Peter wants to buy a life insurance policy for a term of 20 years. The amount of death benefits that he wants is $1,000,000.

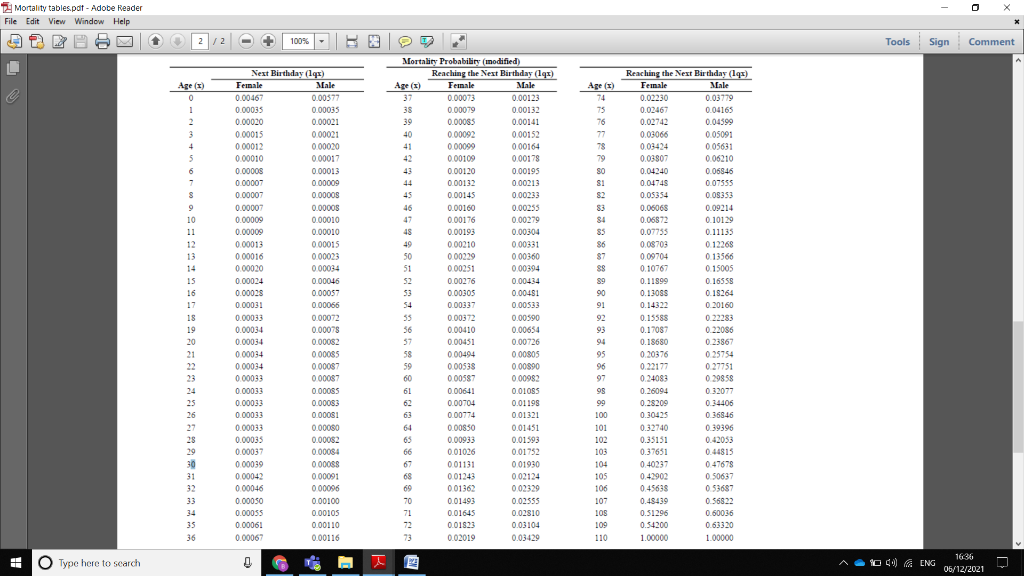

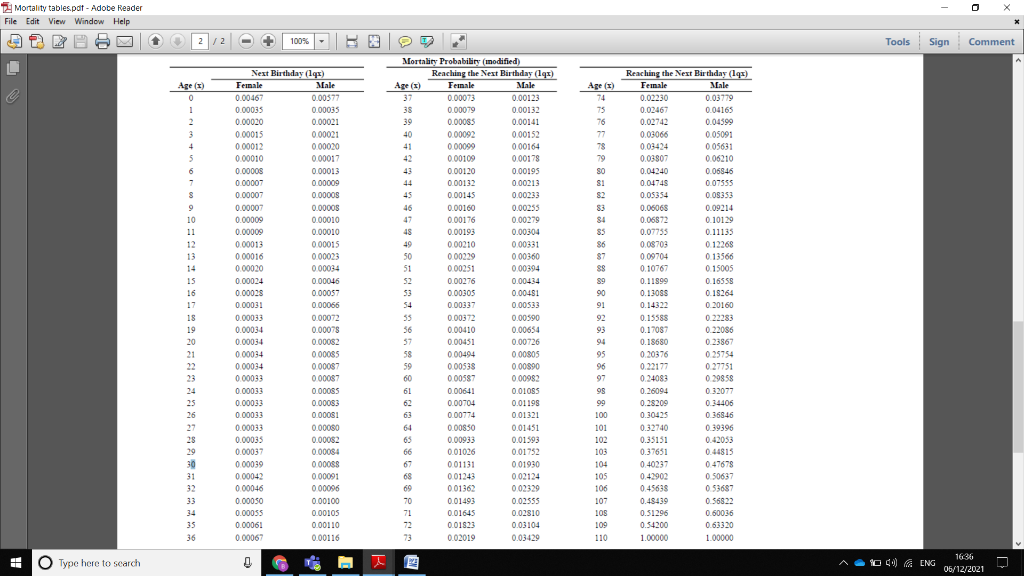

1)Using the mortality tables that we discussed in class (and posted on Avenue), calculate the annual premium that he has to pay under the 20-year term- life policy. Note that the premium will be constant from year to year during the 20-year term. Assume that the interest rate is 3% p.a., annual compounding.

2)Suppose that instead of getting a 20-year term policy, Peter wants to get a 10-year policy (with the same amount of coverage as in (a)), and 10 years from now (i.e., when he turns 55) he will renew it for another 10 years (with the same amount of coverage). The insurance company will allow him to renew his policy without a medical test. Assume that the interest rate and the mortality probability remain the same throughout the next 20 years. What are the total premiums (PV'ed back to today) that he has to pay under this alternative?

O Mortality tablespat - Adobe Reader File Edit View Window Help 1 2 / 2 100%- % 8 Tools Sign Comment Age (x) a 1 2 3 3 Age (x) 74 75 76 77 78 79 SO + 5 9 - IS 7 8 9 10 11 12 13 82 83 84 83 86 87 SS ES Nest Birthday (1x) Female Male 0.00467 0.00577 0.00035 0.00035 0.00020 0.00021 0.00015 0.00021 0.00012 0.00020 0.00010 0.00017 0.00008 0.00013 0.00007 0.00009 0.00007 0.00003 0.00007 0.00005 0.00009 0.00010 0.00009 0.00010 0.00013 0.00015 0.00016 0.00023 0.00020 000034 0.00024 0.00046 0.00025 0.00057 0.00031 0.00066 0.00033 0.00072 0.00034 0.00075 0.00034 0.00082 0.00034 0.00085 0.00034 0.00087 0.00033 0.00087 0.00033 0.00085 0.00033 0.00083 0.00033 0.00081 0.00033 0.00080 0.00035 0.00082 0.00037 0.00084 0.00039 0.00042 0.00091 0.00046 000096 0.00050 0.00100 0.00055 0.00105 0.00061 0.00110 0.00067 0.00116 15 16 17 18 19 20 21 22 23 Mortality Probability Inodified Reaching the Next Birthday (13) Age (x) Female Male 37 0.00073 0.00123 38 0.00079 0.00132 39 0.00085 0.00141 40 0.00092 0.00152 41 0.00099 0.00164 0.00109 0.00178 43 0.00120 0.00195 44 0.00132 0.00213 45 0.00145 0.00233 46 0.00160 0.00255 47 0.00176 0.00279 48 0.00193 0.00304 49 0.00210 0.00331 50 0.00219 0.00360 51 0.00251 0.00394 S2 0.00276 0.00434 0.00305 0.00451 54 0.00337 0.00533 53 0.00372 0.00590 36 0.00410 0.00654 37 0.00451 0.00726 58 0.00494 59 0.00538 0.00890 60 0.00587 0.00982 0.00641 0.01085 62 0.00704 0.01198 63 0.00774 0.01321 0.00830 0.01451 0.00933 0.01593 66 0.01026 0.01752 0.01131 0.01930 0.02124 69 0.01362 0.02329 70 0.01493 0.02555 71 0.01645 0.02810 72 0.01523 0.03104 73 0.02019 0.03429 68 06 16 Reaching the Next Birthday (lqs) Female Male 0.02236 0.03779 0.02467 0.04165 0.02742 0.04599 0.03066 0.05091 0.03424 0.05631 0.03807 0.06210 0.04240 0.06846 0.04745 0.07555 0.05354 0.08353 0.06068 0.09214 0.06872 0.10129 0.07735 0.11135 0.08703 0.12268 0.09704 0.13566 0.10767 0.15005 0.11899 0.16558 0.130SS 0.18264 0.14322 0_20160 0.15588 0.22283 0.17087 0.18680 0.23867 0.20376 025754 0.22177 0.27751 0.24083 0.29858 0.26094 0.32077 0.28209 0.34406 0.30425 0.368.46 0.32740 0.39396 0.35151 0.42053 0.37651 0.44815 047678 0.42902 0.50637 045635 0.53687 0.48439 0.56822 0.51296 0.60036 0.54200 0.63320 1.00000 1.00000 0.22056 S08000 92 93 94 95 96 97 98 TC 19 66 19 880000 25 26 27 28 29 30 31 32 33 34 35 36 100 101 102 103 104 105 106 107 108 LECOFO 89 0.01243 601 110 y U Type here to search 0 104) ENG a 1636 06/12/2021 C O Mortality tablespat - Adobe Reader File Edit View Window Help 1 2 / 2 100%- % 8 Tools Sign Comment Age (x) a 1 2 3 3 Age (x) 74 75 76 77 78 79 SO + 5 9 - IS 7 8 9 10 11 12 13 82 83 84 83 86 87 SS ES Nest Birthday (1x) Female Male 0.00467 0.00577 0.00035 0.00035 0.00020 0.00021 0.00015 0.00021 0.00012 0.00020 0.00010 0.00017 0.00008 0.00013 0.00007 0.00009 0.00007 0.00003 0.00007 0.00005 0.00009 0.00010 0.00009 0.00010 0.00013 0.00015 0.00016 0.00023 0.00020 000034 0.00024 0.00046 0.00025 0.00057 0.00031 0.00066 0.00033 0.00072 0.00034 0.00075 0.00034 0.00082 0.00034 0.00085 0.00034 0.00087 0.00033 0.00087 0.00033 0.00085 0.00033 0.00083 0.00033 0.00081 0.00033 0.00080 0.00035 0.00082 0.00037 0.00084 0.00039 0.00042 0.00091 0.00046 000096 0.00050 0.00100 0.00055 0.00105 0.00061 0.00110 0.00067 0.00116 15 16 17 18 19 20 21 22 23 Mortality Probability Inodified Reaching the Next Birthday (13) Age (x) Female Male 37 0.00073 0.00123 38 0.00079 0.00132 39 0.00085 0.00141 40 0.00092 0.00152 41 0.00099 0.00164 0.00109 0.00178 43 0.00120 0.00195 44 0.00132 0.00213 45 0.00145 0.00233 46 0.00160 0.00255 47 0.00176 0.00279 48 0.00193 0.00304 49 0.00210 0.00331 50 0.00219 0.00360 51 0.00251 0.00394 S2 0.00276 0.00434 0.00305 0.00451 54 0.00337 0.00533 53 0.00372 0.00590 36 0.00410 0.00654 37 0.00451 0.00726 58 0.00494 59 0.00538 0.00890 60 0.00587 0.00982 0.00641 0.01085 62 0.00704 0.01198 63 0.00774 0.01321 0.00830 0.01451 0.00933 0.01593 66 0.01026 0.01752 0.01131 0.01930 0.02124 69 0.01362 0.02329 70 0.01493 0.02555 71 0.01645 0.02810 72 0.01523 0.03104 73 0.02019 0.03429 68 06 16 Reaching the Next Birthday (lqs) Female Male 0.02236 0.03779 0.02467 0.04165 0.02742 0.04599 0.03066 0.05091 0.03424 0.05631 0.03807 0.06210 0.04240 0.06846 0.04745 0.07555 0.05354 0.08353 0.06068 0.09214 0.06872 0.10129 0.07735 0.11135 0.08703 0.12268 0.09704 0.13566 0.10767 0.15005 0.11899 0.16558 0.130SS 0.18264 0.14322 0_20160 0.15588 0.22283 0.17087 0.18680 0.23867 0.20376 025754 0.22177 0.27751 0.24083 0.29858 0.26094 0.32077 0.28209 0.34406 0.30425 0.368.46 0.32740 0.39396 0.35151 0.42053 0.37651 0.44815 047678 0.42902 0.50637 045635 0.53687 0.48439 0.56822 0.51296 0.60036 0.54200 0.63320 1.00000 1.00000 0.22056 S08000 92 93 94 95 96 97 98 TC 19 66 19 880000 25 26 27 28 29 30 31 32 33 34 35 36 100 101 102 103 104 105 106 107 108 LECOFO 89 0.01243 601 110 y U Type here to search 0 104) ENG a 1636 06/12/2021 C