Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peter and Mary use a partnership (50%: 50% ownership) to start a new restaurant business with the name of APC Restaurant. The estimated turnover

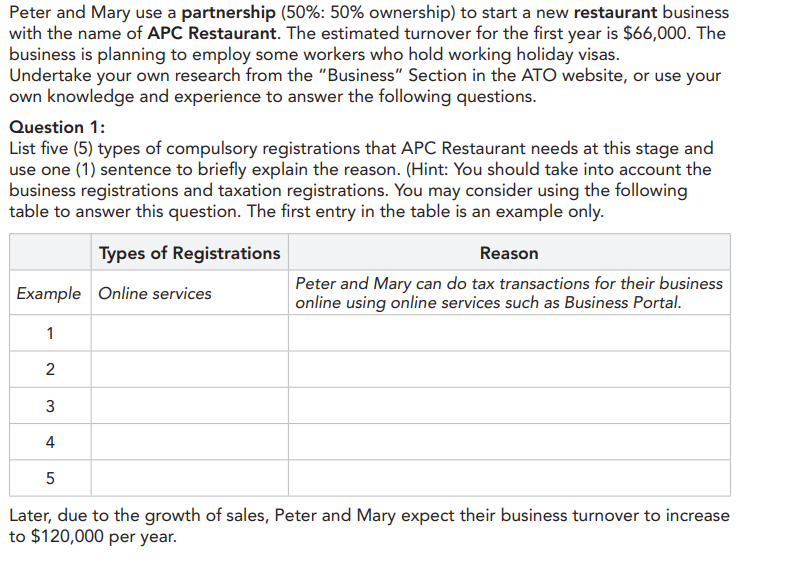

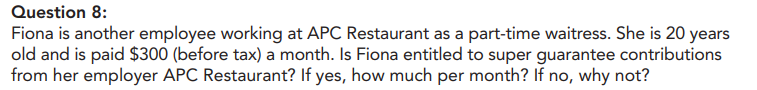

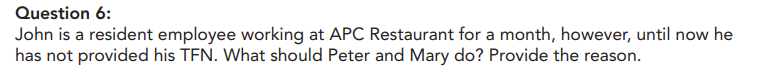

Peter and Mary use a partnership (50%: 50% ownership) to start a new restaurant business with the name of APC Restaurant. The estimated turnover for the first year is $66,000. The business is planning to employ some workers who hold working holiday visas. Undertake your own research from the "Business" Section in the ATO website, or use your own knowledge and experience to answer the following questions. Question 1: List five (5) types of compulsory registrations that APC Restaurant needs at this stage and use one (1) sentence to briefly explain the reason. (Hint: You should take into account the business registrations and taxation registrations. You may consider using the following table to answer this question. The first entry in the table is an example only. Types of Registrations Example Online services 1 2 3 Reason Peter and Mary can do tax transactions for their business online using online services such as Business Portal. 4 5 Later, due to the growth of sales, Peter and Mary expect their business turnover to increase to $120,000 per year. Question 8: Fiona is another employee working at APC Restaurant as a part-time waitress. She is 20 years old and is paid $300 (before tax) a month. Is Fiona entitled to super guarantee contributions from her employer APC Restaurant? If yes, how much per month? If no, why not? Question 6: John is a resident employee working at APC Restaurant for a month, however, until now he has not provided his TFN. What should Peter and Mary do? Provide the reason.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Australian Business Number ABN registration APC Restaurant needs to register for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started