Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peter and Gamora have calculated their taxable income to be $188,000 for 2022, which includes $25,000 of net long-term capital gains. They also made

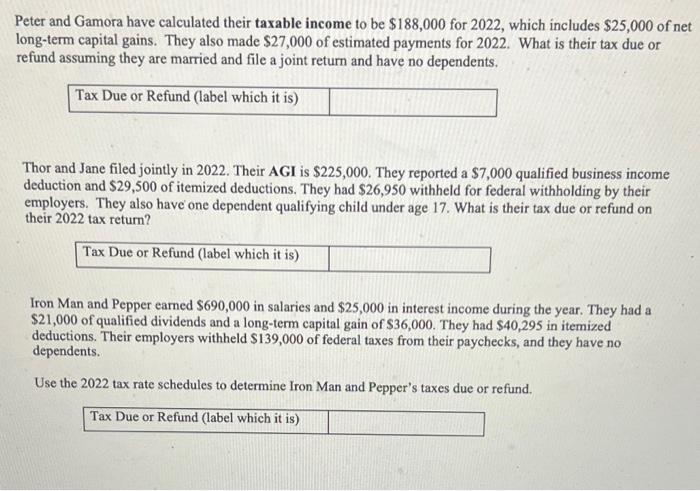

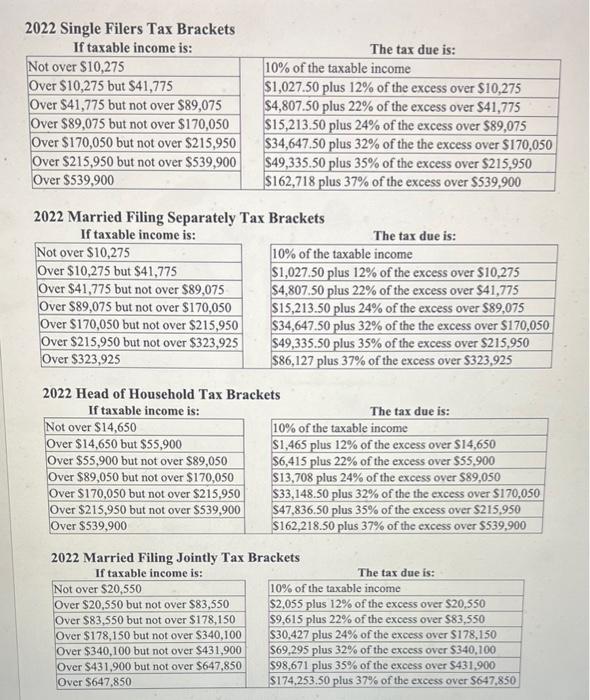

Peter and Gamora have calculated their taxable income to be $188,000 for 2022, which includes $25,000 of net long-term capital gains. They also made $27,000 of estimated payments for 2022. What is their tax due or refund assuming they are married and file a joint return and have no dependents. Tax Due or Refund (label which it is) Thor and Jane filed jointly in 2022. Their AGI is $225,000. They reported a $7,000 qualified business income deduction and $29,500 of itemized deductions. They had $26,950 withheld for federal withholding by their employers. They also have one dependent qualifying child under age 17. What is their tax due or refund on their 2022 tax return? Tax Due or Refund (label which it is) Iron Man and Pepper earned $690,000 in salaries and $25,000 in interest income during the year. They had a $21,000 of qualified dividends and a long-term capital gain of $36,000. They had $40,295 in itemized deductions. Their employers withheld $139,000 of federal taxes from their paychecks, and they have no dependents. Use the 2022 tax rate schedules to determine Iron Man and Pepper's taxes due or refund. Tax Due or Refund (label which it is) 2022 Single Filers Tax Brackets If taxable income is: Not over $10,275 Over $10,275 but $41,775 Over $41,775 but not over $89,075 Over $89,075 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 2022 Married Filing Separately If taxable income is: Not over $10,275 Over $10,275 but $41,775 Over $41,775 but not over $89,075 Over $89,075 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $323,925 Over $323,925 The tax due is: 10% of the taxable income $1,027.50 plus 12% of the excess over $10,275 $4,807.50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $34,647.50 plus 32% of the the excess over $170,050 $49,335.50 plus 35% of the excess over $215,950 $162,718 plus 37% of the excess over $539,900 Tax Brackets 2022 Head of Household Tax Brackets If taxable income is: Not over $14,650 Over $14,650 but $55,900 Over $55,900 but not over $89,050 Over $89,050 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 10% of the taxable income $1,027.50 plus 12% of the excess over $10,275 $4,807.50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $34,647.50 plus 32% of the the excess over $170,050 $49,335.50 plus 35% of the excess over $215,950 $86,127 plus 37% of the excess over $323,925 Not over $20,550 Over $20,550 but not over $83,550 Over $83,550 but not over $178,150 Over $178,150 but not over $340,100 Over $340,100 but not over $431,900 Over $431,900 but not over $647,850 Over $647,850 The tax due is: 2022 Married Filing Jointly Tax Brackets If taxable income is: The tax due is: 10% of the taxable income $1,465 plus 12% of the excess over $14,650 $6,415 plus 22% of the excess over $55,900 $13,708 plus 24% of the excess over $89,050 $33,148.50 plus 32% of the the excess over $170,050 $47,836.50 plus 35% of the excess over $215,950 $162,218.50 plus 37% of the excess over $539,900 The tax due is: 10% of the taxable income $2,055 plus 12% of the excess over $20,550 $9,615 plus 22% of the excess over $83,550 $30,427 plus 24% of the excess over $178,150 $69,295 plus 32% of the excess over $340,100 $98,671 plus 35% of the excess over $431,900 $174.253.50 plus 37% of the excess over $647,850

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets compute the tax due or refund for each of the given scenarios 1 Peter and Gamora Taxable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started