Answered step by step

Verified Expert Solution

Question

1 Approved Answer

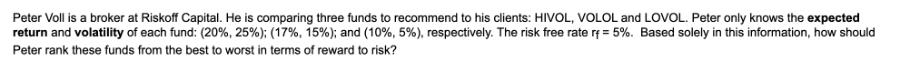

Peter Voll is a broker at Riskoff Capital. He is comparing three funds to recommend to his clients: HIVOL, VOLOL and LOVOL. Peter only

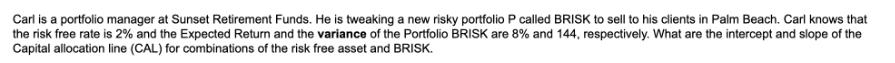

Peter Voll is a broker at Riskoff Capital. He is comparing three funds to recommend to his clients: HIVOL, VOLOL and LOVOL. Peter only knows the expected return and volatility of each fund: (20%, 25%) ; ( 17%, 15%); and (10%, 5%), respectively. The risk free rate rf = 5%. Based solely in this information, how should Peter rank these funds from the best to worst in terms of reward to risk? Carl is a portfolio manager at Sunset Retirement Funds. He is tweaking a new risky portfolio P called BRISK to sell to his clients in Palm Beach. Carl knows that the risk free rate is 2% and the Expected Return and the variance of the Portfolio BRISK are 8% and 144, respectively. What are the intercept and slope of the Capital allocation line (CAL) for combinations of the risk free asset and BRISK.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 Peter shoul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started