Answered step by step

Verified Expert Solution

Question

1 Approved Answer

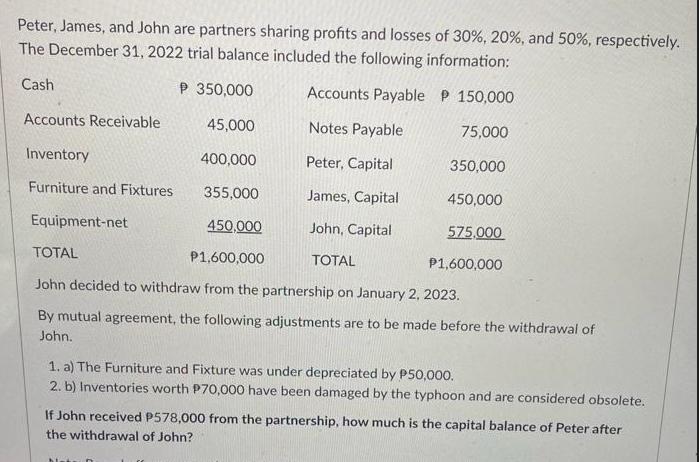

Peter, James, and John are partners sharing profits and losses of 30%, 20%, and 50%, respectively. The December 31, 2022 trial balance included the

Peter, James, and John are partners sharing profits and losses of 30%, 20%, and 50%, respectively. The December 31, 2022 trial balance included the following information: Cash P 350,000 Accounts Payable P 150,000 45,000 Notes Payable 75,000 400,000 Peter, Capital 350,000 355,000 James, Capital 450,000 450,000 John, Capital 575,000 TOTAL P1,600,000 TOTAL P1,600,000 John decided to withdraw from the partnership on January 2, 2023. By mutual agreement, the following adjustments are to be made before the withdrawal of John. Accounts Receivable Inventory Furniture and Fixtures Equipment-net 1. a) The Furniture and Fixture was under depreciated by P50,000. 2. b) Inventories worth P70,000 have been damaged by the typhoon and are considered obsolete. If John received P578,000 from the partnership, how much is the capital balance of Peter after the withdrawal of John?

Step by Step Solution

★★★★★

3.44 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Peters capital balance after the withdrawal of John we need to adjust the partnerships assets and liabilities and calculate the total capital balance before the withdrawal Adjustment 1 Fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started