Question

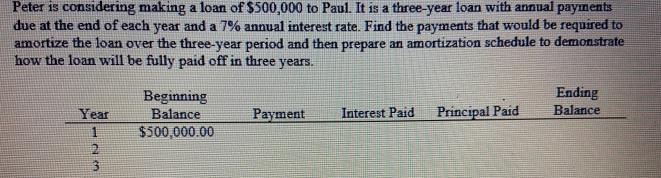

Peter is considering making a loan of $500,000 to Paul. It is a three-year loan with annual payments due at the end of each

Peter is considering making a loan of $500,000 to Paul. It is a three-year loan with annual payments due at the end of each year and a 7% annual interest rate. Find the payments that would be required to amortize the loan over the three-year period and then prepare an amortization schedule to demonstrate how the loan will be fully paid off in three years. Beginning Balance Ending Balance Year Payment Interest Paid Principal Paid $500,000.00 123 2

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Year Beginning Balance Payment PMT73500000 Interest PaidBegi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Analysis with Microsoft Excel

Authors: Timothy R. Mayes, Todd M. Shank

7th edition

1285432274, 978-1305535596, 1305535596, 978-1285432274

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App