Question

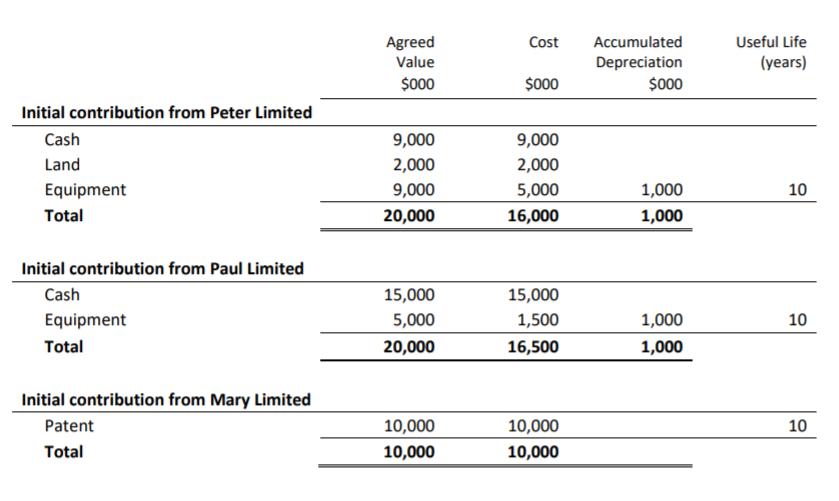

Peter Limited, Paul Limited and Mary Limited entered into a joint operation on 1 July 2019 to manufacture old fashioned music vinyl records. It was

The joint operators chose not to revalue their remaining interests in the contributed assets in their separate records. All joint operators agree to record any depreciation or amortisation of the joint operation in their own books. There are no residual values for the assets of the joint operation.

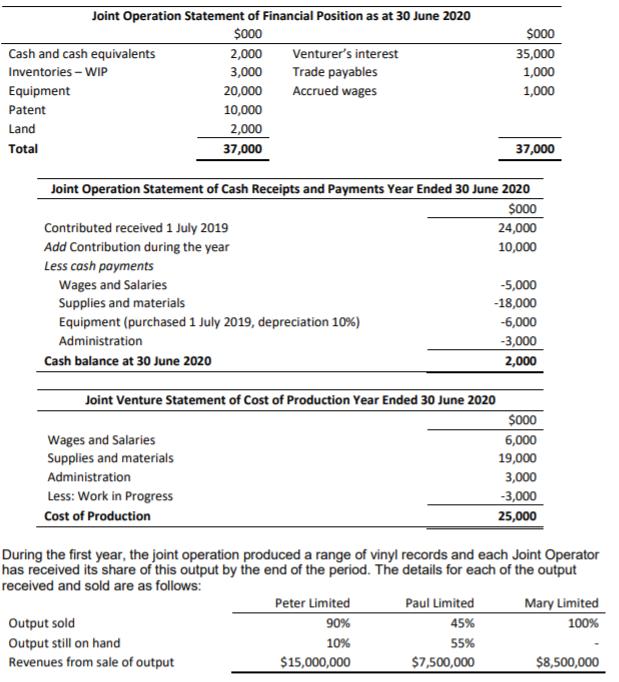

During the year ended 30 June 2020, Peter Limited, Paul Limited and Mary Limited contributed a further total of $10,000,000 cash to the joint operation in the same ratio as their initial interests.

Peter Limited was appointed Joint Operation Manager, receiving a sum of $500,000 for this service during the first year of operation. This service fee is included in the Administration costs reported in the Statement of Cash Receipts and Payments shown below.

The financial statements for the joint operation for the year are as follows:

Required

1. Prepare the general journal entries for the year 1 July 2019 to 30 June 2020 for Peter Limited only in respect of the joint operation and related inventory transactions, assuming no entries have yet been made for the year ended 30 June 2020. Peter Limited uses the line-by-line method to account for its interest in the joint operation.

2. Based on the facts provided in Question 1, immediately after the initial contribution, what is the value of total Cash represented in the Interest in the Joint Operation held by Mary Limited?

3. Briefly discuss the principles you used in calculating your answer in Question 2.

Agreed Cost Accumulated Value Depreciation Useful Life (years) $000 $000 $000 Initial contribution from Peter Limited Cash 9,000 9,000 Land 2,000 2,000 Equipment 9,000 5,000 1,000 10 Total 20,000 16,000 1,000 Initial contribution from Paul Limited Cash 15,000 15,000 Equipment 5,000 1,500 1,000 10 Total 20,000 16,500 1,000 Initial contribution from Mary Limited Patent 10,000 10,000 10 Total 10,000 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 General Journal Entries for Peter Limited a Initial Contribution on 1 July 2019 Debit Cash 20000000 Debit Land 2000000 Debit Equipment 9000000 Credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started