Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peter now has $60,000 cash to invest in a property with purchase price of $300,000 property. To finance the purchase, he could obtain a

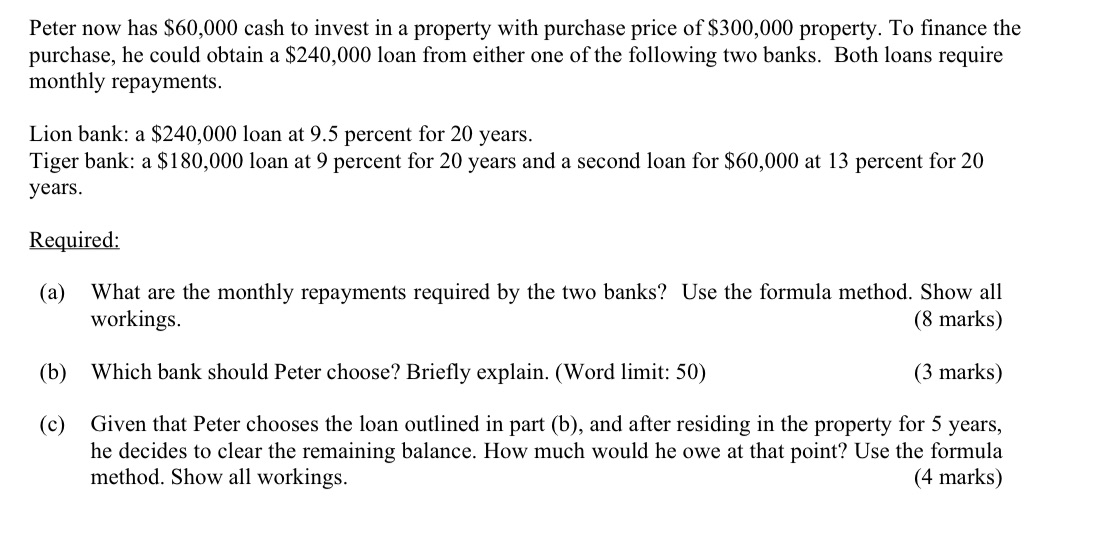

Peter now has $60,000 cash to invest in a property with purchase price of $300,000 property. To finance the purchase, he could obtain a $240,000 loan from either one of the following two banks. Both loans require monthly repayments. Lion bank: a $240,000 loan at 9.5 percent for 20 years. Tiger bank: a $180,000 loan at 9 percent for 20 years and a second loan for $60,000 at 13 percent for 20 years. Required: (a) What are the monthly repayments required by the two banks? Use the formula method. Show all workings. (b) Which bank should Peter choose? Briefly explain. (Word limit: 50) (8 marks) (3 marks) (c) Given that Peter chooses the loan outlined in part (b), and after residing in the property for 5 years, he decides to clear the remaining balance. How much would he owe at that point? Use the formula method. Show all workings. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Monthly Repayments Lion Bank Monthly Interest Rate Convert the annual interest rate 95 to a monthly rate 95 12 monthsyear 07917 per month Loan Term ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started