Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peter Pan was employed by Curry Ltd at a monthly salary of $20,000 up to 30 June 2018. In addition to his salary, the

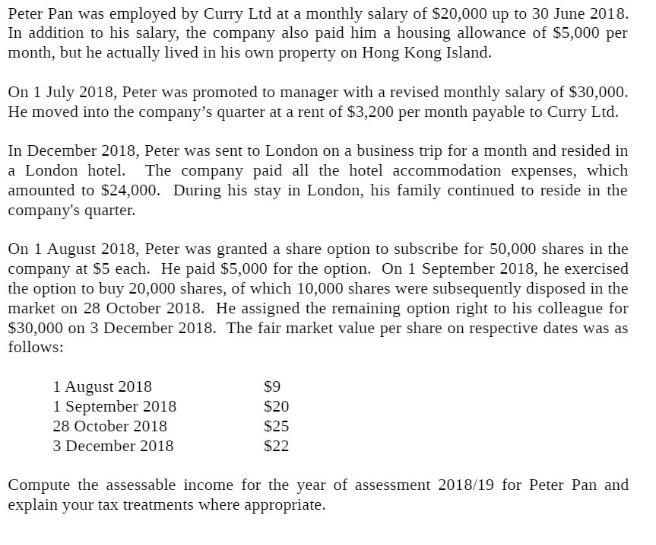

Peter Pan was employed by Curry Ltd at a monthly salary of $20,000 up to 30 June 2018. In addition to his salary, the company also paid him a housing allowance of $5,000 per month, but he actually lived in his own property on Hong Kong Island. On 1 July 2018, Peter was promoted to manager with a revised monthly salary of $30,000. He moved into the company's quarter at a rent of $3,200 per month payable to Curry Ltd. In December 2018, Peter was sent to London on a business trip for a month and resided in a London hotel. The company paid all the hotel accommodation expenses, which amounted to $24,000. During his stay in London, his family continued to reside in the company's quarter. On 1 August 2018, Peter was granted a share option to subscribe for 50,000 shares in the company at $5 each. He paid $5,000 for the option. On 1 September 2018, he exercised the option to buy 20,000 shares, of which 10,000 shares were subsequently disposed in the market on 28 October 2018. He assigned the remaining option right to his colleague for $30,000 on 3 December 2018. The fair market value per share on respective dates was as follows: 1 August 2018 $9 1 September 2018 $20 28 October 2018 $25 $22 3 December 2018 Compute the assessable income for the year of assessment 2018/19 for Peter Pan and explain your tax treatments where appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the assessable income for the year of assessment 201819 for Peter Pan we need to consider his salary housing allowance rent hotel accommoda...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started