold merchandise to Salsa for $120.000. Of this merchandise, 40% was resold by Salsa in 2018 and the other 60% was resold by Salsa in 2019. Pesto earned a gross margin of 30% on its sales to Salsa. Pesto uses the cost method to account for its investment in Salsa. Both companies pay income tax at the rate of 40%. Salsa declared no dividends in 2018. Salsa's retained earnings balance at December 31, 2018 was $4,600,000. The Company has elected to value the non-controlling interest at fair value (entity theory). A) Prepare the original purchase price allocation (2 Points) Based solely on the information above, calculate the balances of the following accounts: On the consolidated statement of income for the year ended December 31, 2018: B) Cost of goods sold (4 Points) Pesto Company purchased 80% of the common shares of Salsa Ltd for $5,600,000 on December 31, 2009. All the purchase price discrepancy was allocated to goodwill except for land which had a fair value of $250,000 greater than book value. This land has yet to be sold since then. Salsa's shareholders' equity on the date of acquisition was $4,000,000 for common shares and $2,000,000 for retained earnings. There have been no goodwill impairment losses since then. The following data was extracted from the financial records of the two companies as at December 31, 2018: Pesto Salsa Inventory $ 600,000 $ 500,000 Equipment - Net 1,400,000 1,200,000 Cost of Goods Sold 4,800,000 4,100,000 Depreciation Expense 200,000 180,000 Profit for the Year 1,500,000 2,000,000 The only intercompany transactions between the two companies were as follows: On January 2, 2015, Salsa sold equipment to Pesto for $300,000. Salsa had paid $400,000 for this equipment on January 1, 2011 and had been amortizing the equipment on a straight-line basis over 10 years with no residual value. There has been no change in the estimated useful life of this equipment or residual value. During 2017, Salsa sold merchandise to Pesto for $200,000. Of this merchandise, 30% was resold by Pesto in 2017 and 70% was resold by Pesto in 2018. Salsa earned a gross margin of 45% on its sales to Pesto. During 2018, Salsa sold merchandise to Pesto for $220,000. Of this merchandise, 20% was resold by Pesto in 2018 and the other 80% was resold by Pesto in 2019. Salsa earned a gross margin of 45% on its sales to Pesto . During 2018, Pesto sold merchandise to Salsa for $120.000. Of this merchandise, 40% was resold by Salsa in 2018 and the other 60% was resold by Salsa in 2019. Pesto earned a gross margin of 30% on its sales to Salsa. Pesto uses the cost method to account for its investment in Salsa. Both companies pay income tax at the rate of 40%. Salsa declared no dividends in 2018. Salsa's retained earnings balance at December 31, 2018 was $4,600,000. The Company has elected to value the non-controlling interest at fair value (entity theory). A) Prepare the original purchase price allocation (2 Points) Based solely on the information above, calculate the balances of the following accounts: On the consolidated statement of income for the year ended December 31, 2018: B) Cost of goods sold (4 Points)