Answered step by step

Verified Expert Solution

Question

1 Approved Answer

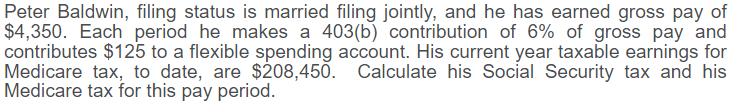

Peter Baldwin, filing status is married filing jointly, and he has earned gross pay of $4,350. Each period he makes a 403(b) contribution of

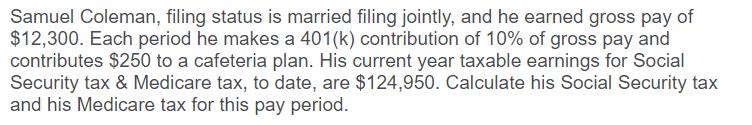

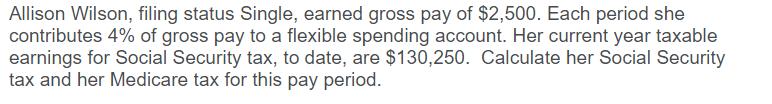

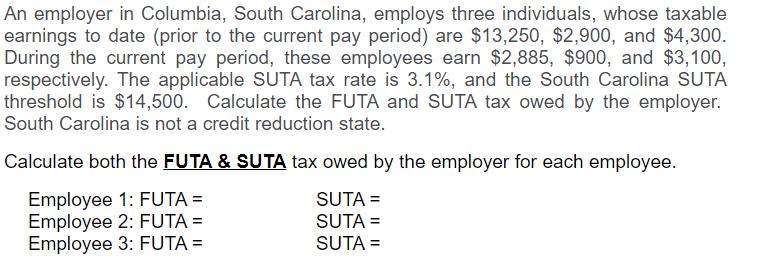

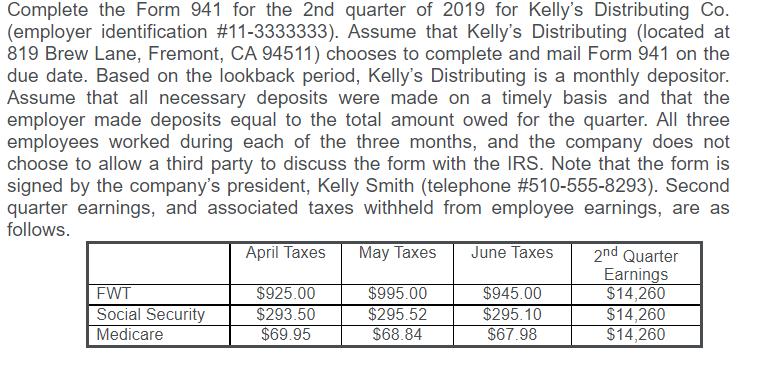

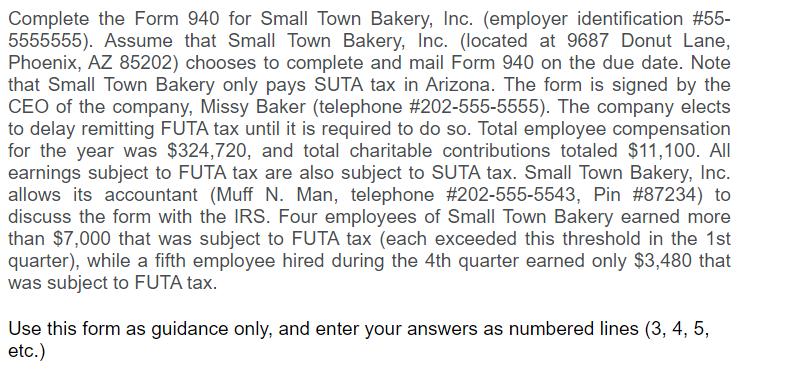

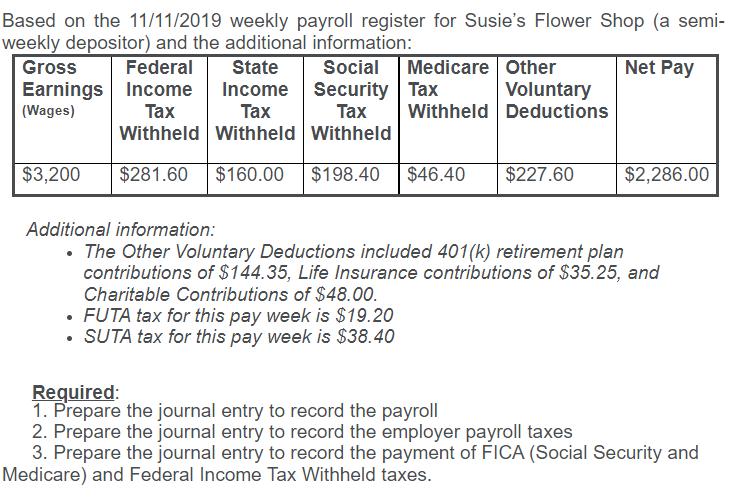

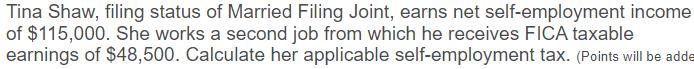

Peter Baldwin, filing status is married filing jointly, and he has earned gross pay of $4,350. Each period he makes a 403(b) contribution of 6% of gross pay and contributes $125 to a flexible spending account. His current year taxable earnings for Medicare tax, to date, are $208,450. Calculate his Social Security tax and his Medicare tax for this pay period. Samuel Coleman, filing status is married filing jointly, and he earned gross pay of $12,300. Each period he makes a 401(k) contribution of 10% of gross pay and contributes $250 to a cafeteria plan. His current year taxable earnings for Social Security tax & Medicare tax, to date, are $124,950. Calculate his Social Security tax and his Medicare tax for this pay period. Allison Wilson, filing status Single, earned gross pay of $2,500. Each period she contributes 4% of gross pay to a flexible spending account. Her current year taxable earnings for Social Security tax, to date, are $130,250. Calculate her Social Security tax and her Medicare tax for this pay period. An employer in Columbia, South Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $13,250, $2,900, and $4,300. During the current pay period, these employees earn $2,885, $900, and $3,100, respectively. The applicable SUTA tax rate is 3.1%, and the South Carolina SUTA threshold is $14,500. Calculate the FUTA and SUTA tax owed by the employer. South Carolina is not a credit reduction state. Calculate both the FUTA & SUTA tax owed by the employer for each employee. Employee 1: FUTA = Employee 2: FUTA = SUTA = SUTA = Employee 3: FUTA = SUTA = Complete the Form 941 for the 2nd quarter of 2019 for Kelly's Distributing Co. (employer identification #11-3333333). Assume that Kelly's Distributing (located at 819 Brew Lane, Fremont, CA 94511) chooses to complete and mail Form 941 on the due date. Based on the lookback period, Kelly's Distributing is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. All three employees worked during each of the three months, and the company does not choose to allow a third party to discuss the form with the IRS. Note that the form is signed by the company's president, Kelly Smith (telephone # 510-555-8293). Second quarter earnings, and associated taxes withheld from employee earnings, are as follows. April Taxes May Taxes FWT Social Security Medicare $925.00 $293.50 $69.95 $995.00 $295.52 $68.84 June Taxes $945.00 $295.10 $67.98 2nd Quarter Earnings $14,260 $14,260 $14,260 Complete the Form 940 for Small Town Bakery, Inc. (employer identification #55- 5555555). Assume that Small Town Bakery, Inc. (located at 9687 Donut Lane, Phoenix, AZ 85202) chooses to complete and mail Form 940 on the due date. Note that Small Town Bakery only pays SUTA tax in Arizona. The form is signed by the CEO of the company, Missy Baker (telephone #202-555-5555). The company elects to delay remitting FUTA tax until it is required to do so. Total employee compensation for the year was $324,720, and total charitable contributions totaled $11,100. All earnings subject to FUTA tax are also subject to SUTA tax. Small Town Bakery, Inc. allows its accountant (Muff N. Man, telephone #202-555-5543, Pin #87234) to discuss the form with the IRS. Four employees of Small Town Bakery earned more than $7,000 that was subject to FUTA tax (each exceeded this threshold in the 1st quarter), while a fifth employee hired during the 4th quarter earned only $3,480 that was subject to FUTA tax. Use this form as guidance only, and enter your answers as numbered lines (3, 4, 5, etc.) Based on the 11/11/2019 weekly payroll register for Susie's Flower Shop (a semi- weekly depositor) and the additional information: Net Pay Gross Federal State Social Medicare Other Earnings Income Income Security Tax Tax (Wages) Tax Tax Withheld Withheld Withheld $281.60 $160.00 $198.40 $46.40 $227.60 $3,200 Voluntary Withheld Deductions FUTA tax for this pay week is $19.20 SUTA tax for this pay week is $38.40 Additional information: The Other Voluntary Deductions included 401(k) retirement plan contributions of $144.35, Life Insurance contributions of $35.25, and Charitable Contributions of $48.00. $2,286.00 Required: 1. Prepare the journal entry to record the payroll 2. Prepare the journal entry to record the employer payroll taxes 3. Prepare the journal entry to record the payment of FICA (Social Security and Medicare) and Federal Income Tax Withheld taxes. Tina Shaw, filing status of Married Filing Joint, earns net self-employment income of $115,000. She works a second job from which he receives FICA taxable earnings of $48,500. Calculate her applicable self-employment tax. (Points will be adde

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Work order...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started